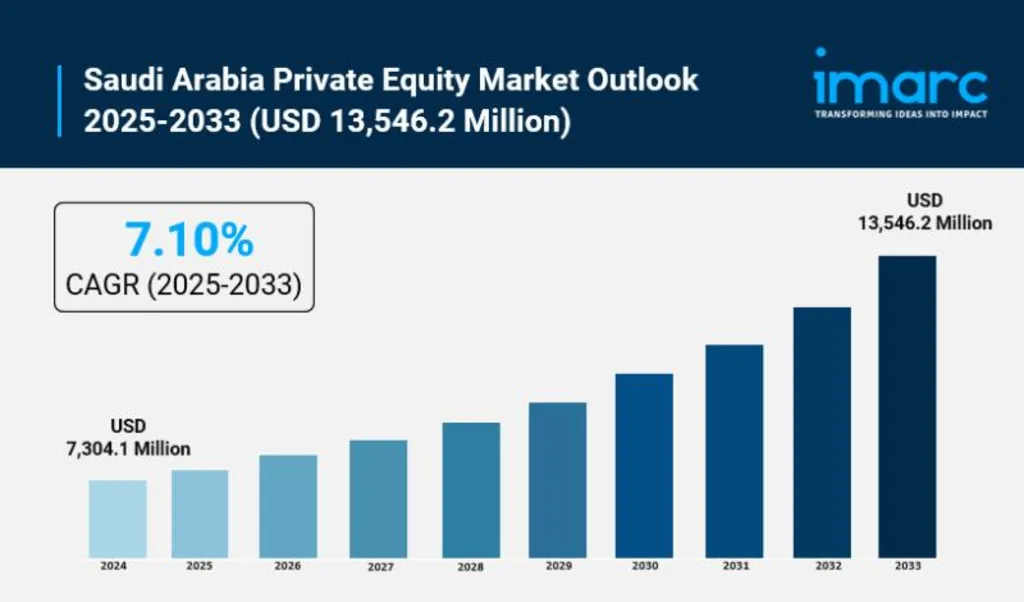

Market Set to Grow at 7.10% CAGR, Reaching $13.5B by 2033

The Saudi PE market forecast points to a robust expansion, with the market expected to nearly double from USD 7.3 billion in 2024 to USD 13.5 billion by 2033. This growth, driven by a 7.10% compound annual growth rate (CAGR), reflects the Kingdom’s accelerating shift toward economic diversification and private sector empowerment.

Private equity is becoming a strategic pillar of national development. With Vision 2030 in full swing, the demand for private capital is surging across infrastructure, technology, healthcare, and tourism.

Saudi Led MENA PE Activity in H1 2025 with 45% of Deals

According to recent data, Saudi Arabia accounted for 45% of all private equity transactions in the MENA region during the first half of 2025. The Kingdom recorded 13 deals, marking an 8% year-on-year increase, while the UAE followed with 12 deals—a 25% decline from the previous year.

Together, Saudi Arabia and the UAE made up 86% of all regional private equity activity, underscoring their dominance in the MENA investment landscape. Notably, 12 of Saudi Arabia’s 13 deals involved local investors, highlighting strong domestic confidence and capital deployment.

Larger Deals Dominate: $500M–$1B Transactions Rise to 29%

A key trend shaping the Saudi PE market forecast is the shift toward larger, high-conviction investments. In the first half of 2025, transactions in the $500 million to $1 billion range accounted for 29% of total deal volume and 42% of disclosed capital—surpassing even the $1 billion-plus segment.

Meanwhile, smaller deals under $50 million dropped to just 14%, the lowest share on record. This concentration of capital into fewer, larger deals signals a maturing market that’s aligning with global private equity trends.

AI and Automation Fuel Efficiency in Saudi PE Market

Artificial intelligence is playing a transformative role in the Saudi PE market forecast. AI-driven due diligence platforms are accelerating deal evaluation, while machine learning tools are enhancing portfolio monitoring and performance optimization.

Predictive analytics are helping firms time their exits more effectively, and intelligent automation is streamlining fund administration. These innovations are not only improving operational efficiency but also enabling firms to focus on strategic value creation.

Vision 2030 and Regulatory Reform Drive Investor Confidence

Saudi Arabia’s Vision 2030 continues to be a major catalyst for private equity growth. The government’s push to diversify the economy away from oil has opened up new sectors for investment, including renewable energy, digital infrastructure, and healthcare.

The new Investment Law, implemented in February 2025, has simplified the investment process by replacing licensing with registration and ensuring equal treatment for foreign and domestic investors. These reforms are enhancing transparency and reducing barriers to entry, making the Kingdom more attractive to global capital.

BlackRock and Global Players Expand Saudi Presence

Global asset managers are deepening their commitments to the Kingdom. BlackRock, for example, is preparing to double or triple its Saudi exposure, building on its $35 billion investment across equities, fixed income, and infrastructure.

The firm now operates four investment teams in Riyadh and is expanding into multi-asset strategies and mutual funds. Its involvement in landmark deals, such as an $11 billion Aramco transaction and a $40 billion data center acquisition highlights the scale of opportunity in the Saudi PE market forecast.

Also Read: Industrial Diversification in Saudi Arabia: The Next Economic Frontier