Saudi Consumer Spending Trends 2025: SAR 148B Surge in March

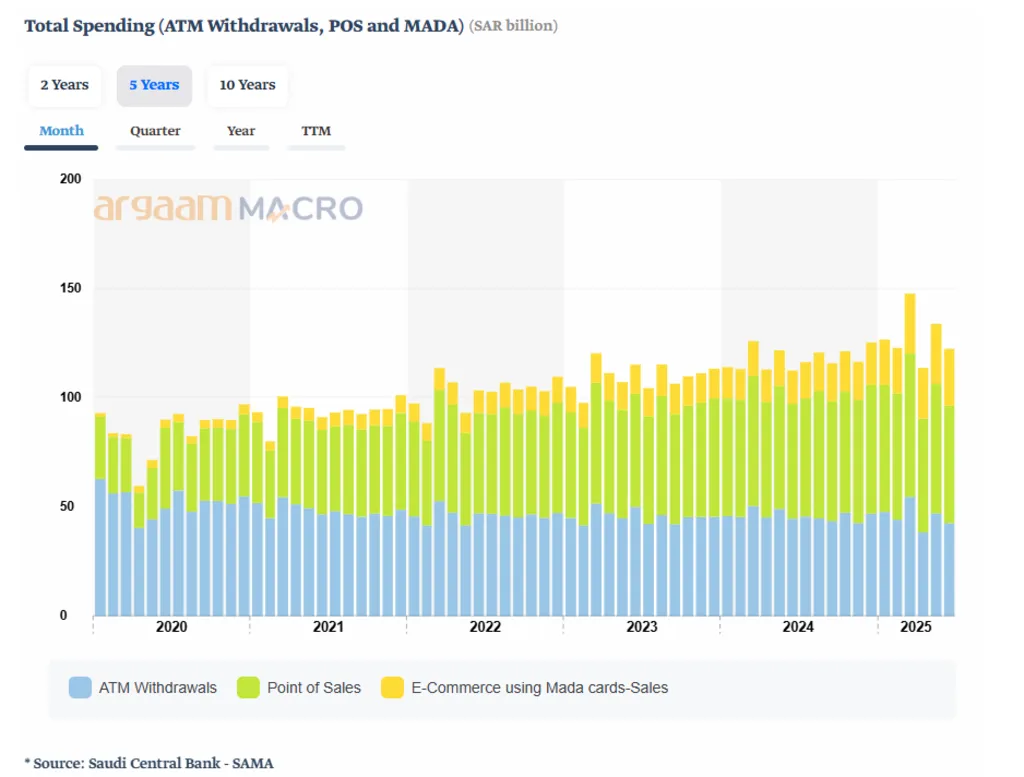

Saudi Arabia’s consumer economy is entering a new phase of resilience and digital transformation. In March 2025 alone, Saudi consumer spending hit an all-time high of SAR 148 billion (US$39.4 billion), marking a 17% year-on-year increase, the strongest surge since May 2021. This spike coincided with Ramadan, Eid Al-Fitr, and the Umrah season, underscoring the cultural and seasonal impact on retail activity.

