Table of Contents

- Foreword

- Executive Summary

- Introduction

-

Understanding Saudi Arabia

-

Historical Context

- From Emergence to a Modern Nation: A Journey Through Time

- The Foundations: The Emergence of the Al Saud Dynasty

- Uniting the Kingdom: The Vision of Abdulaziz Al Saud

- The Oil Era: Economic Transformation (Mid-20th Century)

- Vision 2030: Paving the Way for a Diversified Economy (21st Century)

- Dynamic and Evolving Kingdom

-

Economic Overview

- Saudi Arabia’s Economic Landscape: Transitioning Beyond Oil

- GDP and Economic Growth: A Dynamic Picture

- Industry Contributions to GDP: Oil vs. Non-Oil Sectors

- Diversification Efforts: Towards a Balanced Economy

- Key Industries and Sectors: Pillars of the New Economy

- Investment in Infrastructure: Building the Future

- Global Economic Conditions: Navigating Complexities

- Economic Vision 2030: A Roadmap for Transformation

-

Sociocultural Landscape

- Navigating Saudi Arabia’s Sociocultural Dynamics in Business

- Social Norms and Practices: A Blend of Tradition and Modernity

- Language and Communication: Understanding Nuances

- Business Etiquette: Building Relationships

- Religion: Islam’s Influence

- Impact of Religion on Consumer and Business Behavior

- Demographics: A Youthful Consumer Base

- Cultural Insights Based on Hofstede’s Dimensions

- Modernization and Vision 2030: A Society in Transition

- Historical Relationship with Europe

-

Historical Context

- Business Climate and Opportunities

- Legal and Regulatory Frameworks

-

Establishing Presence in Saudi Arabia

-

Entry Strategies

- Export to Saudi

- Joint Ventures (JVs) and Partnerships

- Mergers and Acquisitions (M&A)

- Greenfield Investments

- Understanding the Business Environment

- Understanding Entry Strategies

- Case Study: Hoffmann-La Roche (Switzerland): Export and joint venture

- Case Study: IKEA (Sweden): Greenfield Investment

- Case Study: AccorHotels: Mergers and acquisitions (M&A)

- Operational Considerations

- Building Relationships

-

Entry Strategies

- Conclusion

- Authors

Foreword

In an era where understanding and navigating global markets is paramount to success, “The CEO Guide to KSA” stands out as an indispensable resource for business leaders looking to harness the opportunities within the Kingdom of Saudi Arabia. As we stand on the precipice of unprecedented change, driven by Vision 2030, the Kingdom’s ambitious blueprint for economic diversification and social transformation, the insights within this guide illuminate the path forward.

Eurogroup Consulting, with over four decades of experience in steering organizations through their strategic and transformational journeys, recognizes the significance of this moment for CEOs and business leaders. The Kingdom of Saudi Arabia represents a dynamic market, rich with potential and poised for a future that promises innovation, growth, and a redefined role on the world stage. This guide, meticulously crafted, offers a comprehensive exploration of the multifaceted business landscape of Saudi Arabia, from its historical roots to the modern-day economic, legal, and sociocultural dynamics shaping its future.

Our commitment at Eurogroup Consulting to facilitating positive transformation aligns with the spirit of Vision 2030. We believe in the power of knowledge to drive informed decision-making and strategic action. “The CEO Guide to KSA” embodies this belief, providing a deep dive into the Kingdom’s evolving business climate, highlighting lucrative opportunities across various sectors, and discussing the legal and regulatory frameworks pivotal for success.

As the Kingdom forges ahead with its transformative agenda, understanding its unique business environment becomes crucial. This guide serves not just as a resource but as a roadmap for success, fostering meaningful connections and opportunities in one of the world’s most promising economies. For Eurogroup Consulting, it represents another step towards our mission of aiding businesses to navigate the complexities of change, ensuring they are well-equipped to thrive in the global marketplace.

I commend the authors for their thorough research and insightful analysis, which will undoubtedly benefit business leaders looking to make their mark in Saudi Arabia. “The CEO Guide to KSA” is more than a publication; it is a companion for those ready to embrace the opportunities that the future holds.

Executive Summary

For European entrepreneurs eyeing opportunities in Saudi Arabia, several additional aspects could be particularly interesting and relevant:

Emerging Market Opportunities: With Saudi Arabia’s Vision 2030, new sectors are emerging beyond the traditional oil industry. Areas such as renewable energy, technology, entertainment, tourism, and healthcare, are ripe with opportunities. European entrepreneurs with expertise in these fields may find untapped potential in the Saudi market.

Start-Up and Innovation Ecosystem: Saudi Arabia is actively fostering a start-up and innovation ecosystem. Initiatives like the SAGIA offer support and incentives to start-ups. European entrepreneurs in tech and innovation can leverage these initiatives for market entry and growth.

PIF: The PIF, Saudi Arabia’s sovereign wealth fund, plays a crucial role in the country’s economic diversification efforts. It’s actively investing in various sectors and represents a potential source of funding or partnership for European businesses.

Saudi Arabia’s G20 Presidency in 2020: Saudi Arabia’s G20 presidency highlighted its growing role in global economic affairs. This presents European entrepreneurs with a landscape that is more integrated into the global economy, offering broader networking and partnership opportunities.

Cultural Exchange Programs: There are increasing cultural exchanges between Saudi Arabia and Europe, including art, education, and business conferences. These platforms can provide networking opportunities and deeper market insights for European entrepreneurs.

Ease of Doing Business Reforms: Saudi Arabia has implemented significant reforms to improve its business environment. These include streamlining business registration processes and protecting minority investors, making it easier for foreign entrepreneurs to start and operate a business.

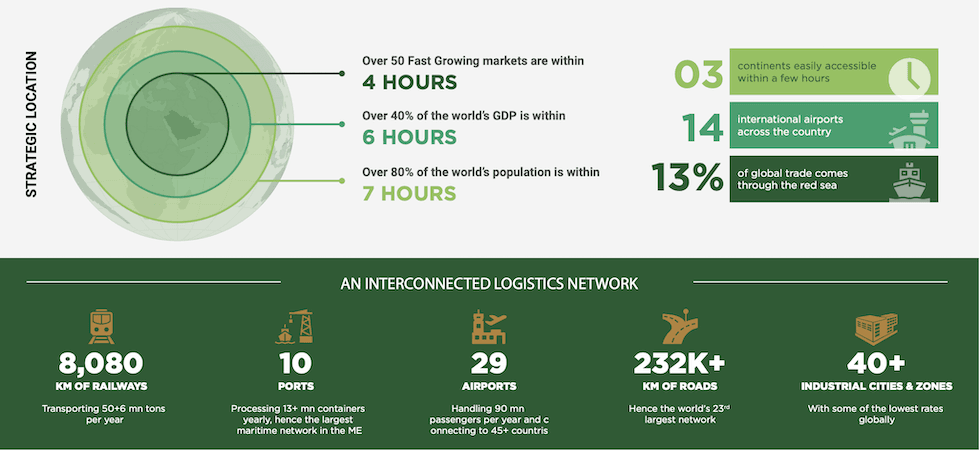

Strategic Geographic Location: Saudi Arabia’s location as a gateway to the Middle East and Africa can serve as a strategic advantage for European entrepreneurs looking to expand not only in the Kingdom but also in the broader region.

Saudi-EU Relations: The ongoing dialogue and trade agreements between Saudi Arabia and the European Union can provide a stable framework and beneficial trade terms for European businesses operating in Saudi Arabia.

Understanding these aspects can provide European entrepreneurs with a more comprehensive view of the opportunities and the business landscape in Saudi Arabia, helping them to make informed decisions about market entry and expansion strategies.

Introduction

In ‘The CEO Guide to KSA,’ we delve into the multifaceted business landscape of Saudi Arabia. This guide is an invaluable resource for CEOs and business leaders who aspire to navigate and capitalize on the abundant opportunities within the Kingdom. It encompasses a thorough exploration of Saudi Arabia’s historical evolution, economic transformation, and the sociocultural dynamics that shape its unique business environment. Moreover, it provides a detailed analysis of the evolving business climate, highlighting lucrative opportunities across various sectors, and discusses the Kingdom’s legal and regulatory frameworks that are pivotal for business success. This guide is an essential tool for understanding and succeeding in one of the world’s most dynamic and rapidly evolving markets.

Understanding Saudi Arabia

Historical Context

From Emergence to a Modern Nation: A Journey Through Time

Saudi Arabia, a country synonymous with its vast oil reserves and pivotal role in the global energy market, has a rich history that has shaped its current economic and geopolitical stature. This historical journey, from the early foundations of the nation to its emergence as a modern economic powerhouse, offers vital insights for business leaders looking to engage with the Kingdom.

The Foundations: The Emergence of the Al Saud Dynasty

The roots of modern Saudi Arabia trace back to the 18th century with the establishment of the Emirate of Diriyah, the first Saudi state. This era witnessed the alliance between Islamic reformer Muhammad ibn Abd al Wahhab and local ruler Muhammad bin Saud in 1744, marking the genesis of the Al Saud dynasty’s influence. Notable events like the capture of Mecca in 1803 underscored the expanding influence of this early Saudi state, despite setbacks such as the fall of the First Saudi State with the Ottoman-Egyptian invasion in 1818.

Uniting the Kingdom: The Vision of Abdulaziz Al Saud

The pivotal transformation of Saudi Arabia began in the early 20th century under the leadership of Abdulaziz Al Saud (Ibn Saud). His successful campaign, culminating in the unification of the Kingdom in 1932, integrated regions such as Hejaz and Najd, laying the groundwork for the modern Saudi state. This period marked a significant shift from a landscape dominated by regional divisions to a unified nation-state.

The Oil Era: Economic Transformation

Saudi Arabia’s discovery of oil in Dhahran in 1938 was a watershed moment, forever altering its economic trajectory. The establishment of ARAMCO in 1933 and the commencement of full-scale oil production in 1951 catalyzed unprecedented economic growth. The oil embargo of 1973 further accentuated Saudi Arabia’s global influence, showcasing its leverage in the oil market. Additionally, the geopolitical dynamics of regional conflicts, such as the Iran-Iraq War and the Gulf War, had significant economic implications, reinforcing Saudi Arabia’s strategic importance.

