Vision 2030 and the Digital Transformation

Saudi Arabia is in the midst of one of the most ambitious national transformations in the world. Vision 2030, the country’s blueprint for economic diversification, places digital infrastructure at the heart of its strategy. From smart cities like NEOM to nationwide 5G rollouts, the Kingdom is building the foundations for a knowledge-driven economy. Within this context, the Saudi Data Center Market has become a critical enabler, providing the backbone for cloud services, artificial intelligence, and advanced digital applications.

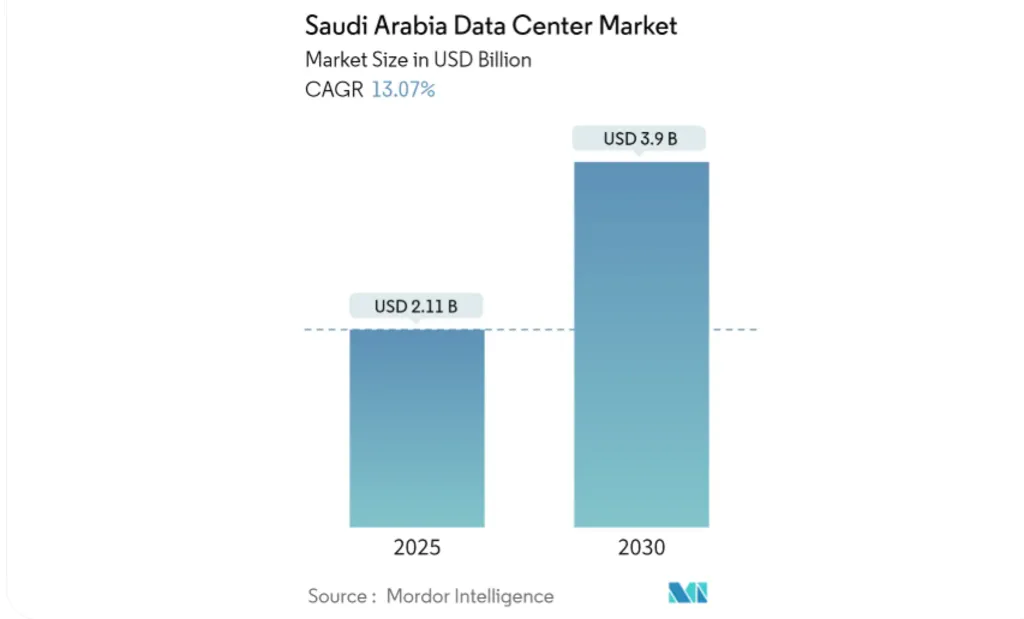

Market Size: USD 2.11 Billion in 2025, USD 3.9 Billion by 2030

The Saudi Data Center Market is entering a rapid growth phase, with its size projected to expand from USD 2.11 billion in 2025 to USD 3.9 billion by 2030. This represents a strong compound annual growth rate (CAGR) of 13.07%. Alongside revenue growth, IT load capacity is expected to surge from 0.41 thousand MW in 2025 to 1.03 thousand MW by 2030, reflecting a CAGR of nearly 20%. These figures highlight the country’s accelerating digital transformation under Vision 2030.

Massive Facilities Dominate, Large Sites Grow Fastest

By data center size, massive facilities captured 62.59% of revenue in 2024, driven by hyperscale economics and AI workloads. Large facilities, however, are the fastest-growing segment, recording a 20.01% CAGR through 2030. This dual-track growth shows how the Saudi Data Center Market is balancing hyperscale consolidation with enterprise demand for dedicated, mid-sized builds. Smaller and edge facilities are also gaining traction, especially along 5G corridors where latency-sensitive applications require localized compute.

Tier 4 Infrastructure: 82.53% Share and Rising

Reliability is non-negotiable in the Saudi Data Center Market. Tier 4 facilities commanded 82.53% of deployments in 2024 and are forecast to grow at 21.10% CAGR through 2030. Banks, ministries, and healthcare platforms demand 99.995% uptime, pushing operators toward fully redundant designs. Tier 3 retains a role in disaster recovery, but regulatory licensing increasingly embeds Tier 4 attributes, reinforcing its dominance.

Hyperscale vs. Edge: 76.77% Share vs. 21.90% CAGR

Hyperscale and self-built sites dominated 76.77% of the Saudi Data Center Market in 2024, reflecting long-term commitments from AWS, Microsoft, and Google. These deployments anchor multi-building campuses and attract ecosystem partners such as SaaS providers and security vendors. Edge computing, while smaller today, is growing at 21.90% CAGR through 2030. Its rise is tied to real-time applications like autonomous vehicles, AR/VR, and telemedicine, where low latency is non-negotiable.