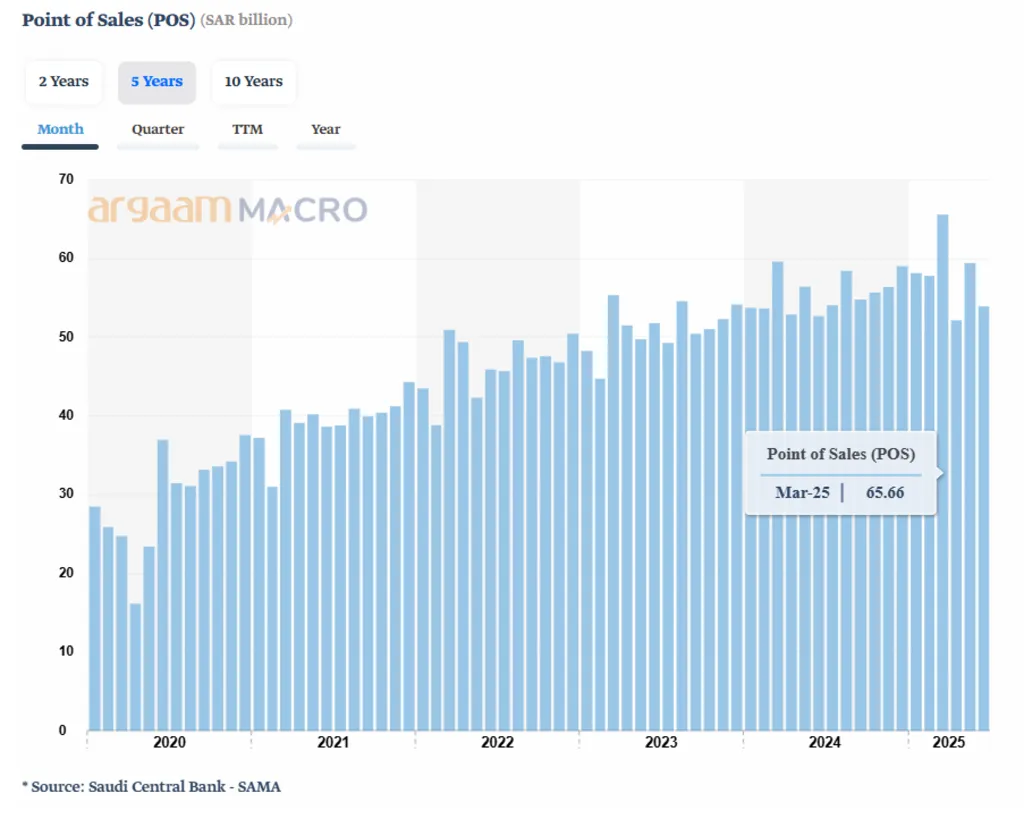

POS Transactions Reach SAR 65.7B: Physical Retail Still Strong

Despite the rise of e-commerce, point-of-sale (POS) transactions climbed 10% YoY to SAR 65.7 billion (US$17.7 billion), processed through over 892 million transactions across 2 million terminals. This reflects sustained consumer engagement with physical retail outlets, from malls and pharmacies to grocery chains and convenience stores.

ATM Withdrawals Hit SAR 54.8B: Cash Still in Circulation

Cash remains a relevant payment method, with ATM withdrawals rising 8% YoY to SAR 54.8 billion ($14.8 billion). These were facilitated through 133.8 million transactions across 15,000 ATMs, showing that while digital payments grow, traditional banking infrastructure continues to support everyday spending.

E-Commerce Sales Soar 73% to SAR 27.5B: Digital Shift Accelerates

The most dramatic growth came from e-commerce via Mada cards, which surged 73% YoY to SAR 27.5 billion ($7.4 billion) in March. With 147.6 million transactions, this reflects the Kingdom’s rapid digitalization and the growing preference for mobile-first, tech-enabled shopping experiences, especially among millennials and Gen Z.

Youth and Digitalization Drive Saudi Consumer Spending Trends 2025

Over 60% of Saudi Arabia’s population is under 30, making it one of the youngest consumer markets in the MENA region. This demographic is fueling demand for cross-border retail, premium products, and personalized shopping experiences. Experts predict a 6.4% CAGR in consumer spending from 2022 to 2028, driven by convenience, health-conscious choices, and digital-first retail strategies.

Grocery and Entertainment Lead Sector Growth in 2025

According to industry insights, groceries and clothing remain dominant spending categories, while 33% of Saudi consumers plan to increase entertainment spending—well above the 19% global average. Vision 2030 aims to double household entertainment spending, boosting sectors like cinemas, theme parks, and leisure travel.

Inflation Alters Behavior, But Not Momentum

While 31% of households reported income drops in 2024, and 11% saw declines over 50%, consumer spending remains resilient. Shoppers are adapting by comparing prices (48%) and seeking value-driven deals (46%), yet demand for high-quality, fresh food and tech gadgets continues to rise.

AI and Quick Commerce Reshape Saudi Consumer Spending Trends 2025

Generative AI is gaining traction, with over 50% of GCC consumers excited about its potential to personalize retail experiences. Meanwhile, digital wallets and “buy now, pay later” models are transforming payment habits. Quick commerce (rapid delivery of non-grocery items) is emerging as a key growth sector.

Structural Reforms and Retail Expansion Fuel Long-Term Growth

Saudi Arabia’s retail landscape is also benefiting from strategic government investments and structural reforms under Vision 2030. These initiatives are not only diversifying the economy but also boosting employment and consumer confidence. International retailers like Spinneys are expanding aggressively, with 12 new stores planned by 2028, reflecting strong investor confidence in the Kingdom’s retail potential. Meanwhile, rising demand for organic, sustainably sourced, and nutrient-dense products signals a shift toward health-conscious and ethical consumption, especially in the food and beverage sector.

Also Read: Saudi Market Research Growth: 62% of Consumers Embrace Cutting-Edge Technology