Vision 2030: Paving the Way for a Diversified Economy

In recent years, under the leadership of King Salman and Crown Prince Mohammed bin Salman, Saudi Arabia has embarked on a transformative journey. The announcement of Vision 2030 in 2016 marked a strategic pivot towards diversifying the economy beyond oil. This ambitious plan encompasses a wide range of sectors including health, education, infrastructure, tourism, and the development of SMEs, signaling a commitment to a sustainable and diversified economic future. The modernization and social reforms initiated in 2017 further aim to attract foreign investment, stimulate the private sector, and create a dynamic business environment.

A Dynamic and Evolving Kingdom

Saudi Arabia’s historical evolution from a region dependent on traditional income sources to a global energy leader, and now towards a diversified economy, underscores its dynamic nature. For CEOs and business leaders, understanding this rich historical context is critical for navigating the complexities and opportunities in a changing kingdom that is actively shaping its future.Economic Overview

Saudi Arabia’s Economic Landscape: Transitioning Beyond Oil

Saudi Arabia’s economy, historically reliant on oil, is undergoing a significant transformation. The kingdom’s gross domestic product (GDP) and economic growth patterns reflect this shift, as it balances the immediate benefits of its oil wealth with the long-term vision of a more diversified economy.

GDP and Economic Growth: A Dynamic Picture

Following the pandemic, the Saudi economy rebounded in 2021 with a real GDP growth of 4.8%, as reported by the International Monetary Fund (IMF). This resurgence was accompanied by a projected budget surplus of 2.5% of GDP. The trend continued into 2022, with a growth projection of 4.8%, driven by the government’s initiatives to diversify income, empower the private sector, and implement structural changes under its Vision 2030 programs. However, contrasting forecasts for 2023 suggest a complex economic landscape ahead. While SP Global projects a GDP growth slowdown to 3.1%, the IMF estimates a 3.7% growth. On the other hand, the World Bank anticipates a contraction of 0.9%, indicating a more cautious outlook.

Industry Contributions to GDP: Oil vs. Non-Oil Sectors

The Saudi economy has long been dominated by the oil and gas sector, a significant contributor to GDP. However, recent diversification efforts have led to a notable shift. The non-oil sector is showing promising growth, with an expected increase of 5.9% in 2023. This progression underscores the rationale behind Saudi Arabia’s diversification drive, aiming to create a more resilient economy less susceptible to global oil market fluctuations.

Diversification Efforts: Towards a Balanced Economy

Acknowledging the volatile nature of oil markets, Saudi Arabia has been aggressively pursuing economic diversification through Vision 2030. This ambitious blueprint seeks to reduce oil dependency and stimulate growth in sectors like tourism, entertainment, and technology. The country is expected to record a budget deficit in 2023 as it ramps up spending to achieve these goals, reflecting a strategic pivot towards sustainable long-term growth.

Key Industries and Sectors: Pillars of the New Economy

Energy: Remains a dominant sector, with efforts to develop renewable energy sources complementing traditional oil production.

Industry and Manufacturing: The National Industrial Development and Logistics Programme (NIDLP) identifies 50 industrial opportunities worth $25.6 billion.

Mining: Emerging as a key sector with significant untapped mineral resources, worth as much as $1.3 trillion, to be developed with the help of a $32-billion planned investment.

Logistics: Capitalizing on its strategic geographical position, Saudi Arabia is set to become a global logistics hub. Connecting three continents, Asia, Europe, and Africa, its position between key global waterways makes it an epicenter of trade and a gateway to the world.

Construction: Experiencing a boom due to mega-projects and infrastructure developments, with nearly $1 trillion invested since 2016.

Agriculture and Food Processing: Efforts to bolster these sectors aim to enhance food security and reduce imports.

Real Estate: A significant sector driven by large-scale housing and urban development projects.

Technology and Innovation: A growing focus on this sector aims to modernize various industries and foster international collaborations.

Investment in Infrastructure: Building the Future

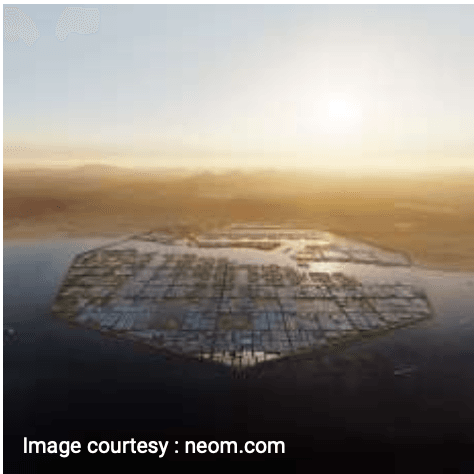

Major investments in infrastructure highlight Saudi Arabia’s commitment to diversification. Giga-projects like NEOM, encompassing The Line, Sindalah, Trojena, and Oxagon, illustrate the kingdom’s ambitious goals. Additionally, the AlUla project and initiatives in electric vehicle infrastructure signal a forward-thinking approach. These investments, including the development of 11 regions and various tourism-driven mega projects, are integral to Saudi Arabia’s economic strategy.

Global Economic Conditions: Navigating Complexities

Saudi Arabia’s economic engagements reflect its strategic ambitions. Recent trade agreements, including amending GCC rules and negotiating with 11 countries, underscore its efforts to expand non-oil exports. The landmark deal with China to sell oil in yuan instead of US dollars marks a significant shift in trade dynamics. However, the kingdom must also navigate through the challenges of economic sanctions and diplomatic complexities.

Economic Vision 2030: A Roadmap for Transformation

Vision 2030 represents Saudi Arabia’s comprehensive strategy to diversify its economy and reduce oil dependency. The kingdom’s substantial financial allocations for key projects and programs in the 2023 budget underscore its commitment to this vision. Through strategic investments and policy initiatives, Saudi Arabia is striving to create a more sustainable and diversified economic landscape, positioning itself as a global investment hub.

Sociocultural Landscape

Navigating Saudi Arabia’s Sociocultural Dynamics in Business

Understanding the sociocultural landscape of Saudi Arabia is essential for effective business engagement in the Kingdom. The country’s unique blend of traditional values, religious norms, and evolving modernization efforts significantly influences its business environment and consumer behavior.

Language and Communication: Understanding Nuances

Arabic, the official language, is central to Saudi communication, with English widely used in business circles. Communication in Saudi Arabia is generally indirect and high context, relying heavily on non-verbal cues and the broader context. Maintaining honor, respect, and ‘saving face’ are crucial aspects of communication and business dealings.

Business Etiquette: Building Relationships

In Saudi business culture, personal relationships and trust are paramount. It’s customary to engage in small talk and establish rapport before discussing business matters. Patience, respect, and adherence to local customs are key to successful business interactions.

Religion: Islam’s Influence

Islam profoundly influences Saudi society and business practices. As the birthplace of Islam and home to its two holiest cities, Mecca and Medina, Saudi Arabia adheres to a conservative interpretation of Sunni Islam. Prayer times, observed five times daily, dictate the rhythm of daily life and business operations. Islamic principles, such as the prohibition of usury, shape practices in sectors like banking and finance. Islamic holidays, following the lunar calendar, and the two-day weekend falling on Fridays and Saturdays, significantly impact business schedules.

Impact of Religion on Consumer and Business Behavior

Religious observances, such as Ramadan and Hajj, dictate consumer behavior and business operations. The adherence to Halal practices, especially in food and beverage, is a critical aspect of business compliance. These religious practices and principles offer insights into the sociological aspects of Saudi consumers and businesses.

Demographics: A Youthful Consumer Base

Saudi Arabia’s demographic profile, marked by a large youth population, is reshaping consumer trends and business strategies. This demographic shift is driving demand in sectors like technology, entertainment, and retail, aligning with the modernization goals of Vision 2030.

Cultural Insights Based on Hofstede’s Dimensions

Examining Saudi Arabia through Hofstede’s cultural dimensions offers valuable insights:

Power Distance:

High, indicating acceptance of hierarchical order and authority.

Uncertainty Avoidance:

Also high, reflecting a preference for clear rules and stability.

Individualism vs. Collectivism:

The society leans towards collectivism, emphasizing group harmony and family ties.

Masculinity vs. Femininity:

Masculine traits like competitiveness and achievement are prominent, though evolving social dynamics are influencing this dimension.

Long-Term Orientation:

This is becoming more significant with the forward-looking Vision 2030.

Indulgence vs. Restraint:

Traditionally restrained but changing as consumer lifestyles evolve.

“There are two main cultural considerations that companies need to be aware of in KSA:

Julien Pescheux, Former EVP of Saudi Airlines Catering Company (SACC)

- [It is beneficial to] build a team while including the younger generation, the recent graduates, the graduates that have been in the workplace for a good ten years and the more mature generation, the one that has seen and that have participated actively to this transition and that are still tied to the more mainstream way of doing business.

- Gender and diversity are a massive, massive advantage. Women in the workplace in the Kingdom have made a huge difference for the better and it needs to continue, and it needs to be well orchestrated.”

Modernization and Vision 2030: A Society in Transition

Vision 2030 embodies Saudi Arabia’s ambitious efforts to modernize and diversify its society. This includes progressive gender policies, expansion of entertainment options, and initiatives to enhance foreign investment and tourism.

Historical Relationship with Europe

The historical relationship between Saudi Arabia and Europe is multifaceted, encompassing diplomatic, economic, and cultural dimensions. This relationship has evolved significantly over the decades, reflecting changes in global politics, economic interests, and cultural exchanges.

The historical relationship between Saudi Arabia and Europe is characterized by a dynamic interplay of economic interests, political alliances, and cultural exchanges. While initially centered around oil, this relationship has evolved to encompass a broader range of interests, adapting to global economic shifts and regional dynamics. As Saudi Arabia continues on its path of economic diversification and modernization, its relationship with European countries is likely to further evolve, presenting new opportunities and challenges.

Business Climate and Opportunities

Market Overview

Saudi Arabia’s Market Dynamics: Resilience, Growth, and Diversification

The Saudi Arabian market has demonstrated remarkable resilience and a positive growth trajectory, particularly since 2021. This section provides an overview of the Saudi consumer spending, consumer behavior and trends, and the competitive landscape in the Kingdom.

