Saudi Agritech Market Valued at USD 15.2 Billion in 2025

The Saudi Agritech Market is entering 2025 with an estimated value of USD 15.20 billion, projected to expand to USD 20.30 billion by 2030 at a steady 6% CAGR. This growth is not just about numbers—it reflects a national transformation under Vision 2030, where technology, water efficiency, and food security converge to reshape agriculture in one of the world’s most arid environments.

Vision 2030 Subsidies Add +1.8% to Market Growth

Government-backed financing is the single most powerful driver of the Saudi Agritech Market. Through the Agricultural Development Fund, farmers can access up to 75% financing for greenhouse projects and irrigation systems, alongside 10-year tax holidays for agritech investments. This policy has already catalyzed landmark projects, such as Topian’s 4-hectare climate-resilient greenhouse in Oxagon (2025), the largest precision horticulture investment in the Kingdom. These incentives are not only accelerating adoption but also aligning private sector returns with national water conservation goals.

Food Security Push Adds +1.5% to CAGR Forecast

Saudi Arabia’s reliance on imports—90–95% of edible oils and large shares of fresh produce—has long been a vulnerability. The COVID-19 pandemic and geopolitical trade disruptions underscored the urgency of domestic resilience. In response, the government launched SABIL (National Grain Supply Company) in April 2025, managing 2.7 million metric tons of grain storage across 14 silos. This vertical integration strategy is reshaping the Saudi Agritech Market, where domestic production capacity increasingly determines competitiveness in government contracts.

Precision and Greenhouse Tech Adoption Adds +1.2%

The Saudi Agritech Market is rapidly embracing IoT sensors, automated climate control, and AI-driven farm management. Partnerships with South Korean technology providers and platforms like FarmERP (launched in Saudi in 2024) are enabling real-time monitoring of soil moisture, irrigation schedules, and crop health. These tools are transforming productivity metrics, allowing farms to optimize scarce resources while stabilizing yields in extreme climates.

Water-Efficiency Programs Save Up to 40% Usage

Water scarcity remains the defining challenge for Saudi agriculture. The National Water Strategy is driving adoption of drip irrigation and micro-sprinkler systems, cutting water use by up to 40% compared to flood irrigation. Investments in desalination facilities tailored for agriculture, supported by KAUST’s research into low-energy desalination, are unlocking new possibilities. Beyond water savings, these technologies improve soil health by reducing salt accumulation, expanding cultivation into previously marginal lands.

Market Restraints: High Capex and Groundwater Depletion

Despite strong growth drivers, the Saudi Agritech Market faces structural hurdles. Extreme aridity and groundwater depletion reduce CAGR by -1.1%, with aquifers declining by 0.6 meters annually and some regions exceeding 1 meter per year. Meanwhile, the USD 1.2 million per hectare cost of advanced greenhouses creates barriers for small and medium-sized farmers, concentrating market participation among large corporations and state-backed entities.

