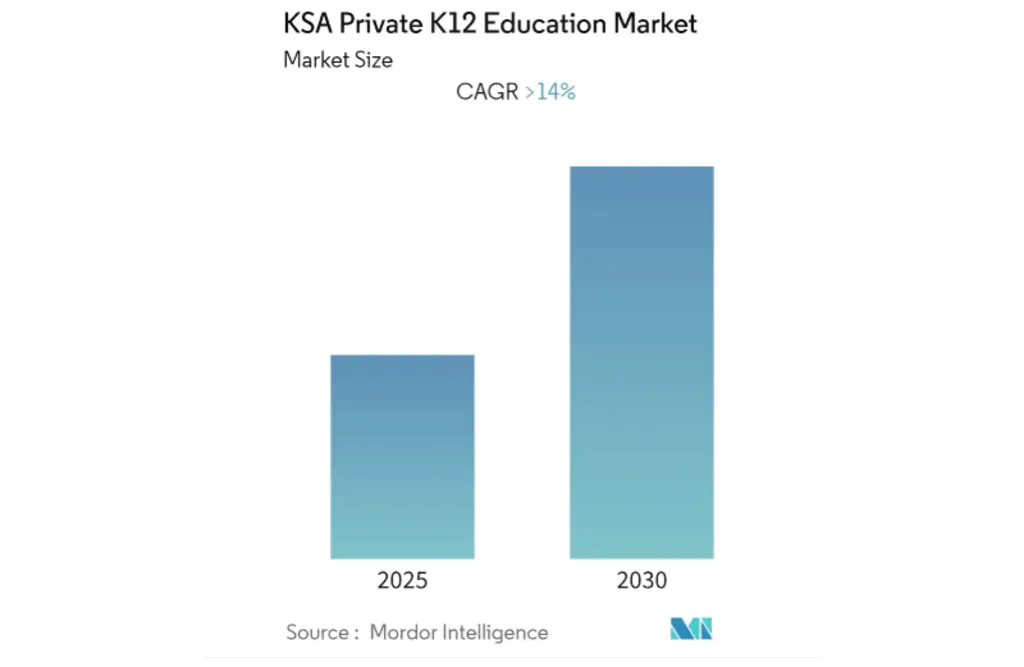

Private Education Poised for 14% CAGR Growth Amid Vision 2030 Reforms

Saudi Arabia’s private K-12 education market is entering a defining era, fueled by an expected 14% compound annual growth rate (CAGR) through 2030. The Kingdom’s bold education reforms, driven by Vision 2030, are accelerating privatization, curriculum diversification, and digital learning adoption. Increasing disposable incomes, demographic shifts, and regulatory changes are opening doors for private investors and global education brands eager to tap into this evolving landscape. In this article, discover Saudi education sector insights, including privatization, investment trends, digital transformation, and the growing demand for global curricula.

USD 37.5 Billion Investment Reinforces Saudi Arabia’s Commitment to Education

The government’s historic USD 37.5 billion allocation in 2022—the largest education budget in the Gulf—signals a deep commitment to modernizing infrastructure, expanding international schools, and integrating advanced learning technologies. With Saudi Arabia’s ambition to become a knowledge-based economy, investments are channeling into teacher development, STEM-focused learning environments, and hybrid education models. The removal of foreign ownership restrictions since 2017 has further unlocked opportunities for global operators looking to expand their footprint in the region.

Privatization Reshapes the Sector: 60 Schools Transitioning to Private Ownership

Saudi Arabia’s education privatization wave is gathering momentum, marking one of the most significant shifts in the region’s schooling system. The National Centre for Privatisation is set to transition 60 state-run schools into private institutions, drawing substantial interest from investors, operators, and multinational education groups. This initiative is designed to enhance competition, drive operational efficiency, and elevate overall learning standards, as private operators introduce modern pedagogy, digital learning tools, and tailored education experiences.