Consumer Spending

In 2021, consumer spending in Saudi Arabia increased to around SAR 261 billion in Q1, up from SAR 256 billion in the same period the previous year, as reported by the Saudi Central Bank. This economic rebound is further evidenced by a real GDP growth of 4.8%, a projected budget surplus of 2.5% of GDP, and substantial foreign reserves of approximately $450 billion. While the oil sector continues to be a significant contributor to the country’s GDP (28.2% in 2021), Vision 2030 aims to reduce reliance on oil, fostering investments across various sectors. This diversification is expected to drive real GDP growth and household consumption, indicating a favorable market outlook.

The Saudi market encompasses a broad range of sectors. The capital markets, particularly the Saudi Stock Exchange (Tadawul), have shown positive trends, further supporting the market’s robustness. The Tadawul All Share Index (TASI) ended 2023 with significant growth. Throughout the year, the index displayed a dynamic performance. It concluded the first quarter of 2023 with a rise of 1.1%, gaining 112 points to reach 10,590 points. The momentum continued with a substantial increase in the second quarter, adding 8.2%, or 869 points. By the end of the first nine months, TASI had risen by 5.5%, or 578 points, to 11,056 points.

“Four keys for companies’ success in Saudi:

Julien Pescheux, Former EVP of Saudi Airlines Catering Company (SACC)

- Access to financing is a big element of success today and it’s one of the angular stones in a country that is driving large capital projects and is crucial to buy yourself (as a company) the endurance to survive.

- Being in a risk-taking position strategically. Companies will not succeed in the Saudi market if they are not capable or willing to take on risk.

- Talent: the war for talent in Saudi is like every emerging or structuring market today. The war for talent is fierce. You have to come in with an “A team” because if you don’t, somebody else will and they will capture the attention of your customers.

- Adapting the service or product provided to the region, especially [to the] identity of the consumers in KSA [as it] is being defined today.”

Consumer Behavior and Trends

Consumer behavior in Saudi Arabia is evolving, particularly in the digital domain. The digital ecosystem has significantly boosted consumers’ confidence in the economy, with digital adoption pacing faster than pre-pandemic levels. This shift has led consumers to favor online browsing and purchasing, making traditional shopping methods seem less relevant, even post-pandemic. Additionally, Saudi consumers are becoming increasingly price-conscious, with approximately 42% showing sensitivity in their purchasing decisions. This trend is evident in the growing time spent on online shopping and the preference for value-for-money products.

What is special about the Saudi consumer is this blend of a traditional and modern approach, influenced by cultural heritage and a young, tech-savvy population. This unique combination presents diverse opportunities for businesses, especially those looking to leverage digital platforms and cater to value-oriented consumer preferences.

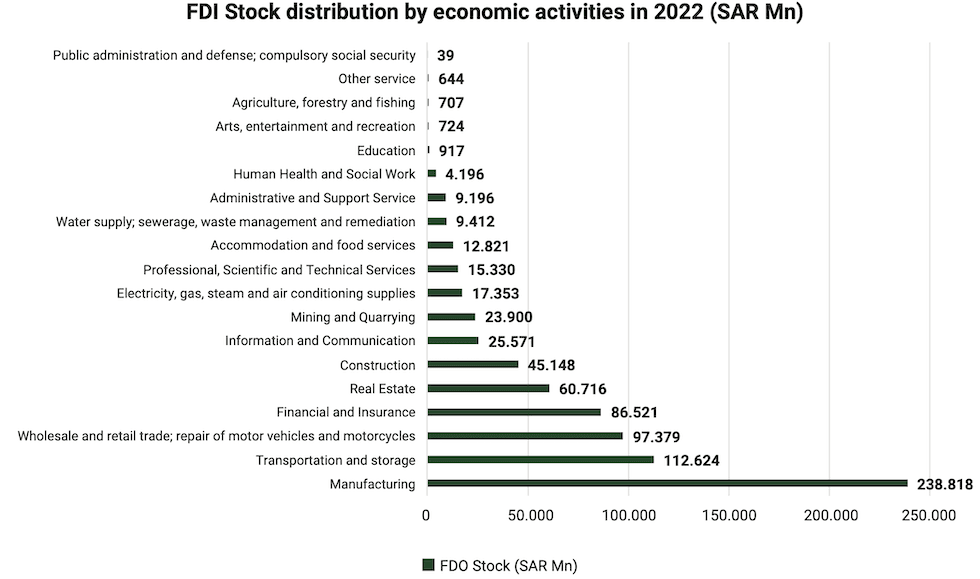

Foreign Direct Investment trends in KSA

In 2022, G20 nations contributed 32% to Saudi Arabia’s foreign direct investment (FDI) stock, with the United States leading at 10% and the United Kingdom following at 8%. Additionally, EU countries collectively accounted for 29% of the total FDI stock in Saudi Arabia.

In 2022, FDI in Saudi Arabia was concentrated in five sectors: manufacturing, transportation and storage, wholesale and retail trade, vehicle repair, and financial and insurance activities. These sectors collectively accounted for SAR 535.3 billion, representing over 70% of the total FDI stock across all economic activities.

Competitive Landscape

The Saudi competitive landscape is evolving with a growing emphasis on private sector participation and international investments. Regulatory reforms aimed at boosting business ease and transparency are driving this evolution. These changes, coupled with the government’s Vision 2030, provide a conducive environment for sustainable growth, and make the Kingdom an attractive market for investment and business operations.

Opportunities across Sectors

Saudi Arabia’s Vision 2030 is not just about diversifying the economy; it’s also about enhancing and expanding opportunities across various sectors. This section delves into each sector, highlighting opportunities, key insights, planned investments, and job creation.

Oil and Gas

- Opportunities: Despite a shift towards diversification, the oil and gas sector remains crucial, with opportunities in technology, efficiency, and sustainability.

- Insight: Saudi Aramco, headquartered in Dhahran, is one of the world’s largest and most profitable oil companies.

- Planned Investment: Saudi Aramco announced plans to increase its capital expenditure to $35-40 billion annually through 2025, focusing on capacity expansion and sustainability initiatives.

- Job Creation: The sector is projected to create over 10,000 jobs by 2025, especially in innovative and sustainable oil technologies.

Technology and Innovation

- Opportunities: The focus is on becoming a regional tech hub, with substantial openings in digital infrastructure, AI, and emerging technologies.

- Insight: NEOM city, a part of Vision 2030, is planned to be a fully automated city, utilizing AI, renewables, and biotechnology.

- Planned Investment: NEOM city has a budget of $500 billion, with technology investments spanning AI, IoT, and robotics.

- Job Creation: Expected to generate over 20,000 jobs by 2030 in various tech fields, including AI, software development, and data analysis.

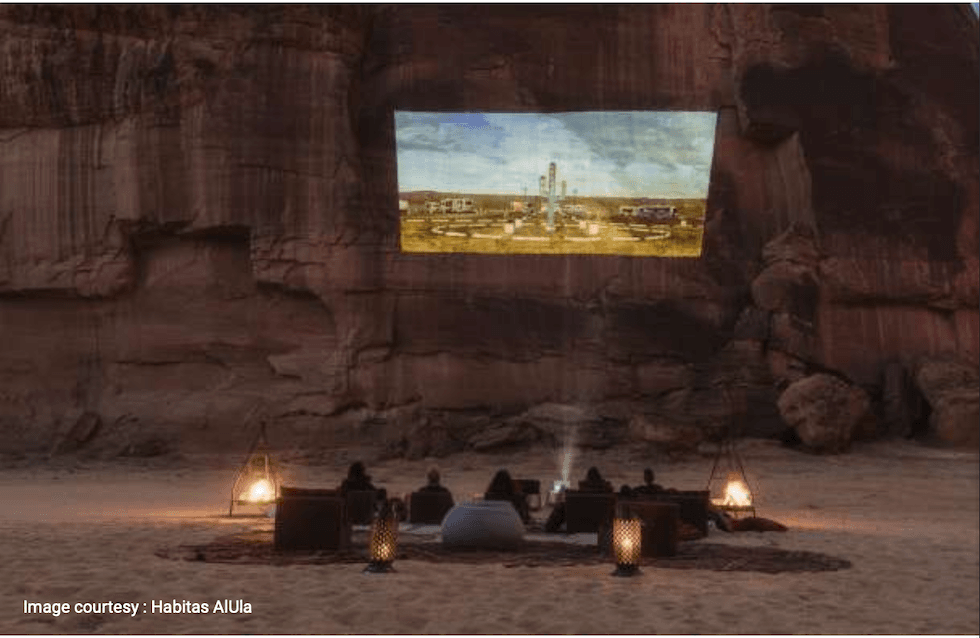

Tourism and Entertainment

- Opportunities: With projects like the Red Sea Project, there are numerous opportunities in hospitality, leisure, and entertainment.

- Insight: Qiddiya Entertainment City aims to be the world’s largest entertainment city, surpassing Walt Disney World in Florida.

- Planned Investment: The Red Sea Project, with an investment of over $10 billion, aims to set a new standard in sustainable development. Qiddiya is expected to attract investments worth $8 billion by 2030.

- Job Creation: These initiatives are projected to create over 50,000 jobs in the tourism and entertainment sector by 2030.

Healthcare and Life Sciences

- Opportunities: Growing demand for advanced medical technologies, pharmaceuticals, and healthcare IT solutions.

- Insight: Saudi Arabia aims to become a leader in genomic research and personalized medicine in the Middle East.

- Planned Investment: Approximately $66 billion is earmarked for healthcare development projects through 2030, focusing on hospital construction, medical technologies, and pharmaceutical development.

- Job Creation: An estimated 25,000 jobs in healthcare and related fields are expected to be generated by 2030.

Industrial Sector

- Opportunities: With a 281% increase in investments, the industrial sector is burgeoning, particularly in areas like MODON.

- Insight: Saudi Arabia’s industrial cities have become beacons of modern manufacturing and technology within the region.

- Planned Investment: The industrial sector, led by initiatives like MODON, has witnessed a surge in investments, with a commitment of $28 billion for various industrial and manufacturing projects through 2025.

- Job Creation: This sector is expected to create over 35,000 new jobs by 2025, focusing on manufacturing, industrial innovation, and technology.

