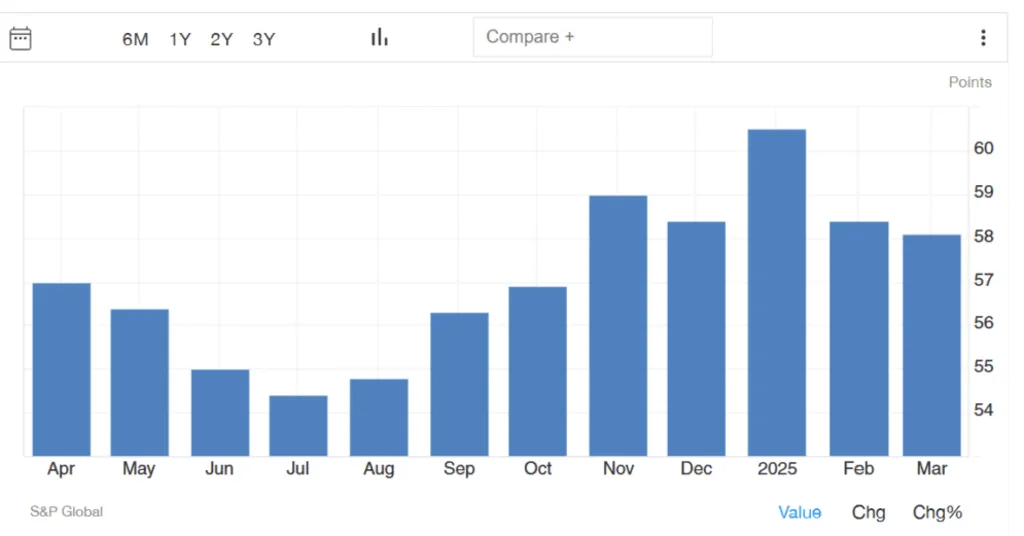

Saudi Market Research Insights: Non-Oil Growth at 58.1 PMI

Despite a slight moderation in pace, Saudi Arabia’s non-oil private sector maintained resilience in March 2025, expanding at a comparatively stronger rate than its Middle Eastern peers, according to Saudi market research insights from S&P. The Purchasing Managers’ Index (PMI) settled at 58.1, down slightly from February’s 58.4, marking its softest expansion in five months. However, this figure still outperformed other regional economies, reflecting steadfast business confidence and sustained economic momentum.

This moderate slowdown comes after January’s near 14-year high in new order growth, indicating a market stabilization phase rather than a contraction. Despite easing, demand remains firm, reflecting the Kingdom’s ongoing economic diversification strategy under Vision 2030.

Comparative Strength in the Middle East

While Saudi Arabia’s PMI dipped, it remains the highest in the region, exceeding UAE (54), Kuwait (52.3), and Qatar (52). This relative strength reinforces its market resilience, with businesses continuing to scale operations despite fluctuations in demand.

New order growth, which saw record highs in January, has softened, particularly in foreign markets. However, domestic sales remained steady, underpinned by diversification efforts in manufacturing, logistics, financial services, and tourism. Employment conditions held firm, with March’s hiring levels unchanged from February’s 16-month high, as businesses expanded sales teams and operational capacity.

Saudi Arabia’s strong PMI score compared to regional peers showcases its ability to navigate market fluctuations, maintaining consumer confidence and investment appeal. Although the expansion rate is the slowest in five months, businesses are still growing, reflecting sustained optimism.

Business Operations and Investment Trends

Saudi firms continued stockpiling inventories, preparing for future demand increases. Purchasing activity surged, reflecting optimism in maintaining a healthy supply chain. Strong vendor relationships contributed to improved delivery times, although some firms reported administrative delays impacting supply flows.

The Kingdom’s aggressive push to attract $100 billion annually in foreign direct investment (FDI) played a key role in supporting private sector growth, reinforcing Saudi Arabia’s long-term economic transformation goals. Governmental enhancements in regulatory frameworks and infrastructure investments continue to drive international investor confidence.

Survey findings revealed that Q1 2025’s job growth rate in Saudi Arabia’s non-oil private sector was the fastest since Q3 2012, underscoring the country’s commitment to workforce development and market expansion. This hiring spree strengthens Saudi Arabia’s labor market, helping lower unemployment rates for Saudi nationals.

Additionally, companies focused on expanding their capabilities, with an increase in training and workforce development programs, ensuring skilled talent to support long-term industrial growth.

Also Read: Saudi Market Research: 62% of Consumers Embrace Cutting-Edge Technology

Pricing Adjustments and Competitive Positioning

Saudi businesses saw input cost inflation easing to its lowest level in over four years, driven by weaker purchase prices and moderated wage inflation. This allowed firms to reduce selling prices for the first time in six months, reflecting intensified market competition and pricing adjustments.

The lower cost environment benefits businesses, enabling them to offer competitive rates while maintaining profit margins. This pricing flexibility positions Saudi Arabia favorably in global trade, enhancing its export competitiveness.

Saudi Arabia’s non-energy exports surged by 10.7% in January, reaching SR26.48 billion ($7.06 billion), showcasing a growing global demand for Saudi non-oil goods.

Future Outlook: Steady, Market-Driven Growth

Saudi Arabia’s non-oil sector now accounts for 52% of GDP, achieving a 20% increase since the launch of Vision 2030. The Kingdom’s ongoing diversification push, coupled with workforce investment and competitive pricing strategies, ensures continued resilience amid market fluctuations.

Looking ahead, Saudi Market Research Insights forecasts gradual but steady expansion, as firms strengthen supply chains, optimize operations, and enhance global market positioning. Saudi Arabia remains a leading player in the Middle Eastern economy, setting the foundation for a diversified future beyond oil dependency.

Also Read: Navigating the Saudi Market: Entry Strategies That Work