As Saudi Arabia undergoes significant economic transformation, the fast-moving consumer goods (FMCG) sector is witnessing dynamic shifts in consumer behavior. With the Kingdom’s Vision 2030 pushing for a diversified economy, the FMCG market is at the forefront of this transformation, shaped by a blend of economic resilience and evolving consumer preferences. Understanding these Saudi FMCG consumer behavior insights is crucial for brands and retailers aiming to capture and retain market share in this competitive landscape.

Economic Resilience and Consumer Prioritization

Saudi Arabia’s economy, historically reliant on oil, is gradually shifting towards a diversified portfolio, including non-oil sectors like FMCG. This economic resilience, amid global uncertainties, is influencing how consumers allocate their spending. Consumers are placing a higher priority on necessities like food and dairy, which account for 41.4% and 28.7% of the total value of the FMCG industry, respectively. Food and dairy products are the most frequently purchased items in these categories, with Saudi consumers doing so on average 15.1 times a month. The trend is further bolstered by the growing penetration of online shopping, with 31.7% of consumers purchasing these products online in the past year.

The preference for modern trade, where 71% of food and dairy transactions occur, highlights a significant opportunity for brands to enhance in-store experiences and promotions. Retailers can capitalize on this by creating compelling in-store narratives that resonate with consumers’ evolving needs, thereby driving loyalty and repeat purchases.

The Evolution of Modern Trade and Online Shopping

The rise of modern trade and online platforms is transforming the Saudi shopping experience. Currently, 53.1% of FMCG spending occurs through these channels, with consumers engaging with an average of 4.7 channels over the past 12 months. The penetration of modern trade now reaches nearly the entire population, underscoring its dominance in the market.

Retail giants such as Panda, Othaim, and Carrefour have become leaders in consumer engagement through strategic store placements and tailored marketing efforts. Panda and Othaim lead in market penetration, capturing 72% and 65% respectively, while Carrefour excels in spend per trip, particularly in the dairy and home care categories.

Discounters, capturing 5.6% of total FMCG spend with a 73.8% penetration, are leveraging targeted strategies to push home care segments. This channel is particularly effective in attracting expat Asian consumers, who are driven by value propositions. Retailers in this space should focus on understanding the specific needs of this demographic to drive further growth.

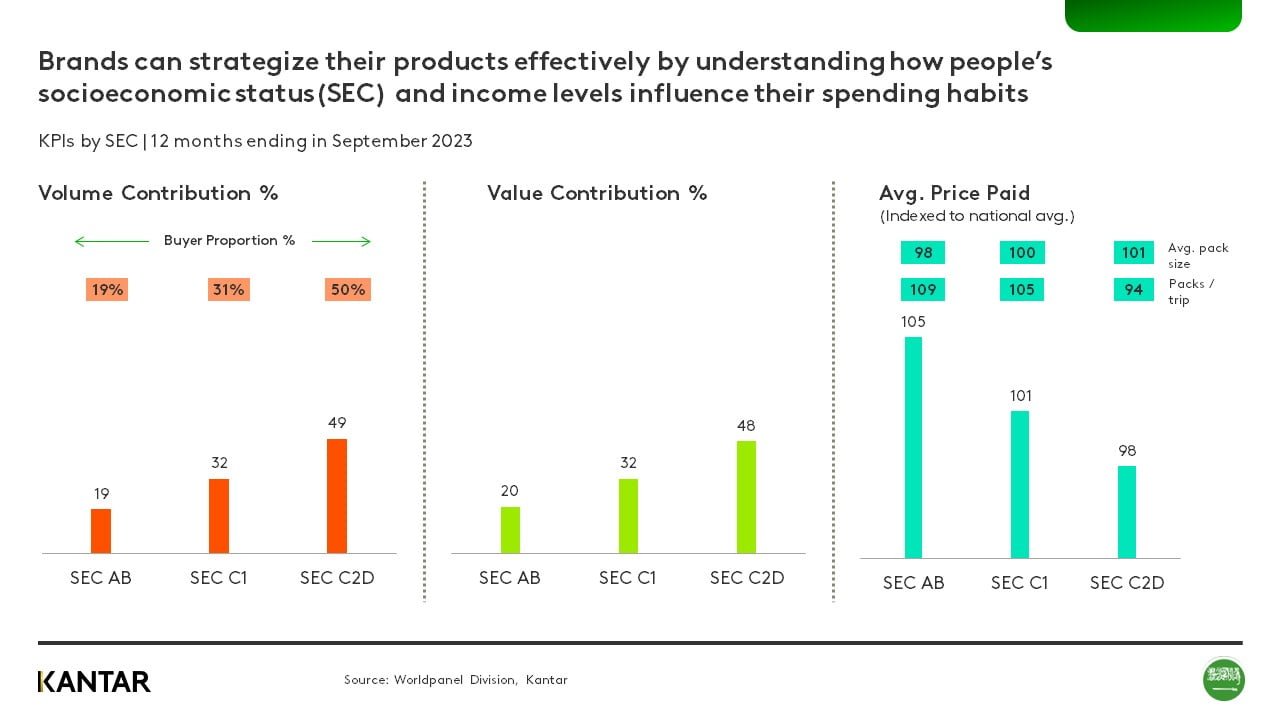

Demographic Influences on FMCG Consumption

Age and income levels are critical factors influencing FMCG spending habits in Saudi Arabia. While higher socio-economic groups have slightly reduced their consumption, the middle class represents a significant growth opportunity for volume sales. Additionally, there is a notable contrast between the spending patterns of consumers under 30 and those over 40, necessitating tailored marketing strategies.

Younger consumers are more willing to pay a premium for quality FMCG products, reflecting their growing engagement with the sector. Conversely, the over-40 demographic, driven by larger family sizes, accounts for 43% of total FMCG value while comprising 40% of the population. This group, however, is showing signs of spending restraint, highlighting the need for products that offer both value and quality.

Brands and retailers must analyze these demographic variations to refine their strategies. For younger consumers, premium quality ranges may be more appealing, while the over-40 demographic may respond better to value-driven products suited to larger households. By aligning product offerings with the specific needs of each segment, brands can optimize their market presence and drive sustained growth.

As Saudi Arabia’s non-oil sector continues to expand, the FMCG market presents numerous opportunities for growth and innovation. By leveraging Saudi FMCG consumer behavior insights, brands and retailers can stay ahead in this rapidly evolving market, ensuring they meet the diverse needs of Saudi consumers.