Other Emerging Sectors

- Opportunities: Diverse, covering chemicals, real estate, fossil fuels, automobiles, tourism, plastics, and machinery.

- Insight: The push towards non-oil sectors has led to a boom in diverse industries, from automobile manufacturing to plastic recycling.

- Planned Investment: A massive $1.3 trillion private sector investment push led by firms like Aramco and SABIC targets diversification across chemicals, real estate, fossil fuels, automobiles, and more.

- Job Creation: These investments are forecasted to generate more than 100,000 jobs across these sectors by 2030.

“There is an underestimated industry right now that’s trying to find its feet, and that’s mining. [...] Mining in Saudi is one of the areas that I would pay particular attention to, [as it] is a massive industry that is about to see an uplift of considerable proportion. [Additionally], the construction industry is obviously dominating the market and the attention today, [...] the hospitality industry is [another] area that’s grabbing a lot of attention [with] higher-end brands [...] coming in tied into the construction and the tourism industry.”

Julien Pescheux, Former EVP of Saudi Airlines Catering Company (SACC)

Government Initiatives and Support

In line with Vision 2030, the Saudi government has implemented a range of initiatives to foster a conducive environment for businesses and entrepreneurs. This section provides an overview of these initiatives, including investment incentives, regulatory support, public-private partnerships, and special economic zones.

Investment Incentives

-

Financial Incentives: The Saudi government offers various financial incentives, including tax breaks, grants, and subsidies, particularly in sectors identified as strategic under Vision 2030. These incentives aim to reduce operational costs and encourage investment in these sectors. For example:

- Tax Breaks for Mega Projects: In line with Vision 2030’s objectives, the Saudi government offers significant tax incentives for investments in mega projects. A prime example is the NEOM project, a $500 billion futuristic city planned in the northwestern region of the country. Investors and businesses operating in NEOM benefit from competitive tax breaks, including reduced corporate taxes and customs duties exemptions, aimed at attracting global investors and companies to this high-tech development.

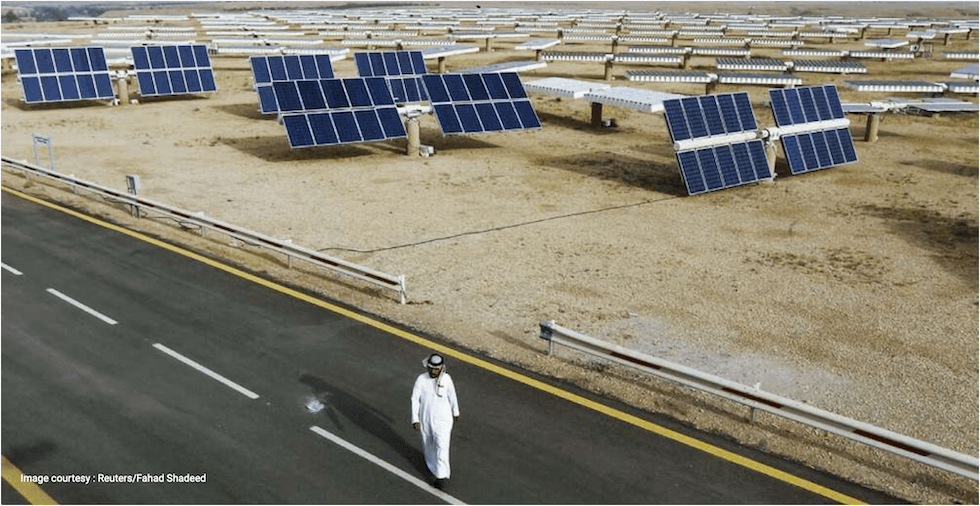

- Subsidies in Renewable Energy Sector: The Saudi government, through the Renewable Energy Project Development Office (REPDO), offers incentives for projects in the renewable energy sector. This includes subsidies and financial support for solar and wind energy projects. An example is the Sakaka solar project, the first utility-scale renewable energy project in Saudi Arabia, where the government provided financial subsidies and support to ensure competitive pricing and attract investment. These subsidies are part of the government’s broader strategy to diversify its energy mix and develop domestic renewable energy resources.

-

Access to Funding: Through entities like the Saudi Industrial Development Fund (SIDF) and the Public Investment Fund (PIF), the government provides financial support and low-interest loans to startups and SMEs. Additionally, venture capital and private equity funding are being facilitated for innovative and high- potential businesses. The government, through entities like the SIDF, offers low-interest loans and financial support to sectors like mining, logistics, and energy. For example:

- SIDF recently launched a program dedicated to financing renewable energy projects, offering loans of up to $267 million with extended repayment periods.

- PIF, Saudi Arabia’s sovereign wealth fund, has invested in numerous startups and SMEs. A notable example is the $45 billion investment in SoftBank’s Vision Fund, which supports a wide range of tech startups globally.

-

R&D Support: Incentives for research and development, particularly in technology and industrial sectors, are a key focus. This includes funding for collaborative projects between businesses and academic institutions. For example:

- The King Abdulaziz City for Science and Technology (KACST) provides grants and funding for R&D initiatives, particularly in sectors like renewable energy and biotechnology. KACST’s partnership with Taqnia Energy for developing renewable energy technologies is a testament to this support.

RHQ Program

As part of Vision 2030, the Regional Headquarters (RHQ) Program in KSA was formed in February 2021 where the RHQ is defined as “a unit of multinational group under the laws of Saudi Arabia for the purpose of supporting, managing, and providing strategic direction to its branches, subsidiaries and affiliates operating in MENA region”. This program aims to attract multinationals to move their regional headquarters to the kingdom and was founded jointly between Ministry of Investment (MISA) and Royal Commission for Riyadh City (RCRC). One important aspect of the initiation of the RHQ program is the announcement of the Saudi government that by 2024, it will stop contracting with multinationals that don’t move their regional headquarters to KSA. To support this announcement, on December 27, 2022, the KSA Council of Ministers implemented regulations barring government agencies from contracting with companies or their affiliates who don’t have a regional headquarters within the Kingdom, effective January 1, 2024.

Once multinationals obtain their Regional Headquarters (RHQ) license, the RHQ program offers them a number of incentives in terms of tax facilitations, hence different tax schemes such as the 0% corporate tax and 0% withholding tax for approved activities of regional headquarters of international companies for 30 years. According to the finance minister, these tax incentives will increase visibility and certainty for future planning related to expanding the MNCs operations in the region, after their RHQ move to the kingdom. This is added to the “relaxed ‘Saudization’ requirements and work permits for the spouses of RHQ executives”. The program provides MNCs the necessary support for setting up their regional HQ in the kingdom from relocation and concierge services (temporary office space, apartments, event organizers, reservations ...) to facilitation and professional services (staffing. Business setup, tax consultancy, GRO services, bank accounts ...). MNCs can also benefit, through the RHQ program, from exclusive discounts on airlines, offices accommodation and schools.

“The RHQ program is a step that companies must take to have access to large public projects opportunities. Since the regional economy’s centre of gravity is shifting to KSA which is a booming market, it makes sense for companies to be under the RHQ program to benefit from market offerings. It is also logical to move due to the increased demand from the private sector (Saudi owned private companies) to have a long-term committed local partner on the ground. A local presence is becoming necessary to be successful in Saudi Arabia.”

Julien Pescheux, Former EVP of Saudi Airlines Catering Company (SACC)

Through all the incentives, facilitations and support provided, the RHQ program is positioning the kingdom as a regional business and commercial leader and an international investment hub. Indeed, as of December 2023, the kingdom exceeded its initial target (of attracting160 HQs) to reach more than 200 RHQ licenses for multinational companies (from Europe and the US mainly) that relocated their headquarters to KSA and jumping from 44 MNCs in 2021 (78% increase between 2021 and 2023). The kingdom’s goal is to secure 480 RHQ licenses by 2030.

This positive receptiveness of the program brings many benefits to Saudi (whether for citizens, residents, or businesses) that are not limited to promoting economic diversification and attracting skilled local and foreign talents but could also lead to positive impact on GDP growth through drawing foreign investment.

Regulatory Support

- Business Reforms: Saudi Arabia has implemented significant business reforms to simplify business registration processes, protect investors, and improve the overall ease of doing business. Significant reforms under the Saudi Arabian General Investment Authority (SAGIA) include the reduction in the time required to start a business, now down to only 18 days, compared to 34 days in previous years.

- Intellectual Property Protections: Strengthening IP laws and enforcement mechanisms to protect innovations and trademarks, thereby encouraging investment and innovation. The Saudi Authority for Intellectual Property (SAIP) has been established to strengthen IP laws. An example is the recent restriction on IP violations, ensuring a secure environment for business innovations.

- Labor Law Reforms: Recent labor law reforms aim to create a more flexible and competitive labor market, benefiting both employers and employees. The Nitaqat program is an example of labor reform, designed to increase the employment of Saudi nationals in the private sector, categorizing companies based on their Saudization levels.

Public-Private Partnerships (PPPs)

- Infrastructure Development: PPPs are being actively promoted in infrastructure projects, including transportation, healthcare, and education, as part of the country’s infrastructure development strategy. The Riyadh Metro project, a $22.5 billion venture, is a significant PPP example involving multiple international firms in the construction of a major public transport system.

- Strategic Partnerships: The government encourages strategic alliances between public entities and private companies, especially in sectors like renewable energy, technology, and tourism. The Saudi REPDO involves PPPs in developing the country’s renewable energy sector, with projects like the Sakaka PV IPP, a $320 million solar park.

Special Economic Zones

As a cornerstone of Vision 2030, NEOM is not just a new city but a special economic zone with its regulatory framework and business-friendly environment, aimed at attracting global investment and innovation. $500 billion mega-project as already mentioned, NEOM is envisaged as a high-tech, fully automated city, integrating smart city technologies, and serving as a hub for innovation

Another special economic zone offering competitive incentives, world-class infrastructure, and access to global markets, particularly for logistics and manufacturing businesses. Spanning over 181 square kilometers, KAEC has attracted global companies like Pfizer and Mars, benefiting from its strategic location and advanced infrastructure

Saudi Arabia is planning to establish free zones in certain areas, offering benefits such as 100% foreign ownership, tax exemptions, and simplified customs procedures. The planned King Salman Energy Park (SPARK) is set to be a fully integrated energy hub with offerings like tax exemptions and duty-free zones, aiming to attract international energy firms.

