Navigating the Power Industry in Saudi Arabia: Trends & Analysis

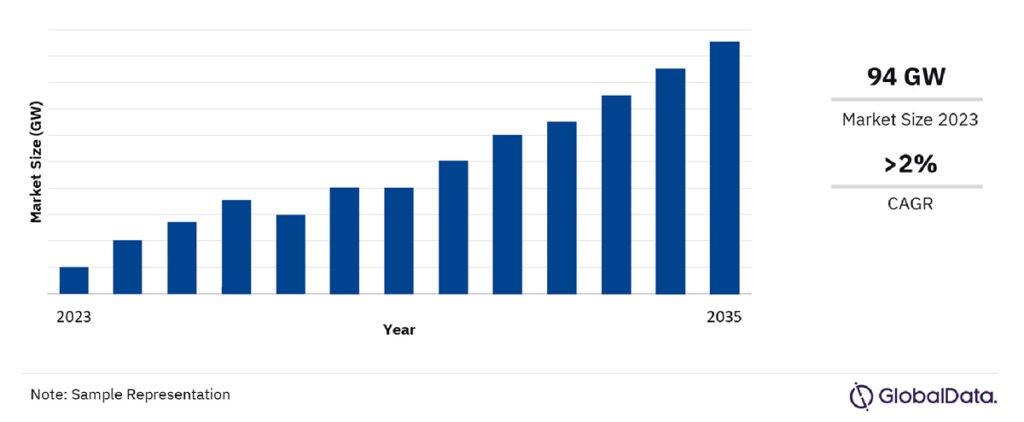

In 2023, Saudi Arabia’s power sector boasted an installed capacity of 94 GW, predominantly fueled by thermal sources due to the country’s abundant petroleum reserves. Projected to expand at a compound annual growth rate (CAGR) of over 2% from 2023 to 2035, the sector is on a clear path toward significant growth, especially in renewable energy, with plans to reach a 130 GW capacity by 2030. This growth is in line with Saudi Arabia’s strategic initiative to diversify energy sources and boost sustainability. In this article, we share key findings from comprehensive Saudi market research that is essential for stakeholders aiming to successfully navigate and prosper in this dynamic environment. Our expert analysis and strategic recommendations empower clients to make well-informed decisions and seize emerging opportunities.

Regulatory Framework and Market Dynamics in Saudi Arabia

The governance of Saudi Arabia’s power industry is meticulously overseen by the Ministry of Water and Electricity, which is tasked with the implementation of comprehensive policies and strategic plans. This oversight ensures that the power sector aligns with the national objectives for economic diversification and sustainability. The Electricity and Co-generation Regulatory Authority (ECRA), established in November 2001, regulates the sector, managing everything from electricity service regulations to the issuance of licenses for generation, transmission, and distribution. This regulatory environment supports a market heavily reliant on thermal energy while steering it towards an aggressive expansion in renewable energy. Notably, the Saudi Electricity Company (SEC) leads in generation and distribution, and the National Grid manages transmission.

Market Segmentation and Key Players in Saudi Power Sector

The power consumption market in Saudi Arabia is segmented into residential, commercial, and industrial sectors, reflecting the diverse energy needs across the country. In 2023, the residential sector was notably significant, aligning with increases in urban development and population growth. The commercial and industrial sectors also contribute substantially to the overall energy consumption, driven by ongoing economic expansions and industrial activities that are central to Saudi Arabia’s economic vision.

The year 2023 featured various types of transactions, including partnerships, debt offerings, acquisitions, private equity, and asset transactions. Partnerships were particularly key, often facilitating technology transfer and integrating global expertise into local projects.

The competitive landscape includes major players such as Saudi Electricity Co., Saudi Arabian Oil Co., Saline Water Conversion Corp, ACWA Power International, and Engie SA. In 2023, Saudi Electricity Co. was at the forefront of power generation, playing a pivotal role in the sector.

Strategic Insights for Success in Saudi Arabia’s Power Market

Saudi Arabia’s power market is not only expanding but also undergoing significant transformation, influenced by regulatory developments and strategic initiatives aimed at diversifying energy sources and increasing renewable energy capacity. As the market evolves and the kingdom progresses towards its ambitious 2030 goals, comprehensive Saudi market research becomes indispensable for those looking to understand the complexities and capitalize on the sector’s vast potential. Our consulting services provide the insights and strategic guidance necessary to navigate these changes effectively. With our support, clients can confidently make decisions that align with the latest market trends and future projections, ensuring success in Saudi Arabia’s dynamic power sector.