Framing the Market: Macroeconomic & Vision 2030 Impact

From the busy highways of Riyadh to the massive industrial manufacturing hubs, the market for lubricants in Saudi Arabia is booming and more vibrant than ever. Numerous changes in consumer behavior will have a significant effect on the lubricants market in KSA as the country’s socioeconomic future reaches new heights.

Previously characterized by its dependence on exporting crude oil, the Kingdom lately has been diversifying and establishing new sectors that reach far beyond. At the center of this transition is Vision 2030, an ambitious agenda to modernize the economy of the country, promote innovation, and lure foreign capital.

The magnitude of the Saudi’s macro-economic expansion is remarkable. The country can only be described as an economic power hub, and with a GDP of more than $1 trillion, it is the largest economy in the Middle East. More specifically, it is currently exceeding all expectations with its GDP annual growth rate. Going from a preliminary estimate of 4.4% in Q4 of 2024, its growth rate reached 4.5% YoY, subsequently surpassing the 2.8% rate in Q3.

Following the unprecedent scaling of KSA’s economy lies the country’s own unique gem; the backbone of industrial and mobility expansion that otherwise is known as, the lubricants market.

This market currently is the foundation that keeps industries running, machines functioning, and transportation systems operating. The Saudi Arabian lubricant market is constantly expanding following several national, social, and economic transformations. These transformations are the main drivers of the market and can be tied to social reforms, public and private mobility transformation, and other consumer trends that we will be diving into within this paper.

With the intention of evaluating the lubricants market in the Kingdom, it is crucial to begin by identifying and understanding the large factors influencing the market. Thus, bringing up multiple questions to answer:

- How has the lubricant market historically evolved in KSA?

- What impact does the shifting economy have on lubricant demand?

- How does Vision 2030 affect lubricant use in transportation, and industrial applications?

- What are the main demand drivers of the lubricants market?

- How will sustainability trends and technology advancements affect the lubricants market?

The answers to these questions will shape the market in the foreseeable future.

The Market Over The years - From Early Developments to Future Expectations

Saudi Arabia's lubricants market went from seed to tree throughout the last two decades. The market today and that of the early 2000s couldn’t be more different as far apart. Nevertheless, as the country continues to evolve, the market is adapting to the new trends and developments. Discussing the key phases of the evolution of the market will provide insights on the historical market shifts and answer critical questions that defines the future trajectory of the market.

Historical Context and Industrial Development

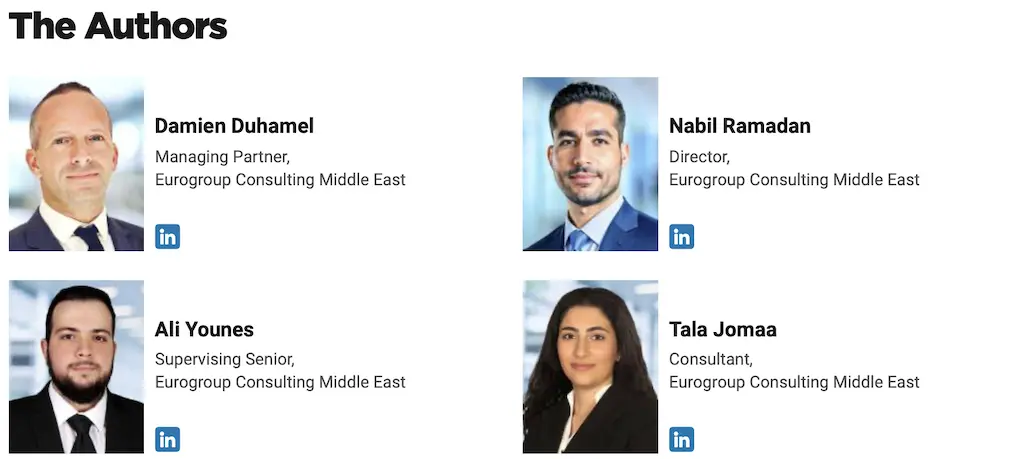

The Saudi lubricants market's growth has coincided with the kingdom’s overall development. The year 1938 marked the beginning of the Kingdom's petroleum sector. In the following years, the number of local refining enterprises grew, and in the late 1960s, the first large plant base oil factory started laying the groundwork for a domestic lubricant sector. This was followed by an expanding demand for lubricants in the 1970s and 1980s as industrialization increased. The need for industrial and automotive oils was driven by large-scale infrastructure projects, heavy machinery, and an expanding transportation industry.

The kingdom was overrun by foreign companies such as Shell, Castrol, and ExxonMobil, which competed with local brands by introducing advanced technological formulations.

As more people started possessing cars in the 2000s, there was a sharp increase in demand for passenger car lubricants. Due to evolving consumer trends and new engine technologies, the industry started to move toward synthetic and long- drain oils. Saudi Arabia became a significant player in the global lubricant market and has witnessed major developments such as Aramco’s acquisition of Valvoline's global products business.

The market is currently expanding as a result of continued industrialization, increased car sales, and investments in infrastructure. The demand for specialty products, such green lubricants and fluids for hybrid and electric vehicles, is being driven by new trends like sustainability, localization, and electric mobility.