These include industrial and technological parks, such as the Riyadh Techno Valley and the MODON Industrial Cities, which offer specialized infrastructure and services tailored to specific industries. Riyadh Techno Valley, affiliated with King Saud University, focuses on technology and innovation, fostering partnerships between academia and industry, with companies like Huawei and Siemens involved in collaborative projects.

The Saudi government’s initiatives and support mechanisms are integral to the Kingdom’s economic transformation. These measures, ranging from investment incentives and regulatory support to PPPs and special economic zones, are designed to create a vibrant ecosystem for businesses and entrepreneurs. These efforts not only align with Vision 2030’s objectives but also position Saudi Arabia as a promising destination for global investors and business leaders.

Commercial Relationship with Europe

From a business perspective, the historical relationship between Saudi Arabia and Europe presents several interesting aspects.

Oil and Energy Sector

The discovery of oil in Saudi Arabia and its subsequent development by American companies drew significant interest from European nations. European countries, particularly the UK and the Netherlands (home to oil giants like BP and Royal Dutch Shell), sought to establish economic ties with Saudi Arabia, focusing on oil exploration and production. This set the stage for long-standing business relationships in the energy sector.

Today, European energy companies continue to engage in significant projects in Saudi Arabia. For instance, companies like Total (France) have been involved in joint ventures for petrochemical projects in the Kingdom. The energy sector is still a significant part of the relationship, although there’s a growing focus on renewable energy and sustainable practices, reflecting global sustainability trends and the goals of Vision 2030. European companies, known for their expertise in renewable energy, are actively participating in Saudi Arabia’s shift towards solar and wind energy. For example, Spanish and Italian companies have been bidding on solar and wind power projects in the Kingdom.

Defense and Aerospace

Europe has been a key partner for Saudi Arabia in defense and aerospace. European defense contractors, like BAE Systems (UK) and Airbus (pan-European), maintain substantial defense contracts with Saudi Arabia, providing military equipment and aerospace technology. These relationships have evolved to include not just sales but also collaborative ventures and technology transfers.

“There are some historically strong sectors that characterize the commercial and business relationships related to French business activity in KSA and vice versa such as defence, aviation, infrastructure, and energy. The new sectors in which reciprocal business relationship is increasing are aerospace, ICT, healthcare, hospitality, entertainment, and media. Giga projects are also providing new opportunities in terms of architecture and internal design. The digitalisation of all sectors and processes also offers interesting opportunities to French companies.”

Guillaume Rebiere, Administrative Manager / Chief of Staff Saudi French Business Council (CAFS)

French-Saudi Business Relationships

Franck Riester, the Minister Delegate for Foreign Trade, Attractiveness, Francophonie, and French Nationals Abroad, embarked on an official three-day visit to Saudi Arabia in early March 2024. This visit aimed to achieve three key objectives: Firstly, to bolster France’s collaboration with Saudi Arabia, enabling the continued export of an increasingly diverse range of goods and services to France and the EU. Secondly, to provide support in critical areas such as tourism, energy diversification, and economic expansion. Lastly, to ensure tangible cooperation, ensuring French companies thrive in vital sectors including tourism, energy, water, transportation, and health within the country. At this juncture of economic opportunities, the France

2030 program spearheaded by Emmanuel Macron aligns harmoniously with the Vision 2030 initiated by Crown Prince Mohammed bin Salman. Both initiatives present genuine synergies for the two nations to cultivate in cutting-edge sectors such as decarbonized energies, sustainable cities, innovative mobility, artificial intelligence, and cybersecurity.

Franck Riester, the Minister Delegate for Foreign Trade, Attractiveness, Francophonie, and French Nationals Abroad, embarked on an official three-day visit to Saudi Arabia in early March 2024. This visit aimed to achieve three key objectives: Firstly, to bolster France’s collaboration with Saudi Arabia, enabling the continued export of an increasingly diverse range of goods and services to France and the EU. Secondly, to provide support in critical areas such as tourism, energy diversification, and economic expansion. Lastly, to ensure tangible cooperation, ensuring French companies thrive in vital sectors including tourism, energy, water, transportation, and health within the country. At this juncture of economic opportunities, the France

2030 program spearheaded by Emmanuel Macron aligns harmoniously with the Vision 2030 initiated by Crown Prince Mohammed bin Salman. Both initiatives present genuine synergies for the two nations to cultivate in cutting-edge sectors such as decarbonized energies, sustainable cities, innovative mobility, artificial intelligence, and cybersecurity.

Notably, significant deals and initial pacts worth $2.9 billion were inked at the French-Saudi Investment Forum in June 2023, convened in Paris, bringing together policymakers, business leaders, and entrepreneurs from both nations.

The presence of French companies in Saudi Arabia has expanded significantly by 43% since 2020. Concrete examples include Vinci Construction’s involvement in the Riyadh Metro project, Total’s investments in renewable energy projects, Accor’s expansion of luxury hotel chains across the Kingdom, and the Agence Française de Développement’s contribution to sustainable development projects in Al Ula.

The French Chamber of Commerce (CAFS) boasts over 200 members, with more than 110 firms currently operating in the Kingdom. Additionally, 360 licenses have been granted to French wholly owned companies or joint ventures, further enriching the economic landscape of the country.

The bilateral trade figures are flourishing, with goods exchanges reaching $11 billion in 2023, marking an 18% increase compared to 2016. French exports to Saudi Arabia have been on a consistent rise since 2019, amounting to $4.8 billion in 2023. Moreover, France’s foreign direct investment in Saudi Arabia soared to nearly $6 billion in 2022. During the visit, the French minister coincided with the commencement of activities and festivities for the Francophonie festival. He extended greetings to the French and Francophone community in Saudi Arabia, actively promoting French culture and language in the Kingdom. With nearly 7,000 French citizens, it stands as the largest EU community in Saudi Arabia. The dynamics are robust, evidenced by a 5% increase in French residents in 2022, particularly in Riyadh, with a notable 7.4% surge in 2023.

Furthermore, French investment has been instrumental in various sectors, including technology, infrastructure, healthcare, and education. For instance, Thales Group has been pivotal in developing cybersecurity solutions, while Airbus has contributed to the modernization of aviation infrastructure. French universities and educational institutions have also established partnerships with Saudi counterparts to enhance knowledge exchange and skills development.

Saudi Arabia is reevaluating and rebalancing its global partnerships and commercial alliances. Now is the time for French companies to investigate and invest in Saudi Arabia.

Infrastructure Development

European companies have played a crucial role in Saudi Arabia’s infrastructure development. From building airports and highways to developing telecommunications networks, European expertise has been integral to Saudi Arabia’s modernization efforts. Today, this expertise is leveraged towards the diversification and modernization goals in line with Vision 2030 – this includes involvement in megaprojects like NEOM and the Red Sea Development Project. Another example would be Siemens’ (Germany) and Alstom’s (France) participation in the Riyadh Metro project. Additionally, there’s a growing presence of European tech companies in the Saudi market, aligning with the Kingdom’s digital transformation goals.

Trade Relations and Bilateral Agreements

The historical trade ties between Saudi Arabia and European nations have been marked by various bilateral agreements, facilitating trade in goods ranging from petrochemicals to luxury items. Trade relations continue to be strong, with Saudi Arabia being a significant importer of machinery, vehicles, and pharmaceutical products from Europe.

Recent trade activity between Europe and Saudi Arabia has been characterized by several key trends and developments:

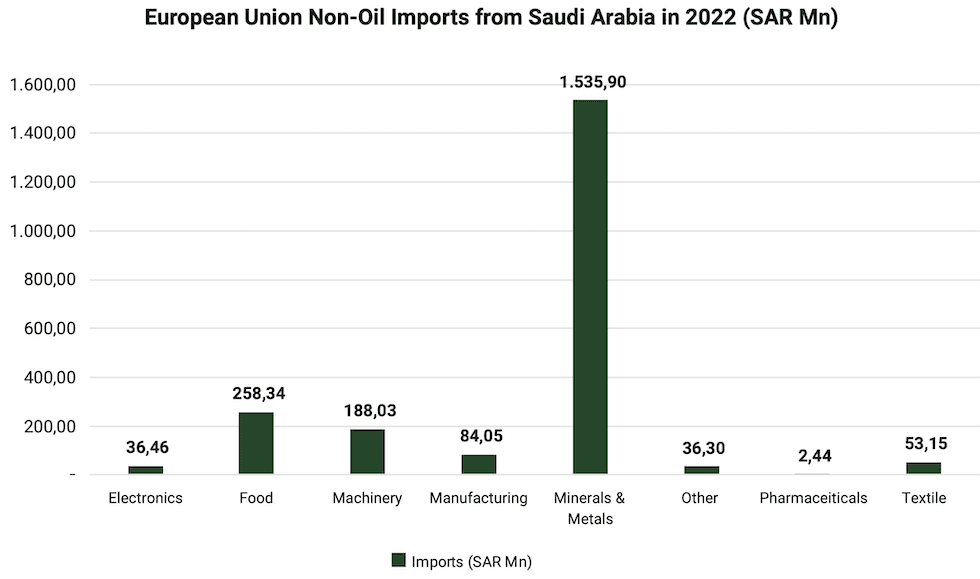

Diversification of Trade: While oil and petrochemicals remain significant in the trade relationship, European countries are importing more non-oil products from Saudi Arabia, such as plastics, organic chemicals, and metals. Conversely, Saudi Arabia is importing a broader range of goods from Europe, including machinery, automobiles, pharmaceuticals, and high-tech products.

Increase in Bilateral Trade Agreements: Saudi Arabia and various European countries have been working on enhancing bilateral trade agreements aiming to facilitate trade, reduce barriers, and increase mutual investments. For example, in a recent forum held in Paris, Saudi Arabia and France signed $2.9 billion worth of investment deals and initial pacts. These accords covered a wide range of sectors, including clean energy, tourism, manufacturing, defense, health, and education. Another recent example is Saudi Arabia and Germany’s launch of seven agreements aimed at boosting investment cooperation. These memoranda of understanding included sectors such as chemicals, waste management, renewable energies, engineering, advanced industries, automotives, and technology.