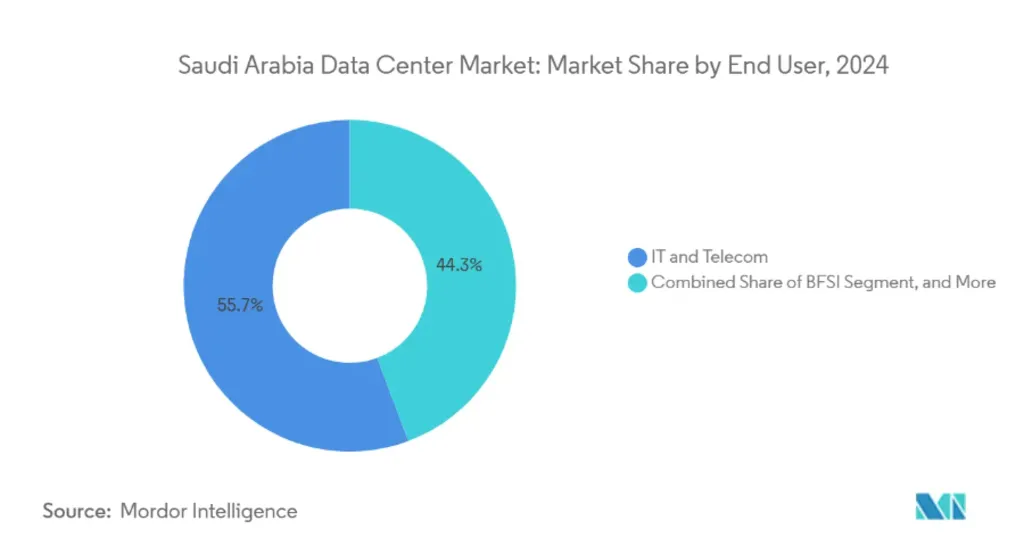

End Users: IT and Telecom Lead, BFSI Surges Ahead

IT and telecom together accounted for 55.74% of demand in 2024, as operators containerize network functions and shift stacks into cloud-native environments. Government mandates add steady baseline demand. Yet the fastest growth comes from BFSI, which is expanding at 21.58% CAGR through 2030. Digital banking licenses, fintech sandboxes, and open-API frameworks are fueling transaction-heavy workloads, making BFSI a critical driver of future capacity.

Riyadh Holds 26.68% Capacity, Dammam Expands Fastest

Geographically, Riyadh remains the anchor hub with 26.68% of installed capacity in 2024, benefiting from proximity to ministries and enterprise clusters. Jeddah follows as a western hub, leveraging submarine cable landings for global connectivity. Dammam, however, is the fastest-growing hotspot, posting a 15.50% CAGR through 2030. Energy-sector diversification and strong transport links into GCC neighbors make Dammam a rising star in the Saudi Data Center Market.

Key Growth Drivers: Vision 2030, Hyperscalers, and Smart Cities

Several forces are shaping the Saudi Data Center Market trajectory:

- Vision 2030 digital-government spend adds +3.20% to CAGR, with mandatory cloud-first directives.

- Hyperscaler cloud regions contribute +4.10%, as AWS, Microsoft, and Google expand local footprints.

- 5G and fiber backbones add +2.80%, fueling traffic growth.

- Mega smart-city projects like NEOM and Qiddiya add +2.30%, embedding data centers into futuristic urban ecosystems.

- AI hub regulations and tax incentives further reinforce demand, ensuring long-term sustainability.

Restraints: Cooling Costs and Talent Shortages

Despite strong momentum, challenges remain. Cooling accounts for over 40% of operating costs in summer months, denting profitability. Talent shortages in Tier-IV-ready engineering also pressure margins, with salary inflation outpacing other ICT segments. Supply-chain bottlenecks for GPUs and liquid cooling add short-term hurdles. These restraints underscore the importance of innovation in thermal design and workforce development.

Competitive Landscape: Sovereign Champions and Global Entrants

Saudi Telecom Company and its subsidiary center3 anchor the incumbent tier, while AWS, Microsoft, and Equinix invest billions to establish cloud regions. HUMAIN, backed by USD 100 billion, is emerging as a sovereign champion with scale rivaling global peers. Technology differentiation now pivots on AI-ready designs; liquid cooling, immersion tanks, and GPU orchestration, giving operators who master desert-specific thermal envelopes a competitive edge.

Also Read: AI Powers Saudi’s $12.24B Data Expansion