By 2030, Saudi Arabia is expected to become a regional center for lubricants. In addition to meeting internal needs, the Kingdom is getting ready to serve the rest of the region with reliable local production, expanding export prospects, and enhancing technological capabilities. A microcosm of the nation's broader aim for industrial excellence and economic leadership, the sector's development spans from oil extraction to the most innovative lubricating technologies.

Vision 2030 - Impact On Lubricants Market

With rising demand for high-performance automotive and industrial lubricants, the world is shifting in response to a developing economic, social, and technological landscape. Saudi Arabia specifically is at a pivotal point in its development. The kingdom is currently undergoing a historic transition in the Middle East, under the direction of its ambitious and innovative Vision 2030. This blueprint is transforming the industrial, transportation, and mobility sectors, all of which are critical to the lubricants market.

Saudi Arabia's Vision 2030 is a creative reshaping of what the Kingdom can be, instead of an abrupt shift in policy. The goal behind the change is to move the nation away from its historical reliance on oil exports and toward a more diverse, innovative future. Large-scale economic plans, however, are not based solely on abstractions; industrial infrastructure, transportation, and machinery all depend on lubricants, a single but often-overlooked component. Whether in manufacturing facilities, delivery trucks, or building massive projects, the engines of this change would come to a complete stop without the most reliable lubricants. The Saudi Arabia's lubricants market is directly impacted by each of the three pillars of Vision 2030: A Vibrant Society, A Thriving Economy, An Ambitious Nation.

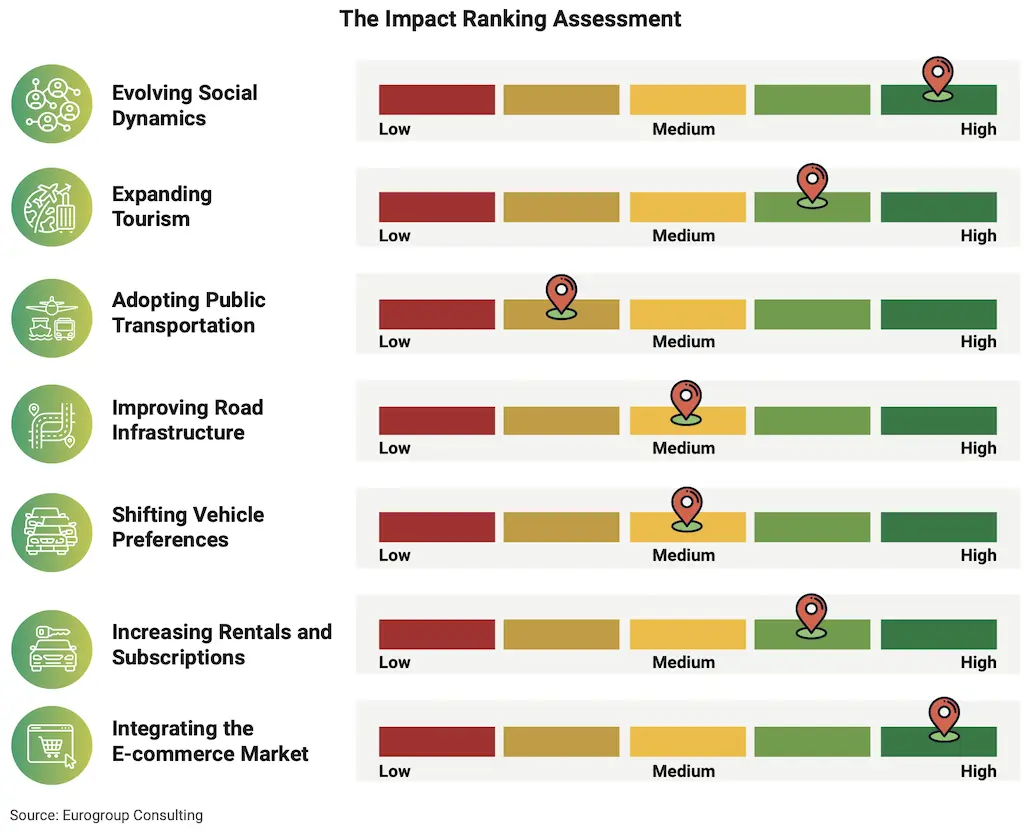

As the tourism and entertainment sectors develop so will demands for safe travels, public transportation, and infrastructure. Increased mobility means increasing number of vehicles, more fleets, and additional lubricant demand. Following the increased tourism, entertainment, and cultural activities, people will travel by road more than ever before. Whether individuals use personal vehicles, ride-sharing services, or interstate buses, more movement means more engine hours and, eventually, more oil changes. This has increased demand for consumer-grade lubricants in local garages, vehicle repair shops, and retail stores.

The Thriving Society pillar, which focuses on quality of life and culture, is already displaying an impact on the sector. Building NEOM, Qiddiya, and Red Sea Global Projects requires thousands of heavy trucks and equipment, all of which operate in hot climates and harsh conditions. The Vibrant Society pillar also represents a movement in consumer attitudes. Consumers are placing a higher importance on quality of life, convenience, and dependability, particularly in their vehicles. Drivers are becoming more maintenance- aware, and they are increasingly choosing high-performance lubricants that provide higher engine protection, longer oil change intervals, and improved fuel efficiency.