Saudi-European Union (EU) Economic Dialogues: There have been ongoing economic dialogues and forums between Saudi Arabia and the EU, aimed at strengthening economic ties and discussing ways to enhance trade and investment.

Impact of Global Economic Trends: Global economic conditions, including the aftermath of the COVID-19 pandemic and fluctuating oil prices, have influenced trade activities. Both regions have shown resilience and adaptability in maintaining and growing their trade relationship.

Overall, the recent trade activity between Europe and Saudi Arabia demonstrates a dynamic and evolving relationship, moving beyond traditional commodities to encompass a wider range of sectors and interests. The involvement of European countries in sectors like renewable energies and technology underscores the mutual interest in sustainable development and technological advancement. This shift is indicative of both regions’ broader economic strategies and global economic trends.

Cultural and Educational Exchanges

The relationship has extended beyond just business and trade. There have been significant cultural and educational exchanges, with many Saudi students studying in European universities and vice versa. These exchanges have fostered a deeper mutual understanding that can facilitate business relations through various initiatives encouraging academic, cultural, and business exchanges. Scholarships and educational partnerships, such as the King Abdullah Scholarship Program, enable Saudi students to study at European universities, fostering cultural and educational ties.

The exchange of cultural and educational products is also a growing aspect of the trade relationship. This includes educational materials, books, and technologies related to cultural preservation and exchange.

Investment Flows

Saudi Arabia has been a significant investor in European markets, with PIF investments spanning diverse sectors such as real estate, technology, and finance. Conversely, European investment in Saudi Arabia has increased, especially with the Kingdom opening up its economy under Vision 2030.

Foreign Direct Investment

Foreign Direct Investment (FDI) plays a significant role in the commercial relationship between Europe and Saudi Arabia, reflecting the evolving economic dynamics and strategic priorities of both regions. Here are key aspects of FDI in this relationship

Joint Ventures and Collaborations

Technology and Innovation: There are increasing joint ventures and collaborations in technology and innovation between European entities and Saudi counterparts. These are not only investment-driven but also focus on knowledge transfer and capacity building.

Impact of Geopolitical and Economic Factors

Oil Market and Global Economy: Fluctuations in the oil market and the global economic climate can impact the flow of FDI. Both regions monitor these factors closely to manage investments effectively.

Sustainability and Green Initiatives

With a global focus on sustainability, there’s growing interest from Saudi investors in European green technologies and renewable energy projects. This is in line with Saudi Arabia’s objectives to reduce its carbon footprint and develop a green economy.

Top 5 Active Sectors in Saudi Arabia-Europe Relationship

The top 5 sectors that are most active in the commercial relationship between Saudi Arabia and Europe are:

These sectors not only reflect the traditional strengths of Saudi Arabia and Europe but also align with new strategic directions under Saudi Arabia’s Vision 2030 and Europe’s green and digital transformation initiatives. The relationship in these areas is marked by both trade and investment, including joint ventures, strategic partnerships, and technology transfers.

Infrastructure and Construction

| Company name | Company Country | Project Description | Project amount |

|---|---|---|---|

| Low |

| 6.07 Billion Euros |

| Medium to high |

| 425 Million Euros |

| High |

| 5.21 Billion USD |

Defense and Aerospace

| Company name | Company Origin | Type | Project Description | Project amount |

|---|---|---|---|---|

| UK | Sales | Sale of 72 Eurofighter Typhoon fighter aircraft in 2007 | 4.43 Billion Pound |

| France | Sales | Talks are underway between Saudi Arabia and Dassault Aviation for the potential purchase of 54 Rafale fighter aircraft | Not yet disclosed |

| France | JV | Collaboration with SAMI to establish an advanced aerostructure production facility to drive Saudi Arabia’s engineering and manufacturing expertise | Not Applicable |

| France | JV | Collaboration with SAMI (Saudi Arabian Military Industries – Established in 2017 and aims to localize KSA’s defense industry) on various projects, including maintenance and logistics for military aircraft | Not Applicable |

Renewable Energy and Green Technologies

| Company name | Company Country | Sector | Project Description | Project amount |

|---|---|---|---|---|

| EDF | France | Renewable Energy |

| 500 Million USD |

| Air Liquide | France | Green Technologies | Construction of hydrogen production and purification units in Yanbu serving a massive 400,000-barrel-per-day oil refinery, enabling cleaner fuel production that meets environmental standards | 350 Million Euros |

Healthcare and Pharmaceuticals

| Top Corporations | Country | Sales (M$) (2018) |

|---|---|---|

| Pfizer | Japan | 644 |

| Sanofi | France | 490 |

| Novartis | Swiss | 439 |

| Spimaco | Saudi | 409 |

| Tabuk | Saudi | 404 |

| GSK | UK | 388 |

| Hikma Pharma | UK | 321 |

| NN | India | 313 |

| MSD | US | 274 |

| AstraZeneca | UK | 235 |

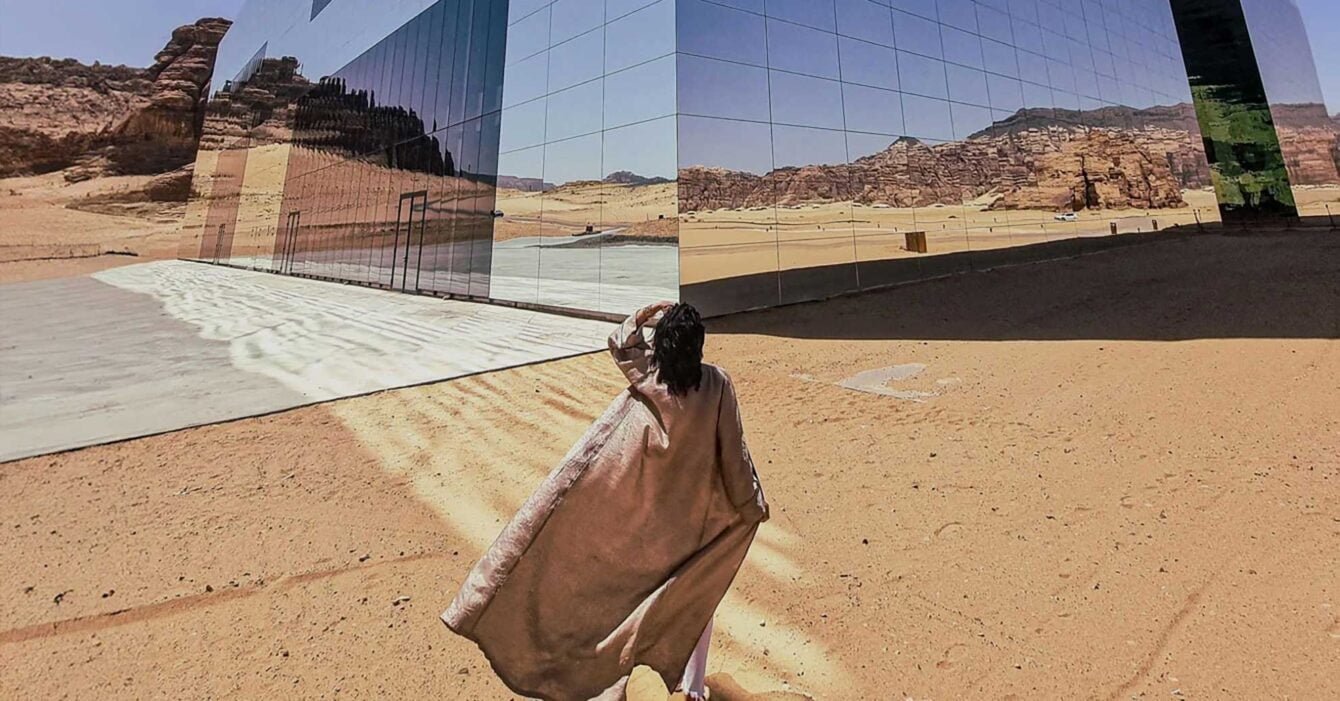

AlUla Project Overview

“We will turn AlUla into a Living Museum, creating memories that visitors will share with the world. Heritage is the main asset of AlUla. We have to use this asset to offer visitors a unique journey through time where they can enjoy a living museum.”

His Royal Highness The Crown Prince Mohammed bin Salman, Chairman of the Royal Commisson for AlUla

The Royal Commission for AlUla made a groundbreaking announcement on April 10th, 2018, marking the inception of a significant cooperative endeavour integral to the ambitious developmental agenda of AlUla. Nestled in the northwest of Saudi Arabia, AlUla stands as a region of profound natural splendour and cultural importance, notably hosting the Nabataean city of Hegra, an esteemed UNESCO World Heritage Site since 2008.

Under the distinguished presence of His Royal Highness Crown Prince Mohammed bin Salman, alongside Emmanuel Macron, President of the French Republic, and Gérard Mestrallet, the Special Envoy of the French President for AlUla, an intergovernmental pact was formalized. His Highness Prince Badr bin Abdullah bin Farhan Al-Saud, Governor of AlUla, and Jean-Yves Le Drian, the Minister for Europe and Foreign Affairs of the French Republic, cemented this agreement.

AlUla epitomizes Saudi Arabia’s unwavering commitment to spearheading a paradigm of sustainable cultural tourism, with a vision meticulously crafted in collaboration with both international and local stakeholders. The distinctive cultural, historical, natural, and archaeological riches of AlUla are poised to be unveiled to the global audience through this ambitious tourism initiative. The Saudi-French collaboration for AlUla serves as a tangible manifestation of the fortified ties between Saudi Arabia and France. Aligned with the objectives of the Vision 2030 program, Saudi Arabia endeavors to foster cross-cultural dialogue and enhance global accessibility. AlUla’s narrative traces back over 4,000 years, symbolizing a rich tapestry of cultural exchange and interaction.

As the custodian of Hegra, Saudi Arabia’s inaugural UNESCO World Heritage Site, AlUla signifies the legacy of the Nabataean civilization, which presided over this pivotal juncture on the Incense Route, linking the Arabian Peninsula with Mediterranean Europe, Africa, and Asia. Through Vision 2030, this initiative aspires to position the Kingdom as a global destination while upholding its intrinsic historical and cultural essence, thereby nurturing the tourism and cultural sectors concurrently.