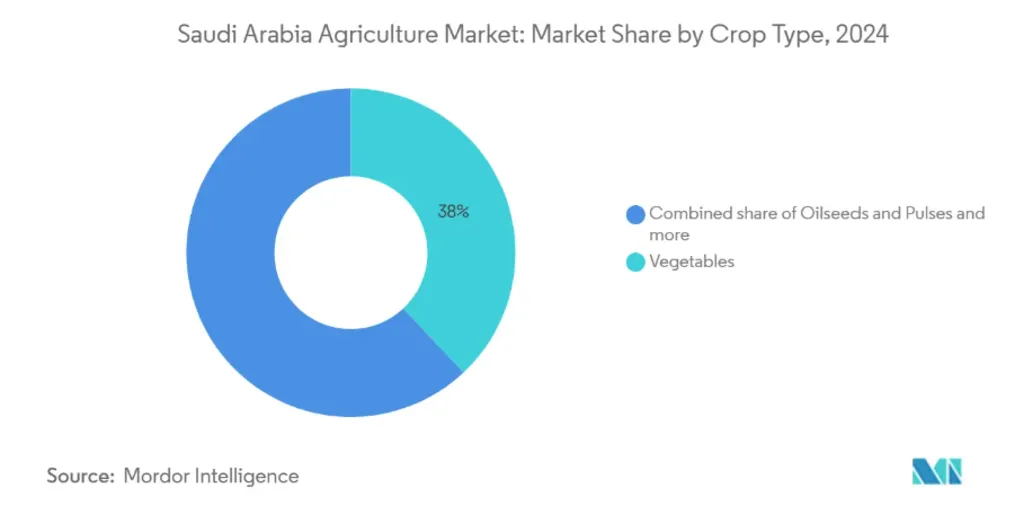

Oilseeds and Pulses Lead with 10.2% CAGR

While vegetables dominate with 38% market share in 2024, oilseeds and pulses are the fastest-growing segment, forecasted at 10.2% CAGR through 2030. This reflects Saudi Arabia’s strategic push to reduce dependence on imported protein-rich crops and cooking oils. Subsidized land and water access programs are prioritizing sunflower and soybean cultivation in northern provinces, where climate conditions are more favorable.

Northern Provinces Produce 65% of Fresh Output

Geographically, the Saudi Agritech Market is concentrated in Al-Jouf, Tabuk, and Hail, which account for 65% of fresh produce output. Al-Jouf has emerged as a hub, with a French-fries processing plant opened in 2024 to serve both domestic and export markets. Meanwhile, central and southern regions remain constrained by aridity, though investments in desalination and cold-chain logistics—59 logistics centers planned by 2030—are improving access and reducing post-harvest losses.

Industry Developments Signal Global Partnerships

Recent deals highlight the international dimension of the Saudi Agritech Market:

- May 2025: Saudi-Chinese Forum signed USD 3.7 billion in agreements on water recycling, agri-tech, and a smart food-security city.

- April 2025: Brasil Foods S.A. invested USD 160 million in a Jeddah poultry plant with 40,000 MT annual capacity.

- March 2025: Hilton Foods and NADEC formed a joint venture to expand value-added protein offerings.

- July 2024: FarmERP partnered with Seiyaj Tech to deliver ERP systems for Saudi farms.

These collaborations reinforce Saudi Arabia’s dual strategy: attract global expertise while building domestic resilience.

Conclusion

The Saudi Agritech Market in 2025 is defined by a delicate balance: rapid technological adoption and government support on one side, and structural water and cost challenges on the other. With a USD 15.20 billion market size in 2025 and a clear trajectory toward USD 20.30 billion by 2030, the sector is positioned as a cornerstone of Saudi Arabia’s Vision 2030 ambitions.

Also Read: $628M Surge in Saudi Agritech Market by 2033

Frequently Asked Questions (FAQs) on the Saudi Agritech Market

1. What is the size of the Saudi Agritech Market in 2025?

The Saudi Agritech Market is valued at USD 15.20 billion in 2025, with forecasts projecting it to reach USD 20.30 billion by 2030 at a 6% CAGR.

2. What are the main drivers of growth in the Saudi Agritech Market?

Key drivers include Vision 2030 subsidies (+1.8% impact on CAGR), the food-security imperative (+1.5%), and rapid adoption of precision irrigation and greenhouse technologies (+1.2%).

3. Which crop segments are growing fastest in Saudi Arabia?

While vegetables hold the largest share at 38% in 2024, oilseeds and pulses are the fastest-growing segment, forecasted at 10.2% CAGR through 2030, driven by import substitution strategies.

4. How is water scarcity being addressed in the Saudi Agritech Market?

The National Water Strategy promotes drip irrigation and micro-sprinklers, reducing water use by up to 40%, alongside investments in desalination facilities tailored for agriculture.

5. Which regions dominate agricultural production in Saudi Arabia?

The northern provinces—Al-Jouf, Tabuk, and Hail—account for about 65% of fresh produce output, thanks to relatively moderate climates and better groundwater availability.

6. What challenges restrain the Saudi Agritech Market?

Major restraints include extreme aridity and groundwater depletion (-1.1% impact), high capital costs for modern farming systems (-0.8%), and logistics gaps in rural areas (-0.4%).

7. What recent investments highlight the Saudi Agritech Market’s global partnerships?

Notable deals include the USD 3.7 billion Saudi-Chinese Forum agreements (2025), Brasil Foods’ USD 160 million poultry plant in Jeddah, and Hilton Foods’ joint venture with NADEC.