The Thriving Economy pillar is fueling this trend even further. Saudi Arabia is developing into a center for logistics and , which is driving up industrial demand for lubricants. Advanced lubrication of heavy machinery and automated equipment is essential for petrochemical facilities, industrial zones, and high-speed rail projects. Simultaneously, demand for truck, marine, and cargo vehicle lubricants is rising due to the expansion of the logistics industry, which is fundamental to the kingdom’s aim of becoming a bridge for worldwide trade. Sustainability and innovation are at the forefront of the Ambitious Nation pillar. Environmentally friendly, synthetic, and re-refined lubricants are being researched by companies due to the growing need for greener technologies. Lubricants are still used in transmission, heat management, and other areas even as the Kingdom moves toward EV adoption. Local production is also accelerating due to legal advances and as a result, Saudi- made lubricants are now competitive with their international counterparts. Consumers will benefit from increased local lubricant production, which improves product availability and price competitiveness.

Lubricants are not front-page news, but they are indispensable. Without lubricants, industrial output will be impacted, logistics activities will come to a halt, and equipment will malfunction. Lubricants are enabling the Kingdom's economic and urban transformation under Vision 2030. The more profound the change, the greater the need, not in terms of quantity but in terms of complexity. While lubricants do not typically make headlines, they have played an important role in this growth, facilitating everything from daily commutes to weekend road getaways. For today's Saudi driver, choosing the right lubricant is more than simply maintenance; it's part of a smart, empowered lifestyle.

However, Vision 2030 is more than just industry, megaprojects, and infrastructure; it is fundamentally about people. The social and economic reforms it has implemented are redefining daily life, altering how people move, work, and commute. As more people buy vehicles, commute longer distances, and travel around the Kingdom, consumer behavior becomes increasingly vital in setting market demand. These lifestyle changes have a direct impact on the lubricants market, not only in terms of volume but also on product selection, maintenance practices, and expectations. In the following chapters, we will look at how the new consumer-driven reality is reshaping lubricant demand in Saudi Arabia.

Understanding Social Reforms: Influence on The Lubricant Market

With more women driving, urbanization spreading, level of tourism rising, and public transportation expanding, Saudis' modes of transportation are changing; and so is the demand for lubricants. Industry alone will not propel the next stage of change; society as a whole will.

As Saudi Arabia rapidly enters its Vision 2030 age, mobility becomes more than just going from one place to the other; it's about equality, opening possibilities, and elevating the quality of life. The once-static highways are now overflowing with a diversified set of drivers, an expanding fleet of ride-hailing services, and a rising public transportation network. These changes reach beyond changing the way people move, to transform the lubricants market, generate new areas of demand and change the face of fleet. Thereafter, as the number of automobiles on the road increases, so does the need for maintenance services, transmission fluids, and engine oils. Subsequently, ride-sharing, public transportation, and luxury car ownership are becoming more popular in Saudi Arabia due to a change in mobility trends. These options all have different lubrication requirements. So, what effect does this societal shift have on the market for lubricants? The question remains unanswered.

Saudi Arabia’s roads are dynamic, varied, and undergoing rapid change. It is thus essential to examine the societal dynamics that are changing; including who drives, how they travel, and what this means for the lubricants market. Thus, such questions remain to be answered.

The Societal Shift - New Women Era

For decades, Saudi highways captured a distinct image, a man behind the wheel. In KSA, driving was only limited and accessible to men, while women had to rely on drivers, or professional chauffeurs. Therefore, mobility is not just perceived as a transportation element; it is an underlying feeling of freedom, opportunity, and self-reliance.