Central to Saudi Arabia’s ethos is the safeguarding of its archaeological, architectural, cultural, artistic, and natural heritage, with a steadfast commitment to showcasing and preserving the unique historical treasures of AlUla. Consequently, the partnership for AlUla is underpinned by an unwavering dedication to sustainability.

Where Is AlUla

Situated in the Medina province, approximately 1,100 km away from Riyadh in the north-western region of Saudi Arabia, AlUla boasts remarkable natural and cultural riches. Encompassing an expanse of 22,561 km2, this area features a verdant oasis valley, majestic sandstone peaks, and historic sites of human civilization spanning millennia

Excitement and Ambition Behind AlUla

Nestled within the Kingdom of Saudi Arabia lies Al Ula, a region pulsating with ambition and excitement.

Historical Richness:

AlUla’s landscape is adorned with historical treasures, notably a UNESCO World Heritage site. Ambitions to preserve and showcase this heritage ignite excitement among tourists and scholars, offering glimpses into ancient civilizations.

Tourism Development:

AlUla’s ambitious tourism plans promise to transform the region into a premier destination. With projects like the Royal Commission for Al Ula (RCU)’s master plan, excitement mounts as travellers anticipate immersive experiences amidst breathtaking landscapes while preserving natural and historical assets.

Sustainable Vision:

AlUla’s ambition emphasizes sustainability and environmental stewardship alongside economic growth. Excitement resonates within sustainability initiatives aimed at preserving the delicate ecosystem and cultural heritage for future generations.

Cultural Festivals and Events:

AlUla vibrates with excitement during cultural events showcasing artistic prowess and traditional performances. These celebrations position AlUla as a cultural hub and a beacon of creativity in the region

Global Collaboration:

Ambitions in AlUla transcend national borders, fostering collaborations with international partners in tourism, archaeology, and sustainable development. Excitement generated by these partnerships underscores Al Ula’s emergence as a global destination for cultural exchange and cooperation

The French Agency For The Advancement Of AlUla

Emerging from this accord, the French Agency for the Advancement of AlUla (AFALULA) endeavors to harness French expertise—comprising specialists, operators, and enterprises—and collaboratively assist its Saudi counterpart, the Royal Commission for AlUla (RCU).

AFALULA convenes a consortium of leading global specialists across vital domains of the initiative: museum curation, archaeology, architectural and urban design, agriculture and botanical sciences, tourism, education, infrastructure, equestrianism, security, water resources, and environmental stewardship.

Why Is The French Collaboration So Significant?

France emerges as a natural ally in unveiling AlUla and the Nabatean city of Hegra, designated a UNESCO World Heritage site since 2008. France boasts a rich history of commitment to Saudi Arabian archaeology.

Recognized globally for its cultural significance and high quality of life, France stands out as a premier tourist destination. Saudi Arabia seeks to collaborate with top-tier experts worldwide, prioritizing the involvement of local communities in development initiatives. Participating in AlUla’s development promises to rejuvenate and fortify the bonds between the two nations.

What Are The Commitments Of Saudi Arabia and France?

Saudi Arabia and France are dedicated to realizing tangible initiatives that benefit both nations.

They share a mutual political commitment to safeguarding and advancing world heritage and the environment, fostering sustainable tourism, cultural and educational programs, and fostering intercultural dialogue.

Both parties are eager to preserve, enhance, and promote the significant historical sites of AlUla, including the archaeological site of Hegra, among others. Building upon this shared determination, two specific outcomes have already been established:

- An intergovernmental agreement pertaining to the cultural, heritage, natural, tourism, human, and economic development of AlUla County between both nations.

- A memorandum of understanding (MoU) between the Royal Commission for AlUla and leading international academic and vocational institutions in France, facilitated by Campus France, to accommodate students from AlUla.

What Does AlUla Embody?

Positioned at a historical convergence point of civilizations, the AlUla valley epitomizes a rich legacy of cultural exchange spanning 4,000 years. This legacy is exemplified by the Nabataean civilization, which flourished as stewards of this vital junction along the Incense Route, linking the Arabian Peninsula to Mediterranean Europe, Africa, and Asia.

Saudi Arabia aspires for contemporary global cultures and industries to converge along this ancient trade route, envisioning AlUla as a premier destination for innovative collaboration and immersive visitor experiences.

The Royal Commission for AlUla is spearheading a pioneering initiative for sustainable cultural tourism, meticulously crafting a vision and program in collaboration with both international and local communities.

AlUla’s unparalleled cultural, historical, natural, and archaeological riches will be unveiled to the world through the most ambitious tourism endeavor in Saudi Arabia’s history.

Enriching AlUla’s Cultural Benchmark: Collaborating With France on Knowledge and Skills

- The evolution of AlUla is poised to exemplify a dedication to fostering global cooperation, interactions, and tourism, in alignment with Vision 2030, Saudi Arabia’s blueprint for future progress.

- Saudi Arabia and France both share a deep-seated commitment to preserving and promoting world heritage and culture, recognizing its role in driving international tourism. This shared aspiration to endorse responsible tourism, safeguard the environment, and invest in top-tier cultural and educational initiatives serves as the foundation for the mutual respect and open dialogue between the two nations. This commitment will materialize through several initiatives: implementation of sustainable practices to safeguard AlUla’s local ecology and natural resources, promotion of responsible tourism practices, and the implementation of a conscientious infrastructure development plan.

- Preservation of archaeological and architectural heritage across AlUla will be a key focus.

- Efforts will be made to uncover grassroots AlUla and Saudi craftsmanship and techniques, with a focus on establishing an economic model to sustain authentic local culture and traditions.

AlUla: Saudi Arabia’s Cultural Hub Enhanced by French Collaboration?

- France has been extended an invitation to collaborate with RCU on specific cultural and artistic initiatives in AlUla, aligning with the goals of Vision 2030 and the overarching objective to cultivate a self-reliant and skilled Saudi workforce.

- AlUla is poised to serve as a model for nurturing the next generation of Saudi nationals, fostering their proficiency in creative production, contribution to arts and culture, heritage preservation, international tourism, and related industries, as outlined in Vision 2030.

- RCU is committed to establishing a global standard of excellence in heritage preservation, cultural development, and fostering a sustainable, community-led ecosystem in AlUla.

- The aim is to actively involve local residents as stakeholders in safeguarding AlUla, empowering them as primary stewards of their homeland and its rich heritage.

- Advocacy within the community will be promoted as a means to protect the natural, cultural, and historical treasures of AlUla.

- Efforts will be made to foster a spirit of communal collaboration, civic duty, and collective responsibility towards AlUla and its cherished heritage.

On June 19th, 2023, Bpifrance initiated the “French Touch Saudi Arabia” international endeavor targeting the Cultural and Creative Industries (CCI) domain, conducted in collaboration with Business France and the French Agency for the Development of AlUla (Afalula). Over the course of five days, the sixteen chosen enterprises explore the Saudi market to validate their plans for expansion into the Middle East.

The primary objective of this mission is to showcase the French Touch community, representing the essence of French creativity, supported by Bpifrance, and to advocate for French culture and lifestyle.

Saudi Arabia launched the Saudi Vision 2030 reform plan in 2016 with the aim of diversifying its economy and reducing reliance on oil. This comprehensive program seeks to bring about economic and social transformation within the Kingdom, encompassing various initiatives in archaeology, tourism, culture, education, and the arts. Since the signing of a bilateral agreement between Saudi Arabia and France in 2018, AlUla, a flagship project of Vision 2030, stands as a testament to Franco-Saudi collaboration. Situated in the Medina province, this oasis is a manifestation of the national strategy for economic diversification, community empowerment, and heritage preservation. Through such initiatives, the nation aspires to emerge as a premier global tourist destination, appealing both to international visitors and the local populace.

As part of this global undertaking, sixteen French companies are offered a comprehensive agenda comprising collective and individual activities.

Initially, the delegation convenes in Riyadh to engage with prominent stakeholders in the entertainment and cultural sectors, including the Saudi Ministry of Culture, JAX Museum, and Qiddiya. These companies will participate in tailored business meetings, networking opportunities, and exclusive dialogues with key entities overseeing Saudi mega projects.

Subsequently, the delegation proceeds to AlUla to engage with the Royal Commission for AlUla (RCU) and explore the pre-Nabataean site. Individual consultations with the RCU, responsible for the mega project, enable them to propose innovative solutions in culture and entertainment, aiming to foster enduring partnerships and contribute to the realization of the Saudi Vision 2030 objectives.

The Royal Commission for AlUla (RCU) has recently disclosed a partnership with Thales Group, a prominent French cybersecurity firm, to protect heritage sites and historic structures within AlUla.

This endeavor will harness state- of-the-art digital technologies and surveillance solutions, as unveiled during the Future Investment Initiative (FII) in Riyadh. The collaboration aims to embed advanced security measures into the RCU’s digital platforms, ensuring robust monitoring and safeguarding of public sites, heritage buildings, and historical landmarks. Its primary objective is to preserve and oversee the cultural, historical, urban, and rural areas of AlUla.

This strategic alliance further cements AlUla’s position as a significant cultural, heritage, and tourism destination, continually attracting a growing number of global visitors annually.

The agreement made with Thales encompasses the sustainable safeguarding of AlUla, including its historical riches, populace, and international guests. Utilizing advanced digital technology and surveillance tools, the valuable ancient artifacts, cultural landmarks, and heritage assets of AlUla will be under constant protection through a new security arrangement valued at SAR 159 million ($42m) between Thales and the Royal Commission for AlUla (RCU). The Strategic Security Integration Project involves collaboration between experts from the French cybersecurity firm and RCU to deploy and manage various security devices and safety solutions. This initiative aims to ensure the continuous monitoring and protection of areas of cultural and historical significance throughout AlUla, extending to crucial urban and rural sites for the safeguarding of the local community, businesses, and visitors.

