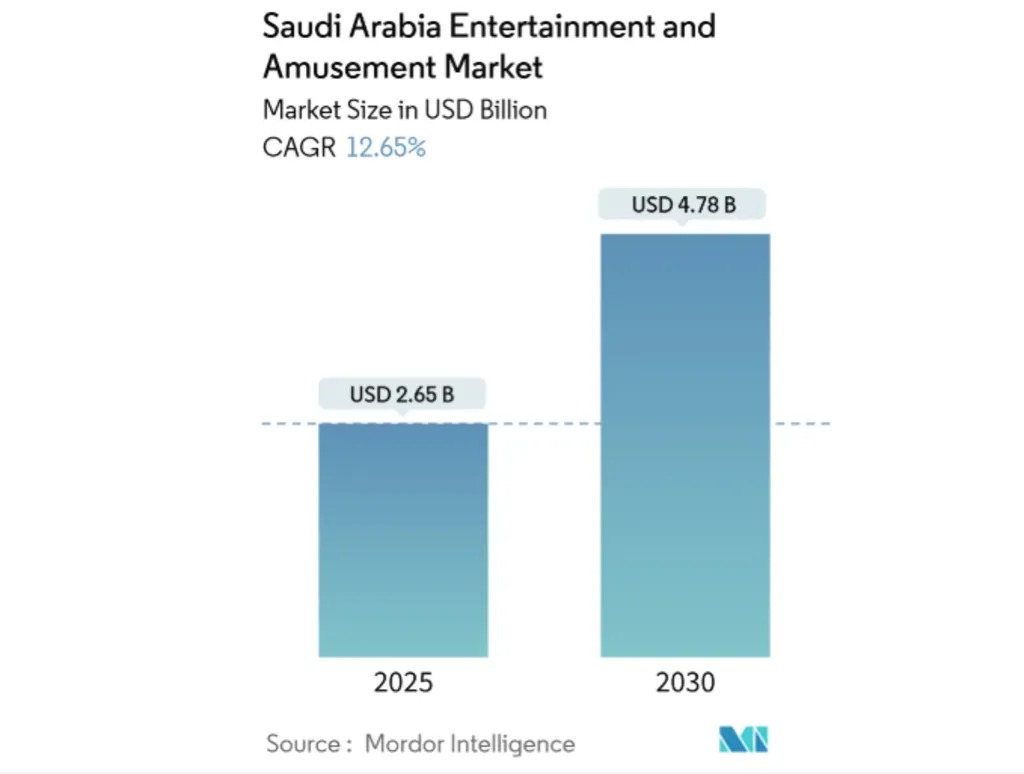

Market Size: USD 2.65 Billion in 2025, USD 4.78 Billion by 2030

The Saudi Entertainment Market is standing at the edge of a remarkable transformation. Analysts project the industry will reach USD 2.65 billion in 2025, before nearly doubling to USD 4.78 billion by 2030. While the 2025 number is still a forecast, since the year has not yet concluded; it reflects strong momentum already visible in government-backed projects, domestic tourism campaigns, and new entertainment hubs. With a 12.54% CAGR expected through 2030, the sector is on track to become one of the Kingdom’s most dynamic growth stories.

Vision 2030 CAPEX Adds +1.4% to Growth Forecast

One of the strongest drivers of the Saudi Entertainment Market is the SAR 50 billion (USD 13.33 billion) investment funneled into leisure infrastructure between 2024 and 2025. Projects such as 21 SEVEN destinations, the Qiddiya giga-theme park, and NEOM’s mixed-reality zones are reshaping the entertainment landscape. This capital injection reduces developer risks, attracts global IP partnerships, and ensures that Saudi Arabia retains more domestic tourism spending rather than losing it to outbound travel.

Domestic Tourism Campaigns Lift Leisure Trips by 17%

The “Saudi Summer” campaigns have proven to be a game-changer. In 2025, intra-kingdom leisure trips rose 17% year-on-year, supported by bundled hotel-and-attraction packages and discounted transport partnerships. These campaigns extend visitor stays, boost mall foot traffic by 11%, and stabilize operator revenues beyond peak religious seasons. For the Saudi Entertainment Market, this means a more predictable cash flow and stronger year-round demand.