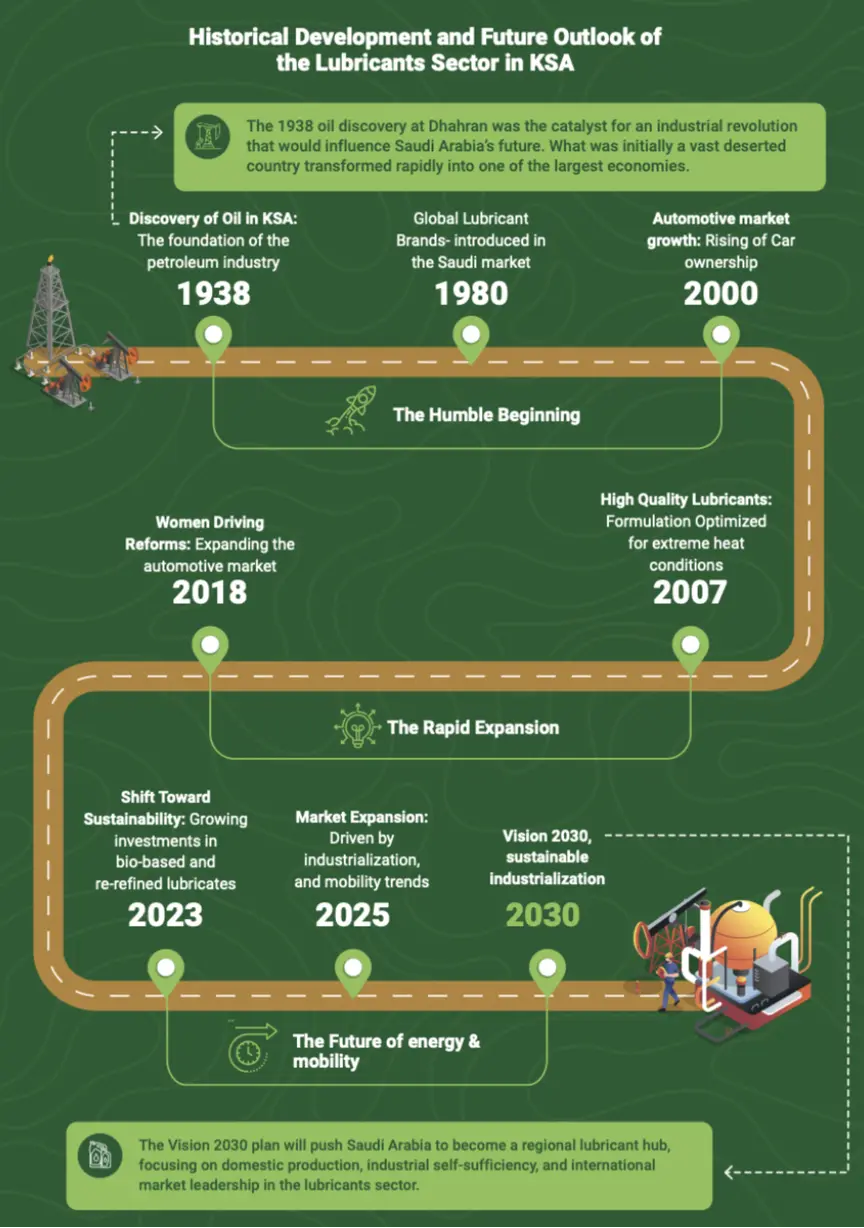

With the lifting of Saudi Arabia's prohibition on women driving in 2018, everything changed. This decision was not a simple policy reform, but a landmark in both economic and cultural history. A flood of new drivers entered the market overnight. Women started to purchase automobiles, shop for insurance, and personally take most of the automotive maintenance decisions. No third-party intervention was needed.

175,000 women had received licenses in the first year of lifting the ban, and millions more are projected to follow. The biggest adaptation of female drivers is seen in the largest urban and economic hubs (Mecca, Riyadh, Eastern Province, and Madina). The effects of this increase translated itself across multiple industries. Automobile sales skyrocketed, and new clients flooded into auto repair shops. The automotive market is expected to increase 9% in 2025, which is a substantial improvement from the 3% yearly growth that had been seen during the preceding years.

In parallel, this expanding customer segment pushed ride-hailing apps such as Careem and Uber to increase the number of available drivers. In addition, since women represent the majority of these apps’ clients, ride-hailing providers have started to recruit lady drivers to provide a better service for female customers.

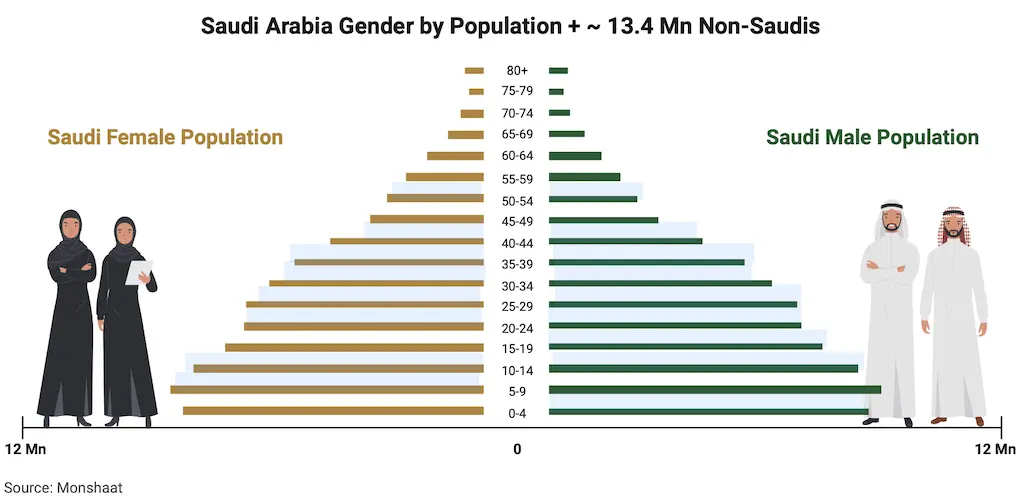

Careem has subsequently announced in 2018 their plan to hire 10,000 female drivers, further emphasizing the app’s commitment to adhere to the changing dynamics. On the other hand, in 2023, Uber announced that the female drivers who use the app are between the ages of 21 and 46 shows the variety of driver profiles, whether it be for financial assistance, cultural break-through, or self-determination. Furthermore, the biggest segment in KSA’s female population is between the ages of 25 and 54, typically their working years. This overlapping with the age range of female Uber drivers, indicates that Saudi women are adopting ride-hailing as a means of earning money and reflecting a larger trend of female labor market involvement. Females seeking part-time or freelance work, especially those with family obligations, find the flexibility of driving for Uber to be an alluring alternative. Pushing Saudi Arabia’s Ride-hailing market to have a projected revenue of US$964.11 Mn in 2025.