AlUla County, home to a plethora of historic artifacts and treasures of national and global importance, requires specialized international expertise like that offered by Thales to shield its considerable cultural wealth from potential harm, such as vandalism or theft. This agreement builds upon a partnership established between RCU and Thales in Paris in 2021, which seeks to advance RCU’s objectives for smart and sustainable city development across various sectors including archaeology, tourism, culture, education, and the arts, aligning with Saudi Arabia’s Vision 2030 plan. To ensure the protection of significant landmarks such as the Nabatean tombs of Hegra and natural formations like Elephant Rock, the project will employ cutting-edge security systems integrated into RCU’s Integrated Smart Operations Centre for centralized and efficient operations. This setup enables security teams to promptly respond to any violations or threats. The recent agreement underscores AlUla’s increasing importance as a cultural, heritage, and tourism destination, attracting a growing number of visitors worldwide each year who are eager to experience its unique living museum.

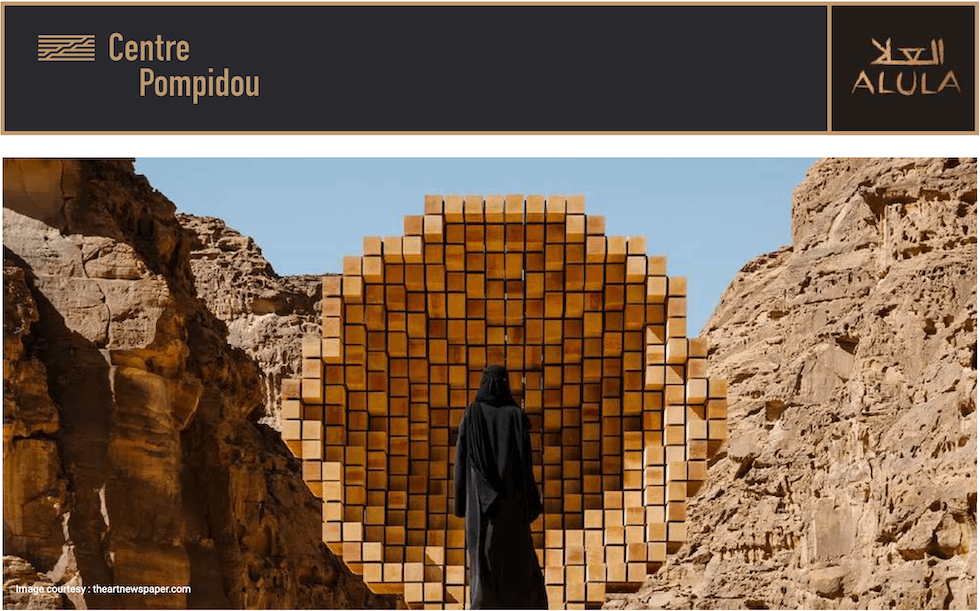

During the visit to Riyadh and AlUla by French Minister of Culture, Rima Abdul Malak, on March 12, 2023, a Memorandum of Understanding (MoU) was signed between the Royal Commission for AlUla (RCU) and the Centre Pompidou, as part of the initiative to establish a Contemporary Art Museum in AlUla.

On November 27, 2023, during H.H. Prince Badr bin Farhan Al Saud’s visit to Paris, Saudi Minister of Culture and Governor of the RCU, a partnership stemming from the MoU was formalized at the French Ministry of Culture.

Laurent Le Bon, President of the Centre Pompidou, and Amr AlMadani, CEO of the Royal Commission for AlUla, signed the agreement in the presence of H.E. Jean-Yves Le Drian, Chairman of the French Agency for AlUla Development, and Nora Aldabal, RCU’s Executive Director of Arts & Creative Industries.

Facilitated by Afalula, this collaboration aims to bolster the cultural, artistic, and creative dimensions of the AlUla site. The Centre Pompidou will lend its expertise in staff training, particularly in conservation management and mediation. Additionally, it may assist in organizing cultural events and programming. The initiative to establish a Contemporary Art Museum in AlUla has advanced with the appointment of architect Lina Gotmeh, recognized for her skill in integrating innovation with environmental consciousness. Gotmeh will craft the museum, drawing inspiration from the location and adhering to a sustainable ethos.

The museum aims to establish groundbreaking standards in eco-friendly architecture, stimulating urban revitalization and conservation efforts. It will actively involve the local community through educational workshops, school initiatives, and other engagement programs. With a clear artistic and curatorial vision, the project facilitates the exchange, acquisition, loan, and exhibition of artworks and artifacts between RCU and Centre Pompidou. Furthermore, it fosters diverse scientific and cultural endeavors focused on sharing distinctive pieces from each partner’s collection.

Centre Pompidou’s expertise in attracting global visitors, hosting cultural festivities, and promoting audience engagement will bolster RCU’s aspiration to transform AlUla into a worldwide center for cultural and heritage tourism, solidifying its reputation as the largest living museum in the world.

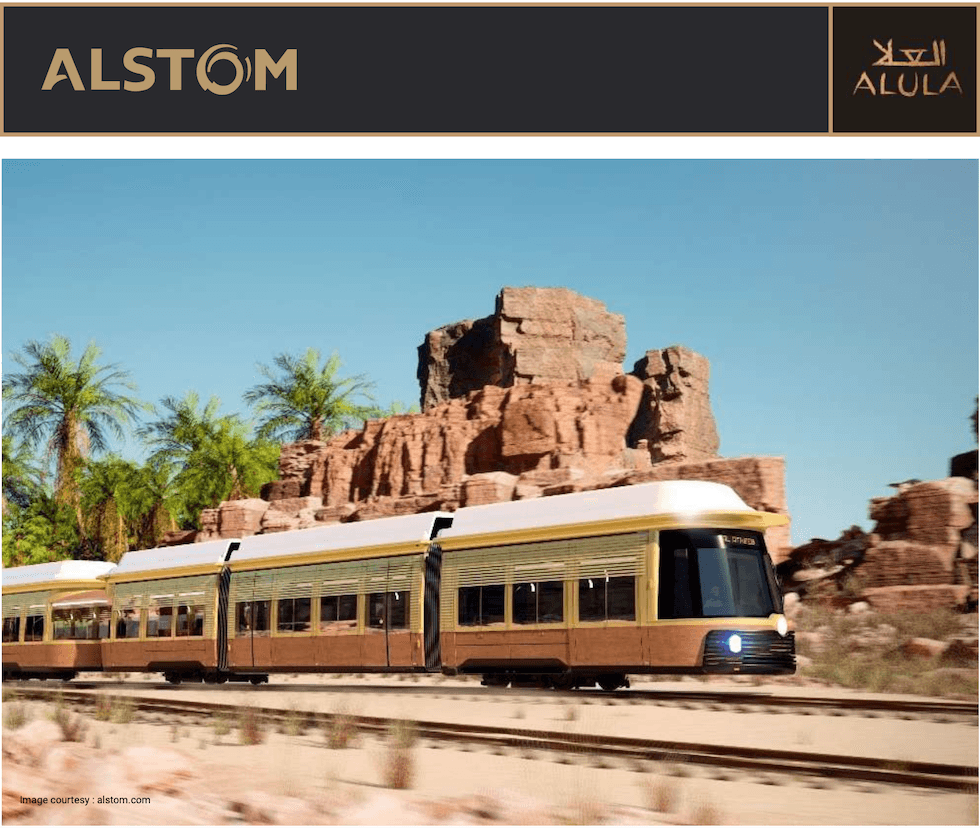

Alstom, a rail transport corporation headquartered in France, has inked a deal worth over EUR 500 million with The Royal Commission for AlUla (RCU) to construct the AlUla tramway.

This initiative entails building a tram network spanning 22.4km with 17 strategically positioned stations. Marked as the world’s lengthiest battery-powered tramway without overhead wires, this project will grant unprecedented accessibility to AlUla’s five principal historical quarters, encompassing UNESCO World Heritage sites like AlUla Old Town (District 1), Dadan (District 2), Jabal Ikmah (District 3), Nabataean Horizon (District 4), and Hegra Historical City (District 5). By interlinking these culturally significant zones, the tramway venture will epitomize a blend of historical richness, heritage, and environmentally friendly mobility unparalleled elsewhere.

Alstom is tasked with providing power, depot equipment, and comprehensive maintenance services for a decade, utilizing the HealthHub, an innovative predictive maintenance tool capable of monitoring the condition of trains, infrastructure, and signaling assets through advanced data analysis. Additionally, service teams will utilize a mobile workshop for various modifications, enhancing flexibility and trimming capital expenses. Alstom will also deliver robust training programs for tram personnel to ensure operational efficiency.

The success of this endeavor hinges on the company’s expertise in integrated railway systems. Production of the tram will take place at Alstom’s French facilities, including the La Rochelle center.

Construction has commenced on the Sharaan Resort and International Summit Centre in AlUla, Saudi Arabia, overseen by the Royal Commission for AlUla (RCU) and crafted by renowned French architect Jean Nouvel. Nestled within the rugged terrain of Sharaan Nature Reserve, the project is committed to ambitious sustainability objectives for both its construction and subsequent resort operations.

During a ceremony held at the Sharaan Nature Reserve, RCU formalized an agreement with Bouygues Construction, a prominent French engineering entity, to oversee the resort’s construction in collaboration with Almabani, a leading Saudi engineering firm. Bouygues Construction brings invaluable expertise in tunneling and the construction of luxury hotels, essential for the intricacies of this development.

Leading the charge in RCU’s Development and Construction sector, the project receives consultation from Canadian consultancy firm WSP and program management support from Jasara, a Saudi company. Together, they endeavor to actualize a visionary concept that celebrates the natural and cultural richness of Sharaan Nature Reserve.

Echoing the ancient Nabataean civilization, renowned for carving structures into nearby sandstone millennia ago, the Sharaan Resort seeks to etch a new narrative into AlUla’s living heritage while preserving its breathtaking landscapes and indigenous biodiversity, aligning with RCU’s overarching vision for Sharaan. Extensive consultations with top mining and excavation experts have been integral to engineering solutions that honor the architectural vision.

Embedded within a mountain formation dating back half a billion years, the Sharaan Resort promises an unforgettable experience with its 38 suites, spa and wellness center, kids club, sports facilities, all-day dining venue, and business center. Perched atop the mountain, a signature fine-dining restaurant will offer panoramic vistas of Sharaan, accessible via a unique glass elevator providing glimpses of ancient geological layers adorned with art and engravings.