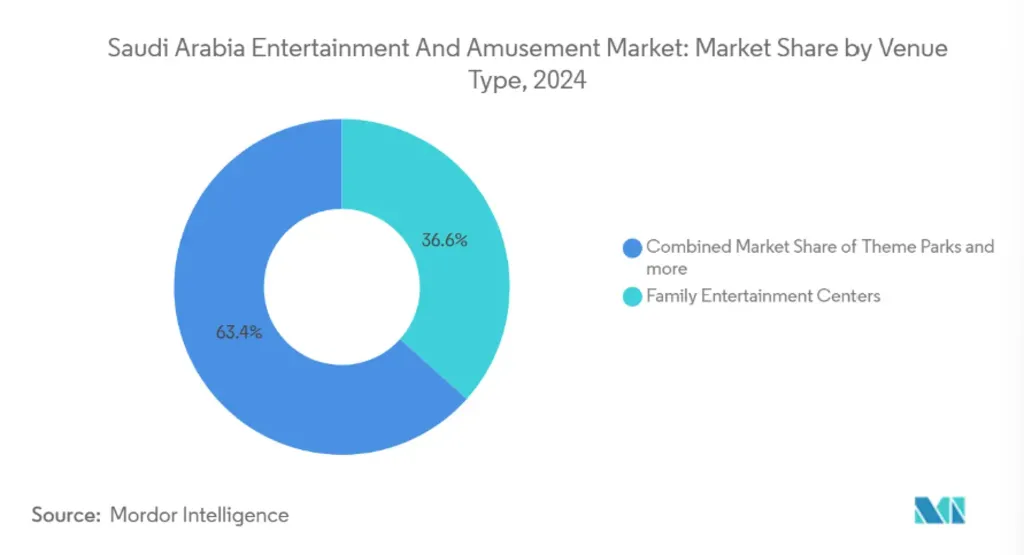

Family Entertainment Centers Hold 36.63% Market Share

By venue type, family entertainment centers (FECs) dominate with 36.63% of the market in 2024. Their appeal lies in multi-age attractions, from arcades to birthday zones, making them the default anchor in new malls. Ticket bundles starting at SAR 89 (USD 23.7), combined with upsold food combos, drive higher per-visitor spending. Meanwhile, VR and mixed-reality arcades, though still under 5% share, are the fastest-growing format with a 19.27% CAGR through 2030, fueled by esports and localized Arabic gaming content.

Ticket Sales Contribute 50.83% of Revenue, Premium Add-ons Grow at 20.73% CAGR

Ticket sales remain the backbone of the Saudi Entertainment Market, accounting for 50.83% of revenue in 2024. However, the real profitability lies in premium add-ons. Experiences such as VIP passes, private cabanas, and AR-enhanced heritage tours are forecast to grow at 20.73% CAGR. With per-capita spending exceeding SAR 600 (USD 160) in some premium packages, operators are unlocking margins that surpass base admissions by over 25 percentage points.