The rise in demand is encouraging the initiation of programs such as Uber’s “Women Drivers” program, which established a women-only ride service in the Kingdom. The function allows women to choose female drivers, providing a more pleasant and secure experience. It promotes female economic involvement and corresponds with Saudi Arabia’s Vision 2030 objectives. These programs create a ripple effect across automotive maintenance sector, particularly in lubricant usage. As more women begin to drive and demand for ride-hailing services grows, so does overall automotive usage. This means that oil is changed more frequently and more lubricants are required, particularly synthetic oils used for stop- and-go commuting. This as well drives the expansion of quick-lube and vehicle repair shops in large cities.

The lubricant industry was similarly influenced by this. Consumer views in the automotive industry have been impacted by this generational transition, leading to a significant shift in favor of high-performance engine lubricants and maintenance supplies. New drivers are also opting for premium lubricants that provide better engine protection and performance.

This aligns with a growing awareness for the significance of automotive maintenance, and the need to guarantee durability and reliability. To address such demands, Valvoline, among others, has shifted to supplying engine oils made from high-quality base oils with performance-enhancing additives.

Moreover, online services have grown in popularity as more women have been choosing online appointments and in-home auto maintenance services. Nevertheless, personal transport wasn't the only aspect this transformation. Women joined the commercial transportation industry and worked in logistics, delivery, and ride-sharing. Their cars required frequent maintenance, high-performance lubricants, and cost-effective repair solutions. Beyond mobility, the shift resulted in a broader economic transition. Women's employment increased, as their mobility created new opportunities for employment and business.

In Saudi Arabia, the number of businesses owned by women increased from 450,094 in 2022 to 648,042 in 2024. This represents roughly 44% growth in just two years. The biggest increase was in Riyadh, where the number of female-owned enterprises increased from 170,177 to 266,211. Even the lowest-numbered region, Bahah, showed an increase from 4,211 to 5,080 businesses. This rise in entrepreneurship mirrors a broader expansion in economic activity, particularly in areas like as transportation, logistics, and services, which require vehicle use and equipment upkeep. As more women start and run enterprises that rely on mobility and machinery, the demand for lubricants naturally rises. Whether it's maintaining delivery vehicles, powering tiny equipment, or servicing an expanding fleet, dependable lubrication is a daily operational requirement. This shift not only promotes economic diversification but also broadens the consumer base for lubricant products in both urban and regional markets.

The Incoming Wave - Tourism Boost

For years, Saudi Arabia’s Tourism sector was mainly based on religious tourism. The only non-Saudis who had ventured into its cities were pilgrims seeking to develop a spiritual connection with the holy region. All of this changed with Vision 2030, that aimed to transform the Kingdom into an outstanding worldwide touristic destination. New travel visas made the KSA more accessible. Aside from religious reasons, pilgrims and tourists in general are now also seeking adventure, history, and entertaining travel.

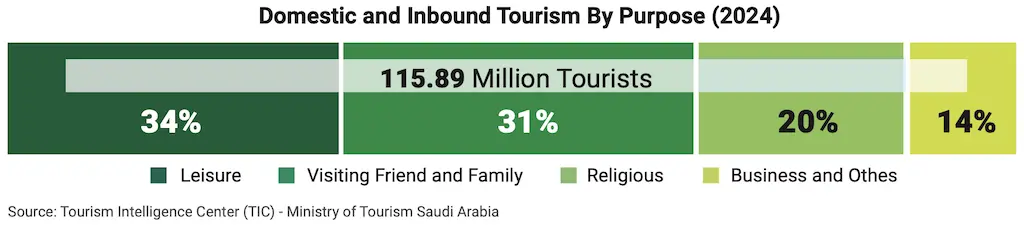

It was recorded that 20% of travellers visit the kingdom for religious purposes, 34% for leisure, 31% wish to visit their friends and families, and the rest for business and other purposes. Thus, highlighting KSA’s shift from a country that was purely visited for religious or familiar reasons, to a major destination for luxury vacation, corporate travel, and cultural discovery. This shift in position started following the launch of a list of Vision 2030 mega projects such as Jeddah Central, King Salman Park, NEOM, the Red Sea Project, and AlUla. KSA has also taken a groundbreaking move in achieving its ambitious Vision 2030 agenda. The kingdom is adjusting to host major international events that will increase tourism while solidifying Saudi Arabia’s standing as a top travel destination for business, leisure, and large-scale events. Among those events are three distinct; 2029 Asian Winter Games, World Expo 2030, 2034 FIFA World Cup, and Riyadh Season. Looking ahead to 2040 and beyond, according to the Google/Deloitte Travel 2040 research, Saudi Arabia will be one of the largest beneficiaries of the 60% increase in worldwide tourism by that year. It is due to these major events that the kingdom is predicted to be among the top 15 tourism destinations worldwide.

As the first desert nation to hold the Asian Winter events, Trojena, a futuristic ski resort in the NEOM mega-city project, is scheduled to host the events in 2029. This event is a testament of Saudi Arabia’s dedication and determination to establishing unique destinations for tourists which combine luxury with innovative technology.

