Saudi Arabia’s Changing Consumer Behavior: Data-Driven Market Opportunities

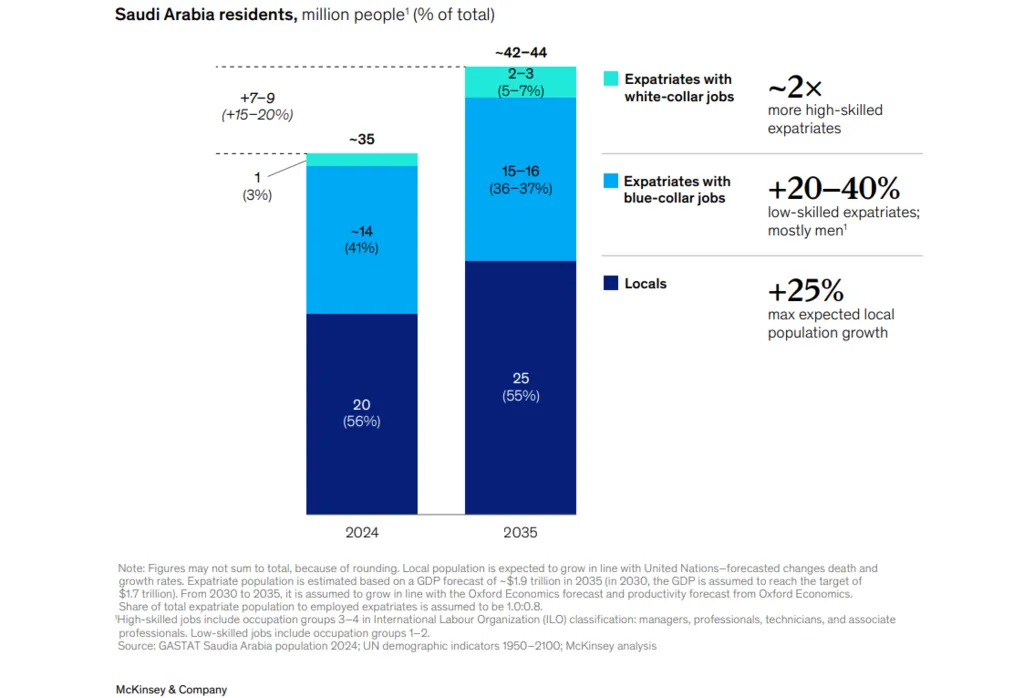

100 Million Consumers by 2035: A New Era of Scale

Saudi Arabia is on the cusp of a consumer revolution. By 2035, the total number of consumers (residents and tourists combined) is projected to exceed 100 million. This surge is fueled by population growth, a rising expatriate workforce, and a booming tourism sector expected to attract up to 70 million international visitors annually. According to the latest Saudi Consumer Insights based on McKinsey’s 2025 research, this expansion marks a seismic shift in market scale, demanding new strategies for segmentation and outreach.