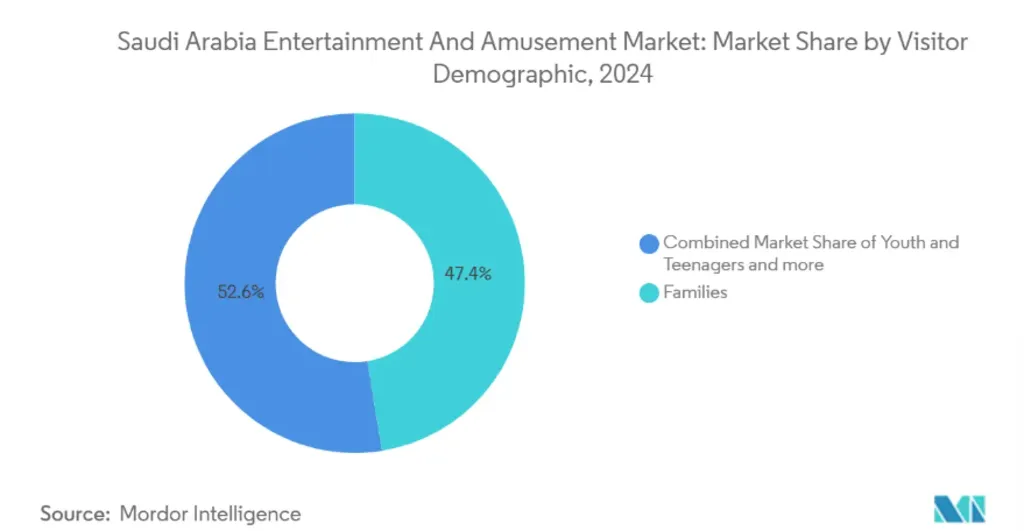

Families Drive 47.44% of Visits, Youth Segment Expands at 13.65% CAGR

Families remain the largest demographic, capturing 47.44% of market share in 2024. Their preferences for stroller-friendly layouts, prayer-room access, and bundled dining make them the backbone of the Saudi Entertainment Market. At the same time, youth and teenagers are the fastest-growing segment, with a 13.65% CAGR. Their appetite for esports, anime crossovers, and social-media-friendly attractions ensures that operators must constantly innovate to stay relevant.

Riyadh Leads with 68% FEC Occupancy, NEOM Tests Net-Zero Concepts

Geographically, Riyadh dominates with weekday FEC occupancy averaging 68%, thanks to its Boulevard zones and luxury retail hubs. Makkah aligns its entertainment mix with pilgrimage cycles, while the Eastern Province leverages its coastal climate for water parks. Emerging regions like Tabuk’s NEOM corridor are experimenting with net-zero ride technologies and holographic theaters, signaling the future direction of the Saudi Entertainment Market.

Competitive Landscape: SEVEN, Qiddiya, and Hokair Lead the Pack

The market is consolidated, with five major players—Saudi Entertainment Ventures (SEVEN), Qiddiya Investment Company, Abdul Mohsen Al Hokair Group, Al Othaim Leisure & Tourism, and Sela—dominating revenues. SEVEN’s multi-IP licensing, Qiddiya’s Six Flags anchor, and Hokair’s 90-location FEC network highlight the scale of competition. Meanwhile, private operators like Fakieh Leisure & Entertainment and Majid Al Futtaim are carving niches in coastal and indoor-ski experiences.

Outlook: A Market on Track for Global Recognition

With esports prize pools exceeding USD 60 million in 2025 and giga-projects like Six Flags Qiddiya targeting 17 million annual visitors by 2030, the Saudi Entertainment Market is positioning itself as a global hub. The combination of government backing, cultural openness, and consumer demand ensures that this sector will remain one of the most dynamic growth stories in the Kingdom’s Vision 2030 journey.

Also Read: 4.6% CAGR: How Saudi Arabia’s Mega Projects Drive Testing Growth

FAQs on the Saudi Entertainment Market

1. What is the size of the Saudi Entertainment Market in 2025?

The market is valued at USD 2.65 billion in 2025, reflecting strong momentum from government-backed projects and rising domestic tourism.

2. How fast is the Saudi Entertainment Market growing?

It is projected to expand at a 12.54% CAGR between 2025 and 2030, nearly doubling in value to USD 4.78 billion.

3. Which venue type dominates the Saudi Entertainment Market?

Family entertainment centers (FECs) lead with 36.63% market share in 2024, while VR and mixed-reality arcades are the fastest-growing segment.

4. What revenue stream contributes the most?

Ticket sales account for 50.83% of revenue in 2024, but premium add-ons like VIP passes and AR-enhanced tours are growing at 20.73% CAGR.

5. Who are the key players in the Saudi Entertainment Market?

Major players include Saudi Entertainment Ventures (SEVEN), Qiddiya Investment Company, Abdul Mohsen Al Hokair Group, Al Othaim Leisure & Tourism, and Sela.

6. Which demographic drives the most demand?

Families captured 47.44% of the market in 2024, while youth and teenagers are the fastest-growing group with a 13.65% CAGR.

7. Which regions are leading in entertainment development?

Riyadh leads with 68% weekday FEC occupancy, while Makkah aligns with pilgrimage tourism and NEOM experiments with futuristic, net-zero concepts.