The kingdom, by hosting World Expo 2030, establishes itself at the forefront of international and cultural interface while also offering the chance to highlight its accomplishments and rich history. Furthermore, the kingdom has successful bid for the 2034 FIFA World Cup demonstrating the country’s commitment to organizing a world-class event, with 15 modern venues in five locations, including Riyadh’s 92,000-seat King Salman International Stadium.

In addition, One of the biggest entertainment events in the Middle East, Riyadh Season launched in 2019 as a component of Saudi Arabia’s Vision 2030 plan to increase tourism and diversify the country’s economy. The event lasts several months each year and includes worldwide concerts, sports championships, cuisine festivals, and immersive experiences, drawing nearly 12 million attendees in 2023 alone. Whether via vision 2030 projects or other initiatives, the country’s tourist boom contributed to the transformation of multiple sections of economy.

Tourism as a Strategic Sector

Travelers created a massive demand for various services in diverse markets. They shifted the landscape of the hospitality, transportation, infrastructure, and mobility markets. With every tourist’s arrival, the need for accommodations, transportation services, more automobiles to rent, and more ride-hailing journeys increased.

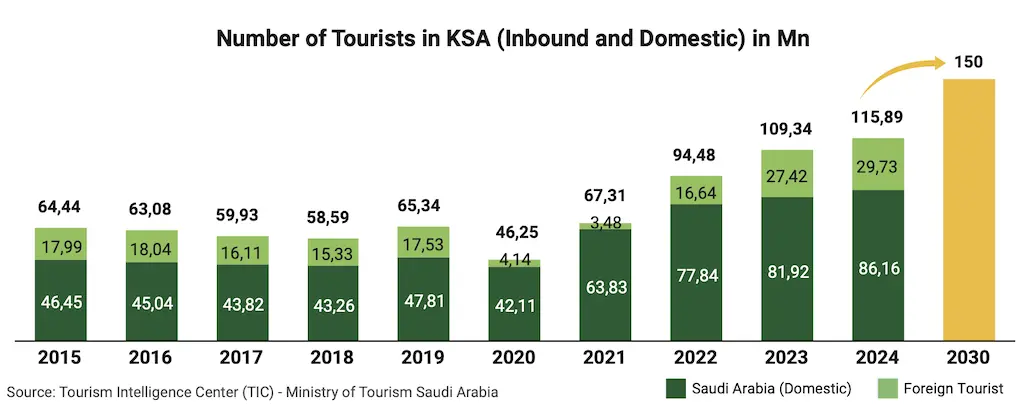

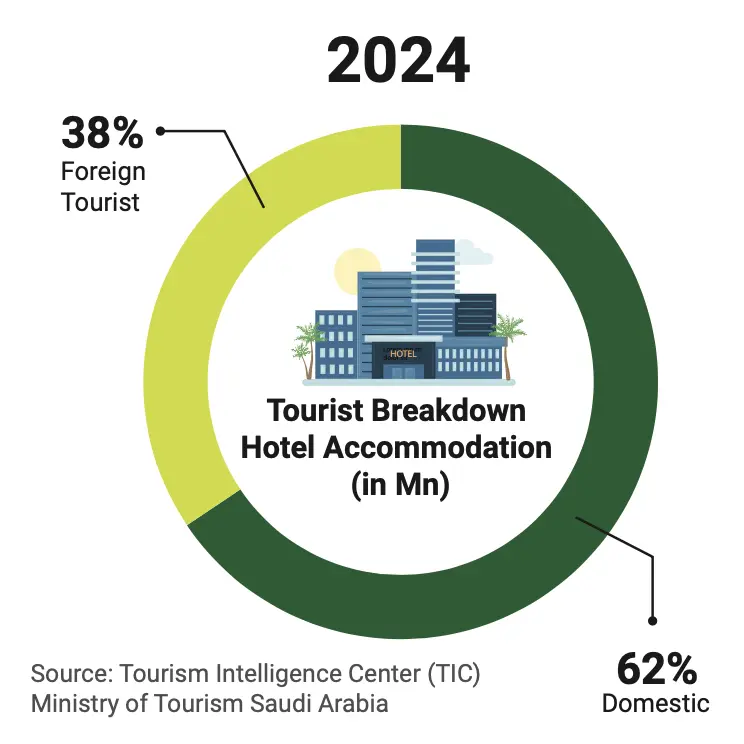

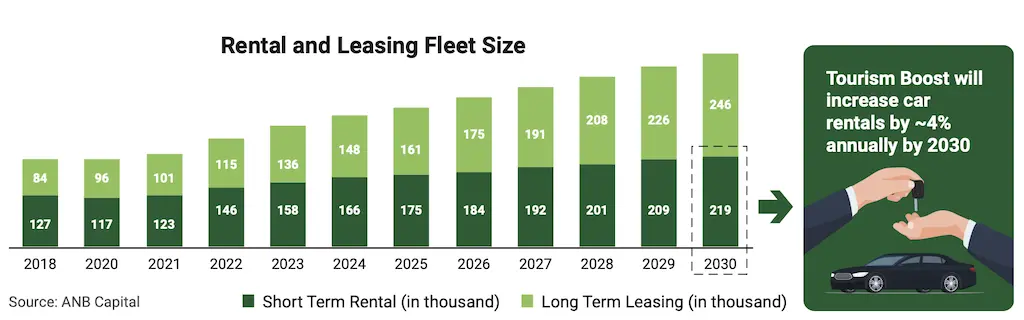

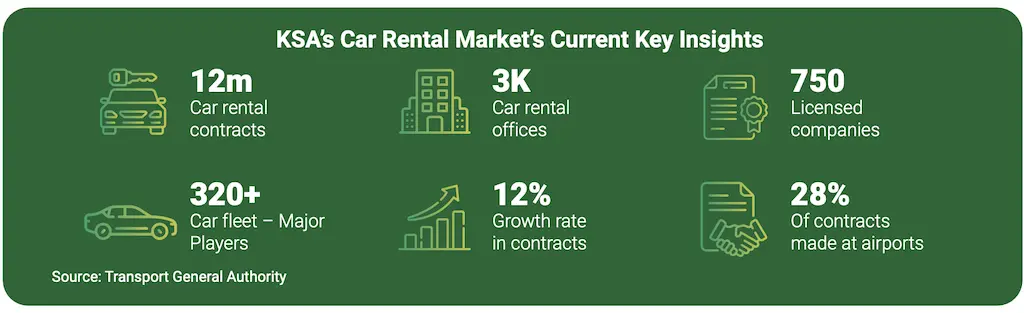

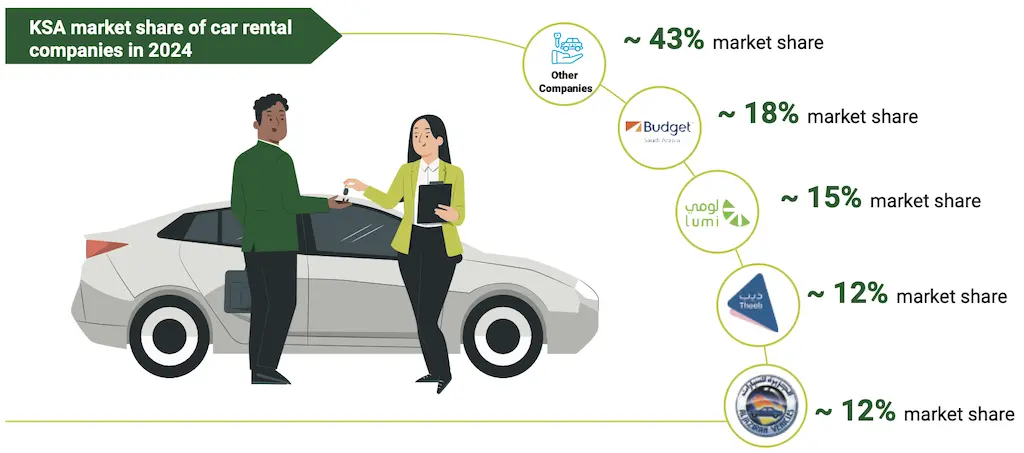

