Synthetic data Saudi Arabia is moving from niche to necessity. With data privacy laws now fully enforced, market researchers are facing a new reality. Access to real user data is shrinking fast. Consent rules are stricter. And accountability is higher.

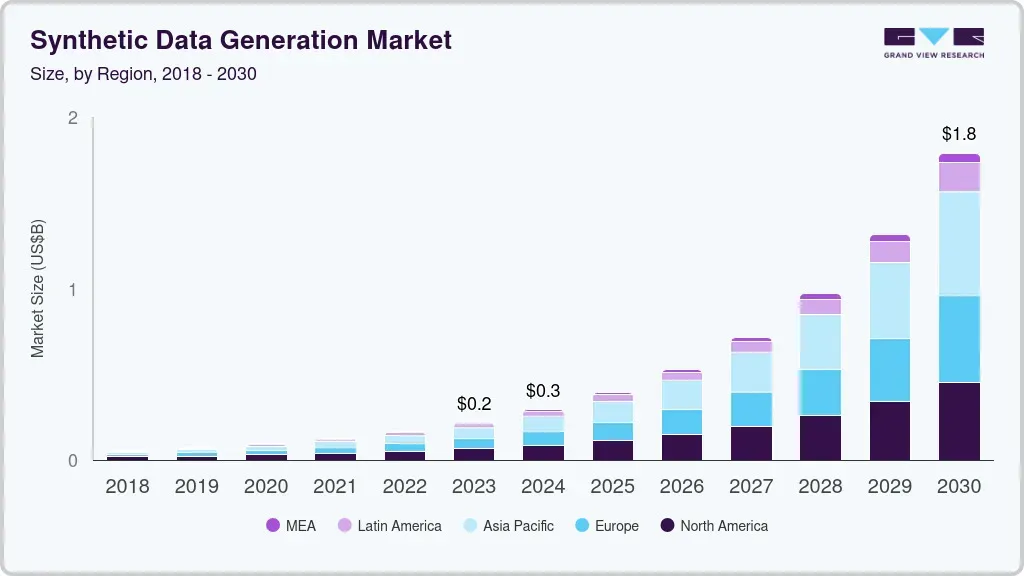

As a result, Saudi Arabia’s synthetic data generation market is growing sharply. It expanded from US$2 million in 2023 and is projected to reach US$14.9 million by 2030, at a 33.3% CAGR. This growth mirrors the wider rise of AI across the Kingdom, where the big data and AI market reached USD 4.1 million in 2024 and is forecast to grow to USD 38.7 million by 2033. Synthetic data is emerging as the solution that allows research to continue without breaking privacy rules.

PDPL Enforcement Pushes Researchers to Synthetic Data Saudi Arabia

Saudi Arabia’s Personal Data Protection Law (PDPL) became fully effective in September 2024. In 2025, enforcement tightened further through amendments led by SDAIA.

These rules changed how market research works. Collecting real customer data now requires strict consent, detailed documentation, and ongoing compliance checks. For many research teams, this adds cost, risk, and delay.

Synthetic data removes much of that burden. It does not contain real personal information, yet it reflects real-world behavior patterns. This makes it a privacy-compliant alternative at a time when PDPL scrutiny is rising across marketing and analytics.

Synthetic Data Saudi Arabia Enables AI “Research Agents”

The shift is not just about data. It is also about who does the research.

Synthetic data allows AI agents to run tasks that once required human moderators. These agents can simulate focus groups, test product concepts, and model customer reactions using AI-generated personas.

By 2026, Gartner predicts 75% of businesses will use generative AI to create synthetic customer data, up from less than 5% in 2023. This change enables research agents to scale fast, test rare scenarios, and operate continuously without privacy risk.

Neural network-based synthetic data keeps statistical patterns close to real populations. This improves reliability while reducing deployment risks.

Read Also: Saudi Data Center Market to Hit USD 3.9B by 2030

Read Also: AI Powers Saudi’s $12.24B Data Expansion

Why Banks and Telcos Will Lead the AI Agent Shift

Saudi banks and telecom companies are already advanced users of AI. They apply it to fraud detection, customer service, and operational efficiency.

More than 80% of Middle East organizations now face pressure to adopt agentic AI. About 69% plan to increase investment by 2026. Deloitte identifies 2026 as the tipping point, when Arabic-optimized AI agents become trusted tools across finance and telecom.

These agents are expected to reduce manual workloads by up to 30%, especially in repetitive research and analysis tasks. Synthetic data is what makes this possible under PDPL rules.

Read Also: Saudi Data-Driven Market Research: How AI Tools Are Transforming Consumer Insights

The New Synthetic Data Saudi Arabia Research Model Takes Shape

Market research in Saudi Arabia is changing direction. Feasibility now depends less on direct surveys and more on AI-driven simulation. Synthetic data makes that shift safe, fast, and scalable.

As Synthetic data Saudi Arabia becomes central to insight generation, organizations need experienced partners who understand AI, regulation, and local market dynamics. With 40 years of distinguished experience, Saudi Arabia Market Research by Eurogroup Consulting excels in delivering strategic consulting services, with a strong focus on market research in Saudi Arabia and the wider region. Their team provides deep insights and trusted support, making them an essential partner for succeeding in the Kingdom’s rapidly evolving market landscape.