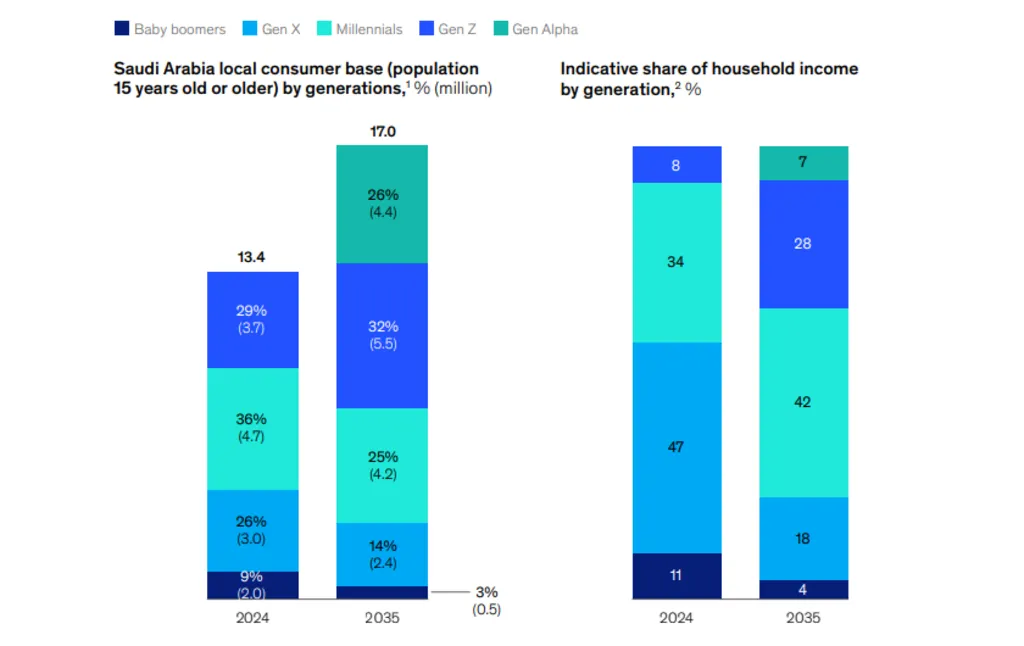

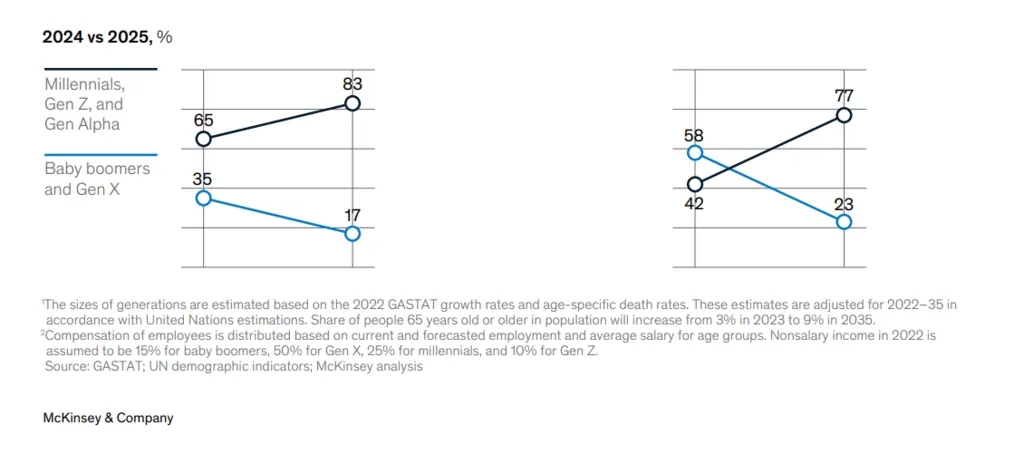

Youth Will Control 77% of Household Income

The generational composition of Saudi consumers is rapidly evolving. By 2035, millennials, Gen Z, and Gen Alpha will represent 83% of the population and control 77% of household income. This youth-dominated landscape will favor brands that understand digital fluency, social commerce, and experience-driven consumption. Saudi Consumer Insights show that companies unable to resonate with younger audiences risk losing relevance in this fast-moving market.

Women’s Workforce Participation to Double

Saudi women are stepping into the economic spotlight. By 2035, the number of working women is expected to double to 3 million, accounting for 37% of the workforce. Two-thirds will hold high-skill jobs, supported by the fact that half of university graduates will be women. This shift is reshaping consumption patterns—demand for ready-made meals, convenience retail, and smaller pack sizes is rising. Saudi Consumer Insights suggest that brands catering to dual-income households will thrive.

75% of Locals Will Be Middle Class

Disposable income is set to double, and 75% of Saudi residents will be classified as middle class by 2035. While premium niches will persist, the bulk of growth will come from value-driven offerings. Interestingly, 90% of consumers have recently traded down, yet more than half still express intent to splurge. This “zero middle” behavior where consumers oscillate between budget and luxury, requires brands to rethink pricing strategies. Saudi Consumer Insights highlight the need for bifurcated product portfolios that serve both ends of the spectrum.

