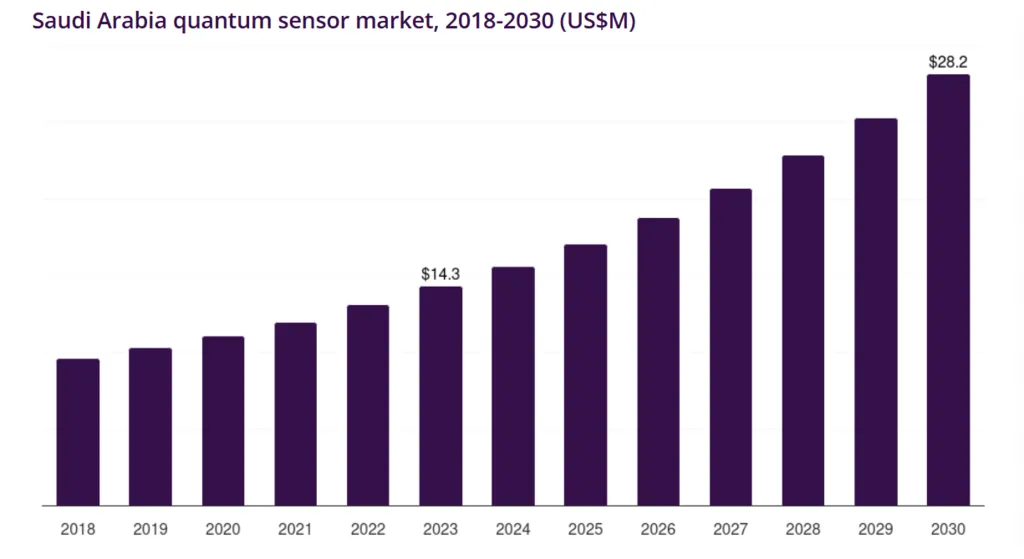

Saudi Quantum Sensors Industry: Doubling to $28.2M by 2030

The growing need for precise measurement, defense, and aerospace applications is propelling the Saudi quantum sensors industry into a critical advancement phase. The industry is expected to rise at a compound annual growth rate (CAGR) of 10.2%, with market revenue expected to soar from USD 14.3 million in 2023 to USD 28.2 million by 2030. Saudi Arabia is now positioned as an important player in the second quantum revolution as a result of both domestic investment and worldwide innovation.

Atomic Clocks Lead 2023 Revenue in Saudi Quantum Sensors Industry

In 2023, atomic clocks emerged as the top revenue-generating segment, underscoring their critical role in high-precision timing systems used in aerospace, navigation, and telecommunications. These sensors leverage quantum properties to maintain ultra-stable frequency standards, essential for satellite synchronization and secure communications.

Saudi Arabia’s focus on aerospace modernization and defense infrastructure has amplified demand for atomic clocks, making them the backbone of the current quantum sensor landscape.

PAR Quantum Sensors to Grow Fastest Through 2030

While atomic clocks dominate today, PAR Quantum Sensors are forecasted to be the fastest-growing segment through 2030. These sensors, which measure photosynthetically active radiation, are increasingly used in environmental monitoring, smart agriculture, and climate modeling.

Their rapid adoption reflects Saudi Arabia’s broader push toward sustainability and smart city initiatives. As the Kingdom diversifies its economy under Vision 2030, PAR sensors offer scalable applications in energy optimization and ecological data collection.

Global Players Fuel Local Innovation in Saudi Quantum Sensors Industry

The Saudi Quantum Sensors Industry benefits from a strong pipeline of global expertise. Key international players such as Adtran Holdings Inc, Microchip Technology Inc, and Bosch are actively shaping the market through partnerships, tech transfers, and R&D investments.

In a late 2024 interview with Thales Group Chairman & CEO Patrice Caine, he spotlighted quantum sensors as a transformative force in aerospace. The company’s strategic pivot from quantum computing to quantum sensing and communication aligns with Saudi Arabia’s ambitions to lead in next-gen aerospace systems. With proof-of-concept technologies already in lab testing, industrial-scale deployment is expected within the next decade.

Also Read: KSA Space Economy to Hit $31.6B by 2035

Quantum Sensors vs AI: A New Frontier in Aerospace Efficiency

While artificial intelligence remains dominant in tech discourse, quantum sensors are quietly emerging as a 100x efficiency multiplier in aerospace systems. Unlike incremental AI upgrades, quantum sensors offer a fundamental leap in precision, speed, and reliability.

Saudi Arabia’s investment in aerospace innovation—bolstered by events like the Future Investment Initiative—signals a readiness to embrace quantum-powered systems. These sensors will not only enhance decision-making but also redefine operational capabilities in defense and aviation.

Market Outlook: Saudi Quantum Sensors Industry Set for 10.2% CAGR

With historical data spanning 2018–2022 and a robust forecast through 2030, the Saudi Quantum Sensors Industry is on a clear upward trajectory. The market’s segmentation—spanning atomic clocks, gravitational sensors, PAR quantum sensors, and quantum magnetic sensors—offers diverse entry points for innovation.

As regional demand intensifies and global players deepen their footprint, Saudi Arabia is poised to become a quantum sensor hub in the Middle East. The next few years will be critical for scaling prototypes, securing industrial applications, and aligning tech development with market needs.