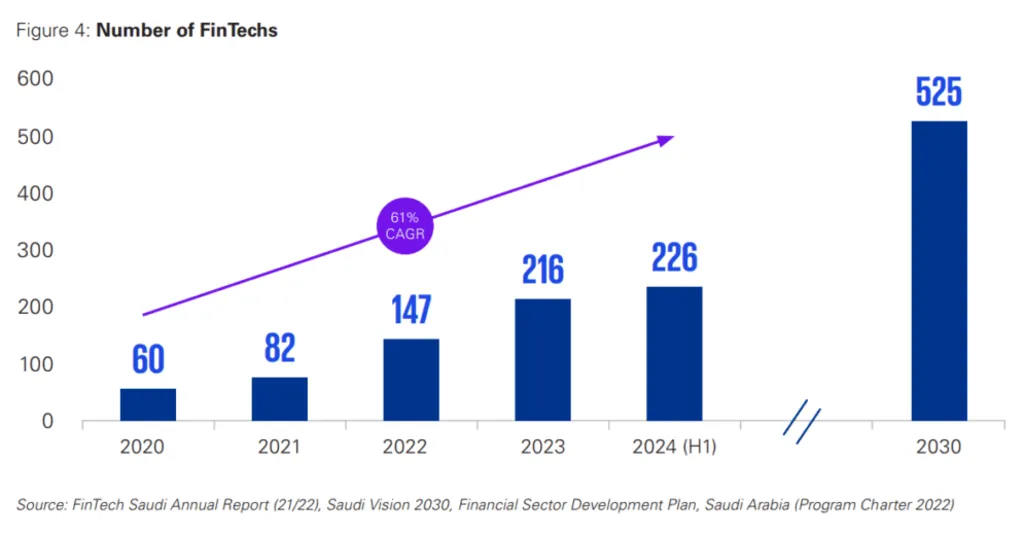

Saudi Fintech market expansion is undergoing a transformation few could have predicted a decade ago. With rapid government-backed initiatives and surging investment, the industry has exploded from just 60 fintech firms in 2020 to 226 by mid-2024—a staggering 61% compound annual growth rate. For investors and entrepreneurs, the kingdom is no longer just a promising market; it’s a thriving, competitive fintech powerhouse.

Venture Capital Flows: Saudi Arabia Defies Global Slowdown

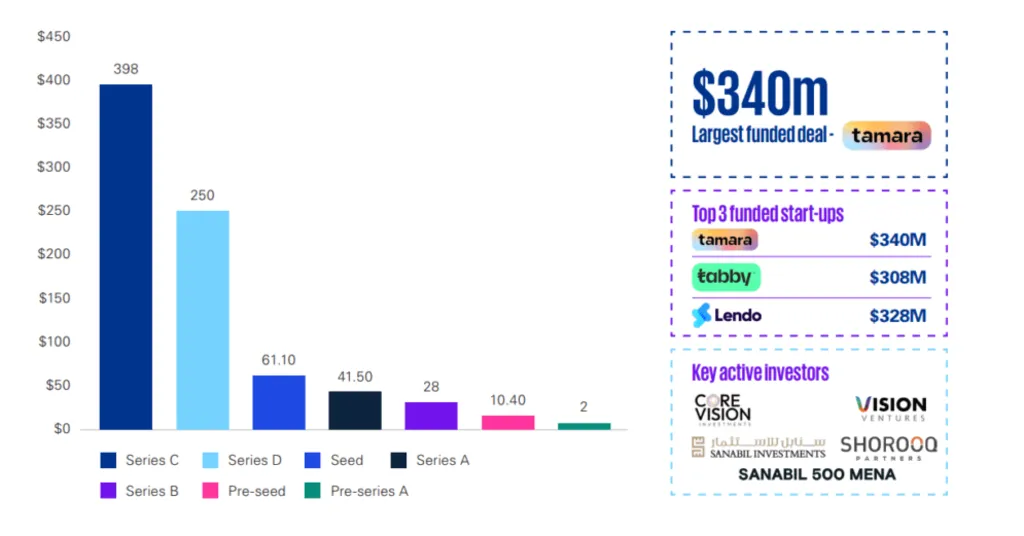

As global fintech investments shrank by 42% in 2023, Saudi Arabia stood as an outlier, attracting $791 million in fintech funding—an astonishing 231% increase compared to the previous year. A significant portion of this capital flowed to BNPL giants Tamara ($340M) and Tabby ($308M), underscoring the kingdom’s appetite for alternative financing models. Meanwhile, venture debt financing accounted for 61% of total venture debt funding, demonstrating the growing appetite for non-equity-based investment.

Payments Revolution: 70% of Transactions Now Cashless

It wasn’t long ago that Saudi Arabia relied heavily on cash for transactions. But the tide has turned. The push for a cashless economy has led to a 70% adoption rate of non-cash payments, up from 62% in 2021. Digital wallets such as stc pay and Alinma Pay have cemented themselves as everyday essentials, while e-commerce transactions are projected to surpass $13.2 billion by 2025. With open banking initiatives gaining momentum, financial accessibility is expanding rapidly, paving the way for broader fintech adoption.

SMEs and Financial Inclusion: A Market in Full Bloom

Saudi Arabia’s small and medium enterprises (SMEs) have long struggled with access to credit, but fintech is quickly filling the gap. In Q1 2024, credit offerings to SMEs grew by 16%, with 94% of financing coming from Saudi banks. Initiatives like Monsha’at’s Funding Gate and the Kafalah Program are helping entrepreneurs secure alternative funding, fostering a financial environment where startups can scale at unprecedented rates. BNPL services have also skyrocketed, with customers growing from 76,000 in 2020 to over 10 million by 2024, proving that fintech-led lending is rewriting the rules of business finance.

The Road to 2030: Fintech’s Future is Written in Bold Numbers

Saudi Arabia’s Fintech Strategy sets ambitious targets, aiming for 525 fintech firms and 18,000 new fintech jobs by 2030. The cumulative venture capital funding in the sector is expected to exceed $12.2 billion, solidifying the kingdom’s place as a regional fintech juggernaut. With SAMA’s Open Banking Lab, insurtech regulations, and a booming climate fintech sector, Saudi Arabia isn’t just keeping pace with global fintech trends—it’s actively setting them.

For investors, founders, and financial institutions, the Saudi fintech market expansion has moved past being an emerging space—it’s now a fully-fledged digital revolution. As regulatory frameworks continue to evolve, and consumer adoption grows, the next phase of Saudi fintech will likely be defined by consolidation, innovation, and a deeper integration with global financial markets. The momentum is undeniable, and if current trends persist, Saudi Arabia’s fintech expansion could very well become one of the standout success stories of the decade.

Also Read: Digital Transformation in Saudi Arabia: What’s Next?