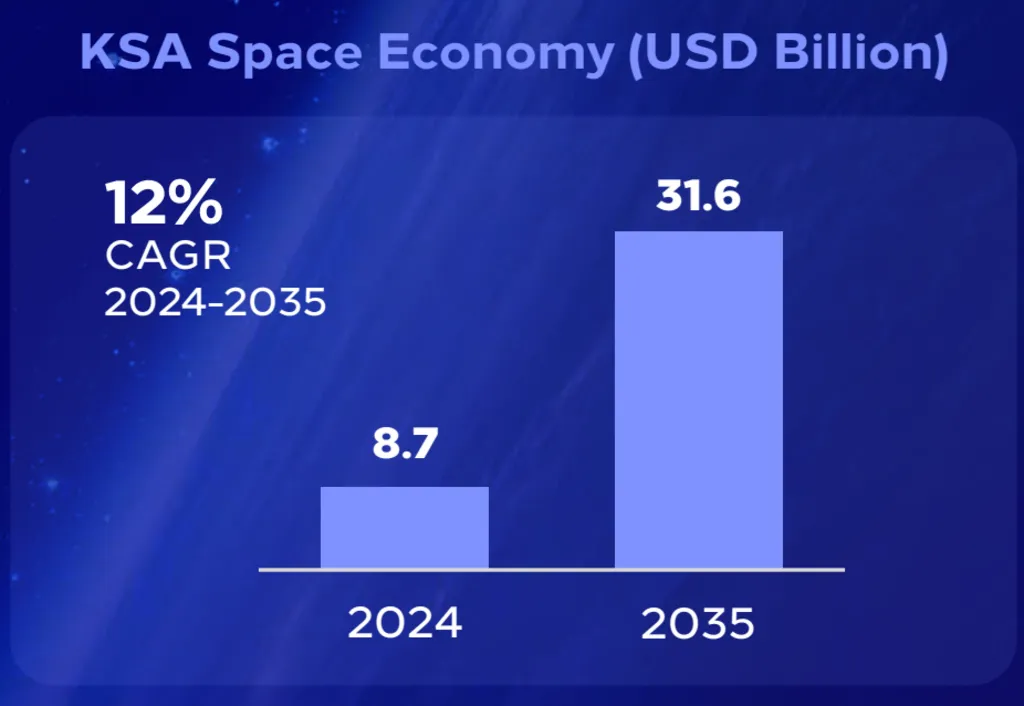

12% CAGR Set to Propel Saudi Space Economy Expansion to $31.6 Billion

Saudi Arabia's space economy is projected to grow from $8.7 billion in 2024 to $31.6 billion by 2035, driven by a 12% compound annual growth rate (CAGR), according to a recent report by the Communications, Space and Technology Commission (CST) of Saudi Arabia. This transformation is powered by robust government support, public-private partnerships, and strategic investments across upstream and downstream sectors. As the global space market undergoes a shift towards commercial applications and satellite-enabled services, Saudi Arabia is positioning itself at the center of this transition.