Changing Preferences: International Curricula Gain Traction, Arabic Programs Hold 29% Share

Saudi parents are increasingly gravitating toward global curricula, redefining the market’s structure. While Arabic curriculum holds a dominant 29% market share, the demand for British, American, and International Baccalaureate (IB) programs continues to rise. Expatriates and local families alike are embracing educational systems that emphasize global mobility, English proficiency, and competitive higher education pathways. Major cities like Riyadh and Jeddah are seeing record enrollments in international schools, a trend expected to reshape Saudi’s education landscape in the coming years.

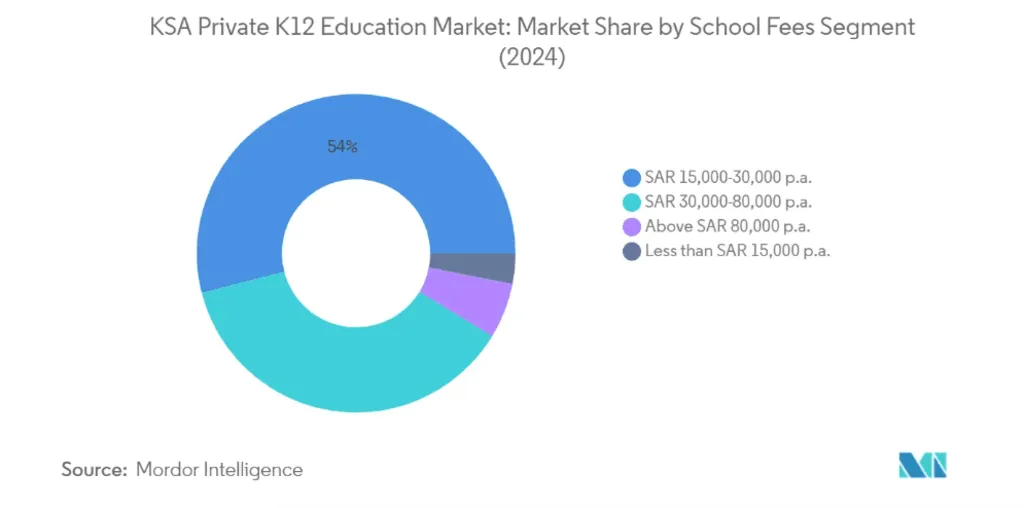

Premium Schools Thriving: Above SAR 80,000 Tuition Segment Grows 15%

Affluent families are fueling Saudi Arabia’s premium private school segment, with institutions charging above SAR 80,000 per year experiencing a 15% growth rate. These high-end schools prioritize world-class faculty, state-of-the-art facilities, and exclusive academic programs, catering to families seeking elite international education within the Kingdom. The rising expatriate executive population and an influx of regional professionals relocating to Saudi Arabia have intensified demand for top-tier schooling options.

Digital Transformation Reshaping Learning: 98% of Students Access “Madrasati”

Saudi Arabia’s education technology (EdTech) revolution is in full swing, redefining how students engage with learning. The government-backed Madrasati platform now reaches 98% of students, marking a major leap in digital education infrastructure. Interactive learning systems, AI-powered tutoring platforms, and virtual classroom experiences are enhancing academic performance. With teachers reporting improved student engagement, the Kingdom is establishing itself as a leader in hybrid and digital education integration.

Market Consolidation Gains Pace: Big Education Players Strengthen Positions

Saudi Arabia’s private education market is witnessing strategic consolidation, as major operators expand through acquisitions and partnerships. Industry leaders such as ATAA Education, GEMS Education, and International Schools Group (ISG) are rapidly absorbing smaller independent schools, creating diversified education portfolios across primary, secondary, and international schooling segments. The influx of investment firms into Saudi’s education market further underscores the sector’s long-term growth trajectory.

Saudi Arabia’s Education Sector Poised for Further Expansion

Saudi Arabia’s private K-12 education sector is heading into its most transformative decade yet. With increasing foreign investment, shifting consumer preferences, and rapid digital integration, Saudi Education Sector Insights indicate a market positioned for continued growth and innovation. As regulatory frameworks evolve and global operators strengthen their presence, Saudi Arabia is on track to establish a robust, internationally recognized education ecosystem.

Also Read: Funding Fuels Saudi EdTech Growth—15 Startups Per Year