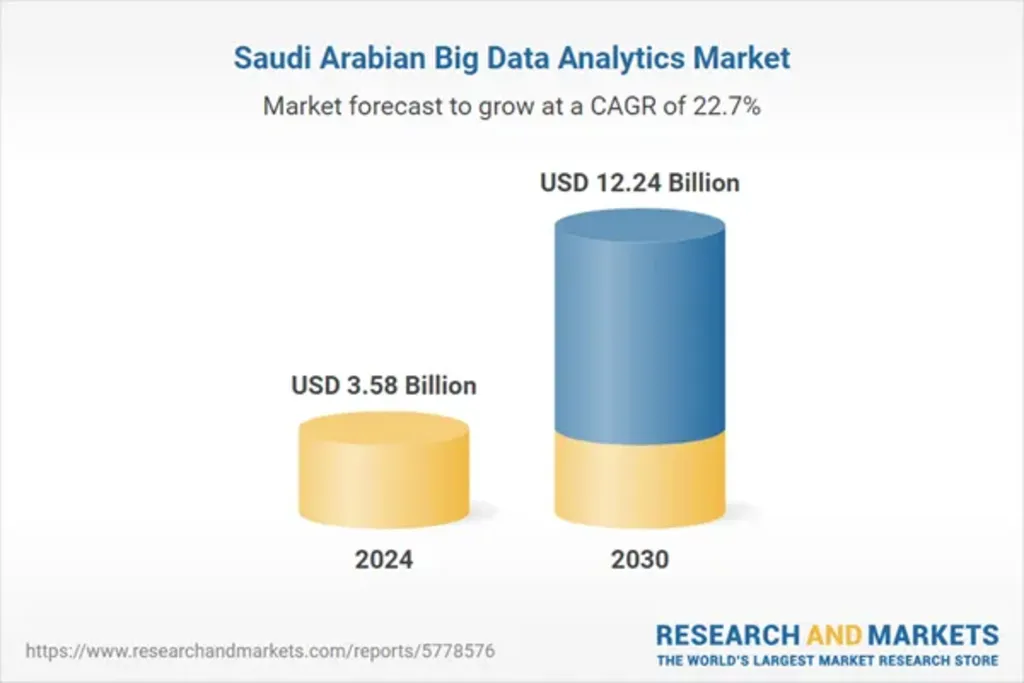

Saudi Big Data Analytics Market Set to Reach $12.24B by 2030

The Saudi Big Data Analytics Market is growing at a pace that’s hard to ignore. Valued at USD 3.58 billion in 2024, it’s projected to more than triple by 2030, reaching USD 12.24 billion. That’s a 22.74% compound annual growth rate, driven not just by technology, but by a national shift in mindset: from oil to information, from instinct to insight.

Vision 2030: The Engine Behind the Data Surge

Saudi Vision 2030 is the driving force behind this pivot, as a blueprint not just for policy, but for Saudi Arabia’s broader ambition to diversify its economy and modernize its institutions. Ministries, municipalities, and major industries are rethinking how they operate, and data is becoming the common thread. Whether it’s optimizing traffic flow in Riyadh or improving patient outcomes in Jeddah, big data analytics is quietly reshaping how decisions are made.

Smart city projects like NEOM and the Red Sea development aren’t just architectural marvels, they’re data ecosystems. Every sensor, every transaction, every interaction feeds into a larger system designed to be intelligent, responsive, and efficient. That’s where analytics comes in: turning raw data into real-time insight.

11,000+ Datasets and a Growing Culture of Openness

One of the most promising signs of maturity in the Saudi Big Data Analytics Market is the rise of open data. As of 2024, the national platform (data.gov.sa) hosts over 11,000 datasets from more than 100 government entities. These numbers represent the foundation for building new technologies, improving services, and driving innovation across industries.

From healthcare and education to transportation and finance, this data is being used to build dashboards, train algorithms, and inform public policy. It’s also encouraging collaboration between the public and private sectors, creating a more transparent and responsive government.

Regulation: A Necessary Hurdle, Not a Roadblock

Of course, with great data comes great responsibility. The introduction of the Personal Data Protection Law (PDPL) has added a new layer of complexity for organizations operating in the Kingdom. Managed by the Saudi Data and Artificial Intelligence Authority (SDAIA), the law sets clear expectations around consent, data handling, and cross-border transfers.

For many companies, especially those still early in their data journey: this means building new governance frameworks, hiring data protection officers, and rethinking how they manage personal information. It’s not easy, but it’s necessary. And while the regulatory landscape is still evolving, the direction is clear: ethical, secure, and citizen-first data practices are non-negotiable.

AI and Analytics: A Natural Convergence

One of the most exciting shifts in the Saudi Big Data Analytics Market is the growing integration of artificial intelligence. We’re seeing a move from descriptive analytics (what happened) to predictive and prescriptive models (what will happen, and what should we do about it).

This is already playing out in sectors like energy, logistics, and retail. Think predictive maintenance in oil refineries, or AI-driven customer segmentation in e-commerce. These strategic shifts allow organizations to act faster, smarter, and with greater precision.

SDAIA is actively promoting this convergence, and it’s clear that AI is becoming a core capability in Saudi Arabia, beyond the buzzwords.

Looking Ahead: Talent, Investment, and Momentum

As the market matures, we’re seeing a surge in investment, both domestic and international. Global tech firms are setting up shop, local startups are gaining traction, and universities are producing a new generation of data-literate professionals.

The momentum is real. And while challenges remain especially around compliance and talent development, the trajectory is unmistakable. The Saudi Big Data Analytics Market is evolving into a cornerstone of the Kingdom’s digital future.

Also Read: Saudi Big Data & Digital Economy: Powering the Kingdom’s Vision 2030 Future

Frequently Asked Questions: Saudi Big Data Analytics Market

1. What is driving the growth of the Saudi Big Data Analytics Market?

The market is expanding rapidly due to Saudi Arabia’s Vision 2030 initiative, which prioritizes digital transformation across sectors. Investments in smart cities, e-government platforms, and cloud infrastructure are generating massive data volumes, creating strong demand for analytics solutions.

2. How big is the Saudi Big Data Analytics Market?

As of 2024, the market is valued at USD 3.58 billion and is projected to reach USD 12.24 billion by 2030, growing at a CAGR of 22.74%.

3. Which sectors are using big data analytics in Saudi Arabia?

Key sectors include healthcare, finance, oil & gas, retail, logistics, and government services. These industries use analytics for everything from predictive maintenance and fraud detection to urban planning and patient care optimization.

4. What role does the Saudi government play in this market?

The government plays a central role through agencies like SDAIA (Saudi Data and Artificial Intelligence Authority), which sets data governance policies and promotes AI adoption. Platforms like data.gov.sa provide over 11,000 public datasets to support innovation and transparency.

5. What are the main challenges facing the market?

The biggest challenge is regulatory compliance, especially with the Personal Data Protection Law (PDPL). Many organizations are still developing the technical and legal frameworks needed to manage data ethically and securely, which can slow down adoption and innovation.