Market Hits $3.82B in 2024: Why Growth Is More Than Skin-Deep

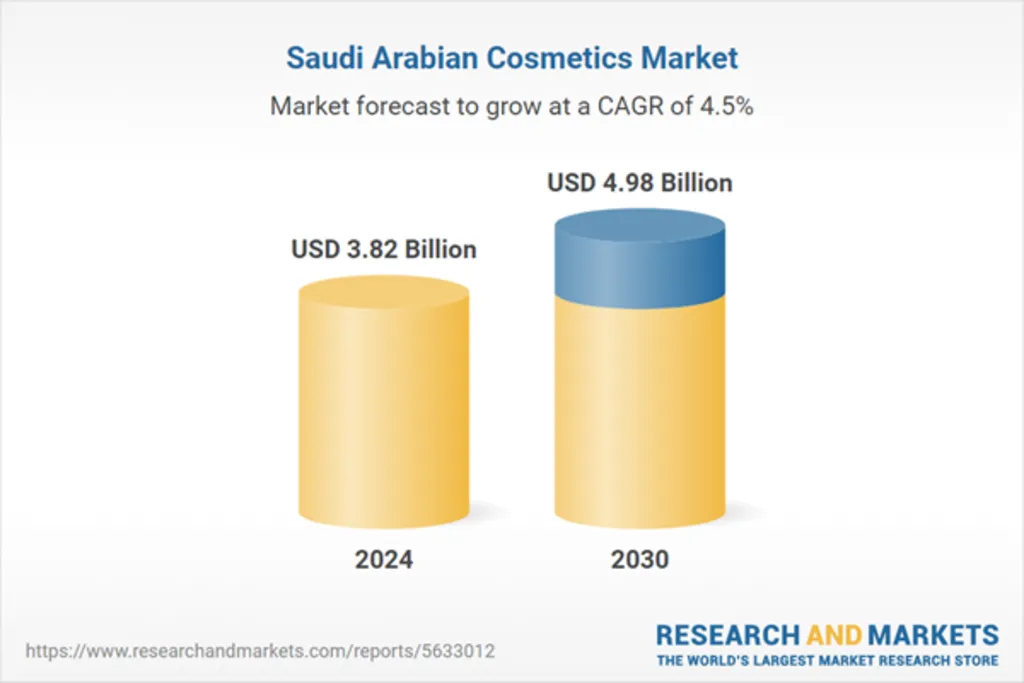

The Saudi Cosmetics Market surged to USD 3.82 billion in 2024 and is projected to reach USD 4.98 billion by 2030, fueled by a steady 4.52% CAGR. Young, socially connected consumers—particularly women—are increasingly drawn to premium and luxury cosmetic offerings. With evolving beauty standards driven by influencers and viral content, cosmetic brands in the Kingdom are riding a wave of cultural and digital transformation.

In this article, we unpack the economic drivers behind this $4.98 billion forecast, spotlight the empowered women reshaping spending patterns, dive into e-commerce’s seismic impact, and dissect the macroeconomic risks brands must navigate. With high-stakes IPOs and compliance tech now entering the scene, the Saudi Cosmetics Market is now a cross-sector business phenomenon.

36.2% Female Workforce Drives Premium Cosmetic Demand

Saudi women's workforce participation hit 36.2% in 2024, creating a new tier of empowered, beauty-savvy consumers. Employed women with high disposable income, especially in healthcare, finance, and tech, are redefining expectations around product efficacy, convenience, and quality. This shift is not just expanding the cosmetics market—it’s reshaping product design and brand messaging to align with professional lifestyles.

Monthly Disposable Income Nears $4814 for Saudi Families

Saudi households are spending more, with families averaging USD 4813.98 in monthly disposable income as of 2023. This upward trend in consumer wealth has unlocked higher demand for prestige products, cruelty-free formulations, and skincare with wellness-driven benefits. Natural and organic cosmetics are seeing rising adoption, boosted by growing health and environmental awareness.

40K+ E-commerce Firms Fuel Digital Beauty Boom

E-commerce is rewriting the retail playbook. Over 40,000 registered online businesses were active by Q4 2024, and the Saudi Cosmetics Market is at the center of this transformation. Beauty brands are embracing AI-powered skin diagnostics, virtual product try-ons, and influencer-driven campaigns across TikTok and Instagram. Hybrid models—such as click-and-collect and smart kiosks—are reshaping how consumers discover and purchase cosmetics, blending convenience with experience.

Nice One Beauty IPO Raises $320M: Digital Retail Gets Institutional Backing

In January 2025, Nice One Beauty, Saudi Arabia’s largest online cosmetics retailer, made headlines with its blockbuster IPO on the Riyadh stock exchange. The company raised USD 320 million, offering 30% of its share capital at SAR 35 per share3. Investor appetite was overwhelming—retail demand was 7.9x oversubscribed, while institutional interest hit 139.4x. Within days, the share price surged 55%, reflecting strong market confidence in digital-first beauty platforms. With over 4 million registered users and a catalog of 28,000+ products, Nice One’s listing marks a turning point: e-commerce beauty in Saudi Arabia is no longer niche—it’s a publicly traded powerhouse.

SGS Debuts at Beautyworld: Compliance Becomes Competitive Advantage

In April 2025, SGS, the global leader in testing and certification, made its debut at Beautyworld Saudi Arabia, the Kingdom’s premier beauty trade event. With over 400 exhibitors and 15,000+ visitors, the event spotlighted Saudi Arabia’s growing influence in the USD 60 billion Middle Eastern beauty market. SGS introduced tailored compliance solutions aligned with SFDA regulations, including ingredient testing, labeling reviews, and certification via the FASEH platform. Their presence signals a shift: regulatory readiness is now a strategic edge for brands entering the Saudi Cosmetics Market. As consumer safety and transparency become non-negotiable, SGS’s services are helping brands navigate market entry with confidence and speed.

SFDA Cracks Down on Illegal Cosmetics: 1.5M Units Seized

In July 2025, the Saudi Food and Drug Authority (SFDA) launched a sweeping enforcement campaign that exposed serious safety violations in the cosmetics sector. Inspectors shut down an unauthorized warehouse in Najran that was illegally storing and distributing 1.5 million non-compliant cosmetic products, many with manipulated expiration dates. The SFDA also suspended a European pharmaceutical factory over breaches in Good Manufacturing Practices, signaling tighter scrutiny on imported goods.

These actions underscore the Kingdom’s commitment to consumer safety and regulatory integrity—especially as the Saudi Cosmetics Market continues to attract global players and scale rapidly. Brands operating in the region must now navigate not only consumer expectations but also increasingly rigorous compliance standards.

Oil Dependency and Price Volatility Challenge Growth

Despite strong fundamentals, the cosmetics sector faces external pressures. Saudi Arabia’s reliance on oil revenue means market sentiment is sensitive to global fluctuations. Economic downturns trigger cautious spending and price-based preferences, challenging high-end brands. Inflation and currency shifts impact import costs, encouraging brands to innovate with pricing flexibility, local production, and loyalty programs that offer added value.

Also Read: E-Commerce & Tourism Will Drive Saudi’s $408.7B Retail Market