International tourist in 2023, spent the most on accommodations out of all the other markets. Following the growing expenditures, KSA’s hospitality sector has rapidly progressed and developed to scale up and accommodate the incoming wave of tourism. With plans to develop 290,000 new hotel rooms by 2030, the country would have surpassed Dubai’s current availability of 150,000 rooms. In addition, by 2030, KSA’s hospitality industry aspires to have the capacity to accommodate approximately 150 Mn tourists annually, combined between domestic and international. Amongst the top 20 most visited countries, KSA has recorded an 18 Mn tourist arriving in 2022 and have attracted close to 100 Mn visitors, both domestic and international, during 2023. This surge affects the lubricants market both directly and indirectly. The rental automobile fleet market has expanded, and rider-hailing grew. Luxury cars with chauffeurs were everywhere. From high-mileage fleet maintenance to premium synthetic lubricants for luxury cars, each of these industries has distinct lubrication needs.

Inbound vs. Domestic Tourism Trends

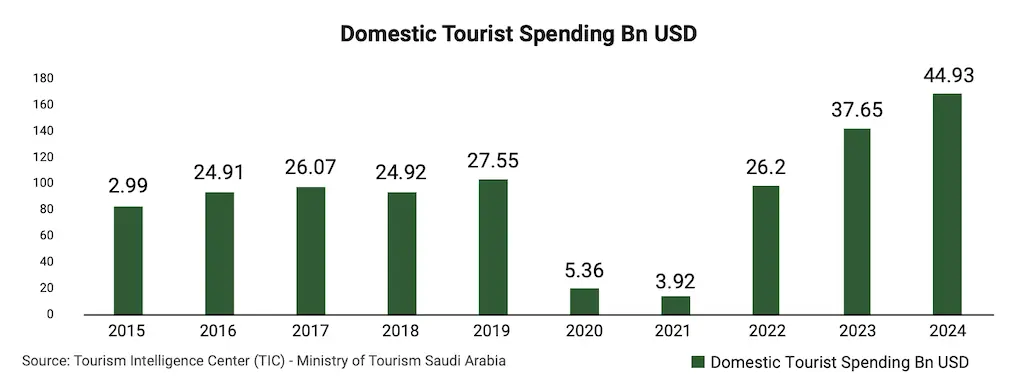

The tourist surge has yet to slow, as the country foresees 150 million tourists a year by 2030. According to ministry of tourism in KSA, the country has witnessed a continuous increase in tourism, reaching around 82 million domestic trips and nearly 27 million foreign visitors in 2023. According to the published TIC data, domestic tourists spend roughly 30.39 Bn USD during their typical 6-night trip, whereas foreign visitors spend almost 16 nights and spend about 37.56 Bn USD

