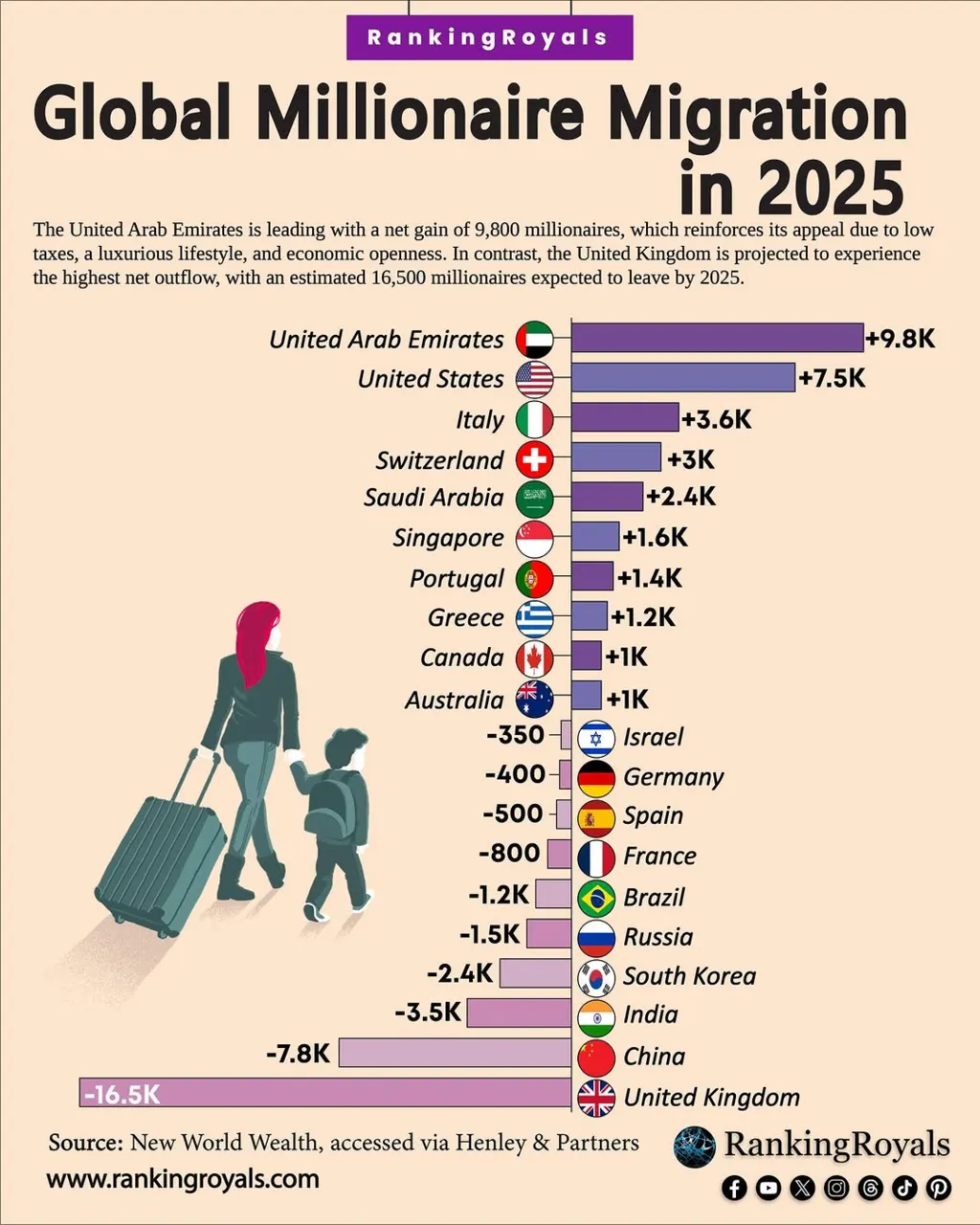

Wealth migration Saudi Arabia is reshaping the global luxury landscape at record speed. The Kingdom is projected to see the world’s fastest growth in centi-millionaires — individuals worth over $100 million.

Saudi Arabia already hosts 58,300 millionaires, including 195 centi-millionaires, a figure that has risen 32% since 2013. What makes this surge historic is momentum. Henley & Partners forecasts 2,400 millionaires relocating to Saudi Arabia in 2025, up from just 300 in 2024 — an eightfold jump and the fastest growth rate globally.

This concentration of extreme wealth is forcing luxury brands to rethink where and how they sell.

Why Wealth Migration Saudi Arabia Is Centered in Riyadh

Riyadh has become the epicenter of this shift. From 2014 to 2024, the city recorded a 65% increase in millionaires and now hosts over 20,000 high-net-worth individuals.

Saudi Arabia’s rise is part of a global pattern. Worldwide, centi-millionaires reached 29,350 in 2024, up 54% over the past decade. Yet Riyadh stands out. It is expected to see the third-highest global increase in centi-millionaires by 2033.

For luxury brands, this density of wealth changes everything. Traditional mall-based retail no longer matches how this elite group wants to engage.

Luxury Retail Reinvents Itself for the Centi-Millionaire

Luxury is moving behind closed doors. Brands are shifting from mall outlets to private client salons, designed for discretion, personalization, and deeper relationships.

Chanel has expanded appointment-only salons to strengthen client ties and increase spending per visit. Gucci opened a 4,380-square-foot private salon for top-tier clients, while Dior and Louis Vuitton have launched similar VIP-only spaces. Harrods followed suit with its “Residence” private boutiques for ultra-wealthy clients in Asia.

This model fits Saudi Arabia’s evolving elite perfectly. Centi-millionaires value privacy, time efficiency, and exclusivity — not crowded storefronts.

Read Also: Saudi Aims to Double Tourism GDP to 10% by 2030

Wealth Migration Saudi Arabia: Investment-Grade Luxury Replaces Status Buying

The new luxury consumer is not just buying handbags. They are buying assets.

Watches and fine jewelry are now seen as inflation hedges. Surveys show 28% of consumers plan to buy pre-owned luxury watches for this purpose. High-end timepieces often appreciate during inflation periods and show low correlation with traditional markets.

For centi-millionaires, luxury is part of portfolio strategy. A watch or rare jewel is no longer a symbol alone. It is a store of value, a diversification tool, and a mobile asset.

What Wealth Migration Saudi Arabia Signals for Brands

This shift explains why luxury brands are investing more in client advisors, private showings, and invitation-only launches. High-value clients want trust, insight, and long-term value — not impulse buying.

As the wealth migratto ion Saudi Arabia continues, brands that fail to adapt will lose relevance. Those who understand this new mindset will secure loyalty for decades.

Read Also: Inside Saudi Creative and Cultural Transformation

Strategic Insight for Market Leaders

Understanding elite behavior requires local depth and global perspective. As wealth migration Saudi Arabia reshapes luxury and investment flows, businesses can explore tailored market intelligence and strategic advisory services from Market Research Saudi Arabia by Eurogroup Consulting. With 40 years of distinguished experience, Eurogroup Consulting excels in delivering market research and strategic consulting across Saudi Arabia, helping leaders succeed in one of the world’s fastest-evolving luxury and wealth markets.