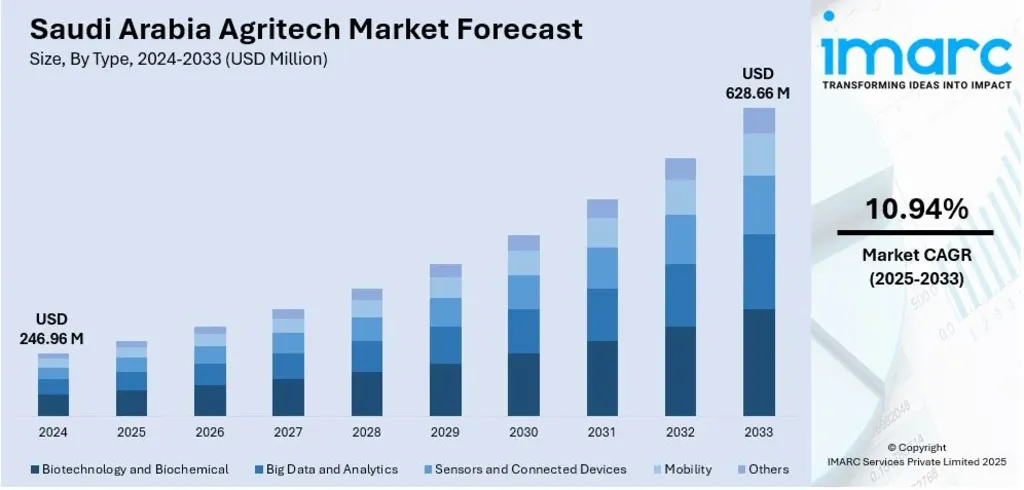

Saudi Agritech Market Surge: A $628.66M Leap Toward Food Security by 2033

The Saudi Agritech Market Surge is no longer a distant vision—it’s a data-backed transformation. With the market projected to grow from USD 246.96 million in 2024 to USD 628.66 million by 2033, at a CAGR of 10.94%, Saudi Arabia is rapidly redefining its agricultural landscape. This surge is fueled by a blend of climate-driven necessity, government-backed innovation, and a bold pivot toward sustainable, tech-enabled farming.

$1B+ Investment Fuels Controlled-Environment Agriculture

One of the most significant drivers of the Saudi Agritech Market Surge is the expansion of controlled-environment agriculture (CEA). With over USD 1 billion earmarked for greenhouse and plant resource development by 2025, the Kingdom is betting big on vertical farming, climate-controlled greenhouses, and indoor cultivation. These technologies are especially vital in urban hubs like Jeddah and Dammam, where traditional farming is constrained by arid conditions.

CEA not only enables year-round production but also supports the Kingdom’s goal of producing over 1 million tons of fresh produce annually. This shift is reducing import dependency and enhancing food security—two pillars of Saudi Arabia’s Vision 2030.

Water-Efficient Agritech Tech Gains Ground in $628.66M Market

With agriculture consuming nearly 80% of the Kingdom’s water, the Saudi Agritech Market Surge is closely tied to the adoption of water-saving technologies. Drip irrigation, hydroponics, and aeroponics are becoming mainstream, particularly in regions like Al-Qassim and Riyadh.

These systems, often integrated with sensors and automation, allow real-time monitoring of water and nutrient levels—minimizing waste and maximizing yield. The Qatrah program, which aims to cut daily water use per person by nearly 50% by 2030, further underscores the urgency and institutional support behind this trend.

Big Data, Sensors, and Biotech Drive 10.94% CAGR

The market’s segmentation reveals a strong tilt toward high-tech solutions. Categories such as big data and analytics, sensors and connected devices, and biotechnology are leading the charge. These tools are enabling precision agriculture—where every drop of water, every nutrient, and every square meter of land is optimized.

From predictive analytics to real-time crop health monitoring, these technologies are not just enhancing productivity—they’re reshaping how agriculture is managed in a desert climate.

Government-Backed Startups and Smart Cities Accelerate Growth

The Saudi Agritech Market Surge is also being propelled by robust government support. Under Vision 2030, initiatives like agritech accelerators, research grants, and regulatory reforms are creating fertile ground for innovation. Smart city projects like NEOM and the Red Sea Project are serving as testbeds for next-gen farming systems.

Startups are thriving in this ecosystem. For instance, Arable, a Saudi agritech startup, secured $2.55 million in seed funding in early 2025—90% of which came from international investors. This signals growing global confidence in the Kingdom’s agritech potential.

Regional Expansion: Central and Western Regions Lead

Regionally, the Northern and Central regions are emerging as agritech hotspots, followed closely by the Western region. These areas are benefiting from both natural resource allocation and strategic infrastructure investments. As the Saudi Agritech Market Surge continues, regional diversification is expected to play a key role in scaling the sector sustainably.

Also Read: Cold Chain to Coffee: Saudi Agri‑Food Market Grows