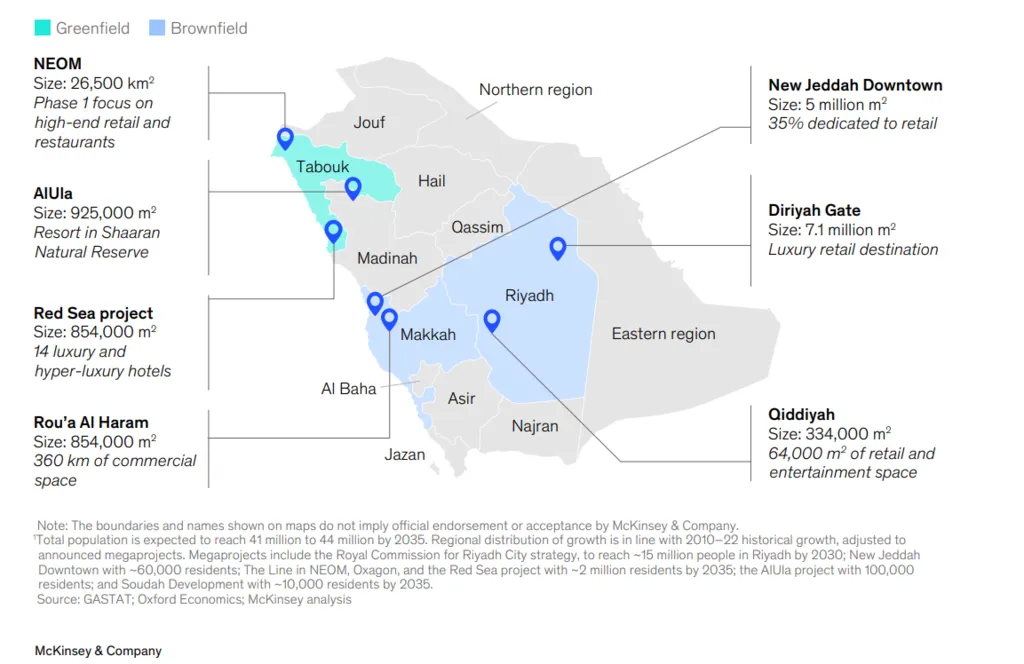

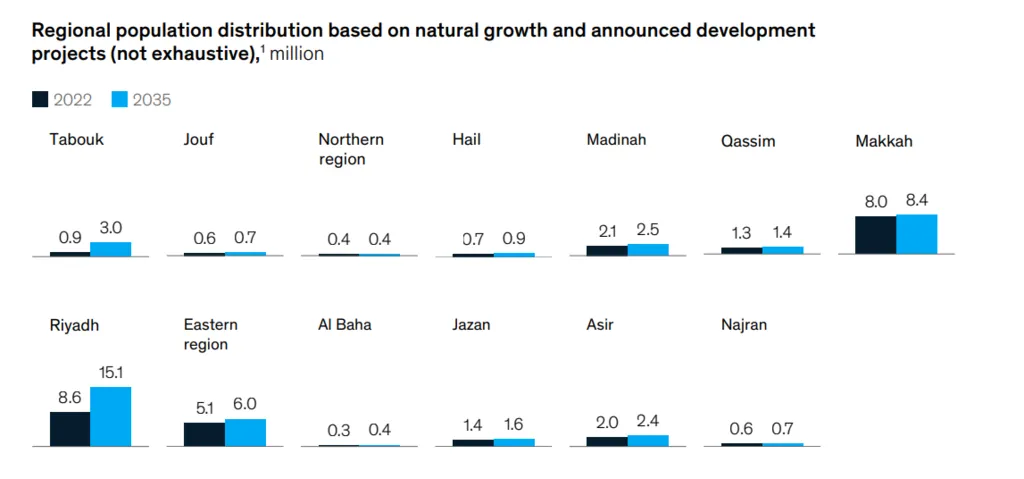

Riyadh to Drive Over 50% of Population Growth

Urbanization is accelerating, with Riyadh poised to absorb more than half of Saudi Arabia’s population growth by 2035. The city’s population is expected to jump from 9 million to 15 million, driven by megaprojects like Diriyah Gate and Qiddiyah. Meanwhile, Tabuk’s population may triple due to NEOM’s development. This underscores the importance of geographic targeting; therefore, retailers and service providers must align their expansion plans with these emerging urban hubs.

E-Commerce to Hit $60 Billion by 2035

Despite being one of the world’s most digitally connected populations, Saudi Arabia’s B2C e-commerce market remains underdeveloped. That’s changing fast. E-commerce is projected to grow 15% annually, reaching $60 billion by 2035. Social commerce is also booming, with 80% of Saudis active on social media and the market expected to hit $4.5 billion by 2028. Saudi Consumer Insights reveal that omnichannel strategies, especially those integrating social platforms will be key to capturing consumer attention.

Loyalty Is Fading, Experimentation Is Rising

Young Saudi consumers are increasingly brand-agnostic. Over half of those who traded down switched retailers, and nearly a quarter changed brands. This “zero loyalty” trend mirrors global patterns, where younger generations favor niche products and independent stores. Saudi Consumer Insights suggest that brands must continuously innovate and personalize to retain engagement.

Health and Sustainability Are Gaining Ground

Conscious consumption is on the rise. Forty percent of Saudis are adjusting their buying habits due to sustainability concerns, and 65% are willing to pay more for healthier food. In apparel, 60% value fair-trade practices, and 62% prioritize sustainable materials. Saudi Consumer Insights indicate that ethical and wellness-oriented brands are well-positioned for growth.

Four Investment Themes for Market Entry

To capitalize on these shifts, companies should focus on four strategic areas:

- Value pools: Serve the growing middle class with affordable offerings.

- New lifestyle products: Tap into sports, wellness, and tourism.

- Channel modernization: Invest in e-commerce and B2B upgrades.

- Capability building: Leverage AI, automation, and M&A for scale.

These shifts highlight a simple truth: understanding Saudi Consumer Insight is the foundation for long-term success.

Also Read: Saudi Retail Digital Trends: Small-Town Stores Go National