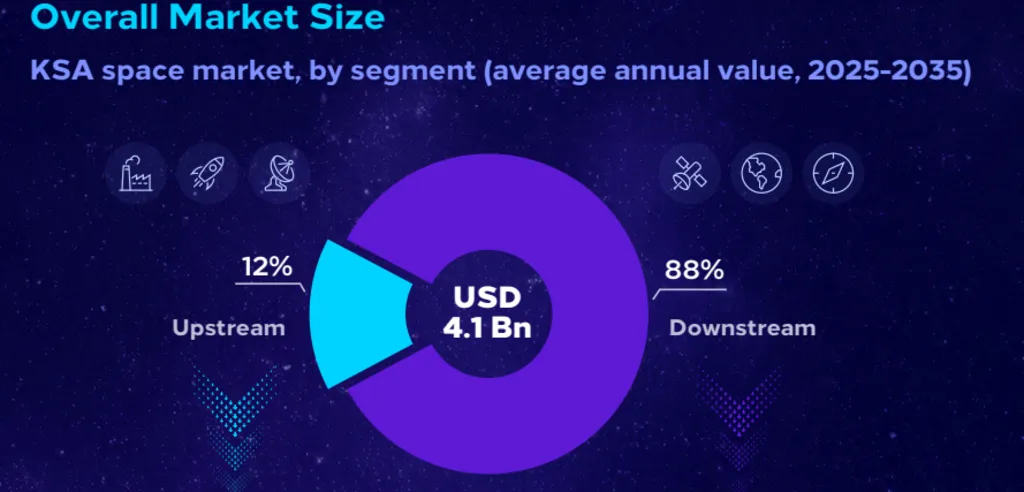

This article breaks down the Kingdom’s sectoral dynamics: from satellite communication, navigation, and Earth observation to manufacturing and launch capacity within the context of the broader Saudi Space Economy Expansion. It explores the challenges, enablers, and twelve key verticals that define short-term and long-term opportunities. With downstream segments commanding 88% of average market share, and the upstream peaking between 2027–2029, the Kingdom’s dual focus on scalability and innovation is recalibrating its space ambition into a sustainable growth strategy.

Downstream Accounts for 88% of Saudi Space Market Growth

A significant portion of the Saudi Space Economy Expansion is anchored in downstream activities such as satellite communication (satcom), navigation (satnav), and Earth observation (EO). Combined, these verticals represent the bulk of market activity, driven by rising demand for consumer broadband, data-driven enterprise services, and national logistics. Satcom leads with an annual average of $1.8 billion, followed closely by satellite navigation at $1.5 billion, while EO contributes over $200 million annually.

Government and commercial sectors alike are pushing the envelope on satellite utility, with applications spanning defense, urban planning, agriculture, and disaster response. Notably, residential broadband coverage and mobile network integration (non-terrestrial networks or NTN) are reinforcing the need for multi-orbit constellations and higher signal fidelity across verticals.

Upstream Activities Peak in 2027–2029 but Face Capacity Limits

Saudi Arabia’s upstream market—including satellite manufacturing, launch services, and ground infrastructure—is forecasted to generate $0.5 billion annually. Manufacturing will peak between 2027 and 2029 as new low-Earth orbit (LEO) constellations roll out, such as SARsat’s plan for 18 satellites. Yet, constraints such as the absence of local launch capabilities and limited domestic manufacturing capacity keep upstream momentum tethered to international partnerships.

Ground segment infrastructure is gaining traction, particularly in collaboration with players like OneWeb and stc. Initiatives to create ground segment-as-a-service (GSaaS) platforms signal Saudi Arabia's intent to modernize legacy systems while exploring cloud-based Earth station deployments.

Saudi Space Investments Surge with Global Partnerships and Local Ventures

Investment activity in the Saudi space market mirrors the global trend of commercial consolidation and innovation-led funding. Aljazira Capital’s $350 million round for Axiom Space, NEOM’s $200 million venture with OneWeb, and NSG’s acquisition of Taqnia ETS reflect the Kingdom's bullish posture on space commercialization. The deals span satellite IoT, EO analytics, and broadband, reinforcing Saudi Arabia’s intent to foster a vibrant tech ecosystem.

New entrants such as NSG, SARsat, and SpaceGuardian are contributing to increased competition, while programs like the Saudi Space Accelerator and initiatives by CST and KAUST are nurturing talent and entrepreneurship. The government’s regulatory and institutional framework—via CST, SSA, and the Supreme Space Council—further strengthens investor confidence.

Twelve Opportunity Themes Define the Expansion Horizon

Twelve key themes illustrate how the Saudi Space Economy Expansion is structured across immediate and strategic horizons. In the short-to-medium term, Saudi Arabia is prioritizing GSaaS, multi-orbit services, NTN integration, and EO analytics. Over the long haul, it aims to localize satellite logistics, pursue deep space exploration, and commercialize augmentation services for precision applications.

Despite hurdles like high capex requirements and talent shortages, enablers such as regulatory clarity, readily available funding, and academic partnerships are accelerating sector maturity. As the Kingdom builds sovereign capabilities in both public and private space ventures, its trajectory points toward long-term self-sufficiency and regional dominance.

Also Read: Saudi’s Air Sector Hits $90B, Transforming Global Connectivity