The division between domestic and inbound tourism results in two unique lubricant demand streams. Domestic travelers make regular excursions inside the Kingdom, either using household automobiles or rented vehicles, triggering a demand for regular oil changes. However, inbound tourists, despite arriving in a smaller number, stay longer and spend more. This results in an increased use of rental cars, shuttles, tour buses, and fleet vehicles, all of which require heavier, commercial- grade lubricants.The combined effect of these movements amplifies lubricant demand in terms of volume and intensity. Residential families commuting between cities create ongoing, repetitive demand for passenger car oils, while tourist visitors contribute to the demand for rental fleet and commercial-use lubricants. Brands and distributors can therefore tailor their strategies accordingly. On one hand, brands can provide mid-range motor oils to local workshops and retail stores, and on the other, offer high-performance, high-quality products to meet the maintenance needs of rental and commercial fleets.

In KSA the preferred type of accommodations across both domestic and foreign tourist is the hotel accommodations. Notably, 93% of foreign tourists stay at a hotel during their visit to the kingdom of Saudi arabia. However, considering the high level of domestic tourism in the country, domestic tourists account for 62% of total tourists that choose a hotel accommodation. Hotels are popular destinations for local tourists, who often travel in groups of several automobiles per household, particularly if senior citizens are traveling with them. This is always the case whether they are taking a road trip to the northern areas or a weekend getaway to Abha. This means more automobiles on the road, more kilometers driven, and more post-trip maintenance requirements.

Moreover, to provide guests with extended hospitality services, some hotels have their own fleets or partner with shuttle and car- rental companies, which leads to increased motor vehicle usage.

As a result, the continued expansion of mid-scale and high-end hotel chains throughout the Kingdom indirectly drives up demand for lubricants, notably for commercial-use cars and hospitality logistics. As the hotel chain expands in line with national tourism policy, its contribution to the lubricants market develops, driving both B2C and B2B demand channels.

Both international and domestic travelers influence the lubricant market, but in different forms. Inbound tourists visiting for religious, business, or recreational purposes primarily employ rent-a-car, hotel shuttles, and tour buses. These vehicles are high-intensity users since they travel long distances in a short amount of time. As a result, their cars require constant maintenance and oil changes, particularly in commercial fleet operations. Increased numbers of foreign tourists have driven up demand for airport shuttle services and inter-province travel, fueling lubricant demand among high-mileage fleets. Alternatively, domestic tourists rely significantly on private transportation. Saudi families frequently take long road journeys over weekends, national holidays, or school breaks. This increases the burden on personal automobiles, resulting in a consistent demand for lubricants throughout the year. The local tourism sector, reinforced by Vision 2030 and national advertising campaigns, has made road travel extremely popular among locals. Ultimately putting constant pressure on the car maintenance industry.

Collectively, these types of tourism increase the demand for lubricants. International tourism drives commercial and fleet demand, while domestic travel indicates that private automobiles remain in use. Together, they generate strong and rising demand across all vehicle classes and geographies.

International Tourism Overview

As reported by the Saudi Ministry of Tourism, tourism concluded the first quarter of 2023 at 23.19 Bn USD, up 132% from the same previous year, while the number of foreign visitors increased 142% to 14.6 million. This marks the sector's best half-year result ever.

In 2024, Saudi Arabia’s tourism industry reached a significant milestone, as foreign tourism revenue increased by 148% from 2019 resulting in the highest overall growth rate among G20 nations. This accomplishment is a testament to Vision 2030’s success, which has solidified the Kingdom’s status as a world leader in innovation, tourism, and entertainment. According to the 2024 annual performance report, strategic investments, regulatory changes, and groundbreaking mega-projects have all contributed to record-breaking pilgrim visitors, cultural landmarks, and significant international events.

According to market projections, the country could welcome more than 80 million foreign tourists a year by 2040.

Domestic Tourism Overview

Saudi Arabia saw a 45 % yearly increase in domestic flight bookings in 2024 due to the Kingdom’s expanded tourism offers and enhanced connectivity via low-cost carriers.

The most recent travel trend data from Almosafer indicates that domestic room night reservations increased by 39% annually. In addition, hotel and domestic aircraft bookings together accounted for nearly 40% of the total travel industry, a rise of 11% annually. The expansion of domestic travel is mostly due to the increased variety of places to visit, places to stay, and things to do that continue to draw tourists who want to travel for leisure. This growing tendency has been mostly attributed to family and group travel, where reservations have increased by more than 70%.

In KSA, domestic spending has increased to a record of SAR 168.52 Bn in 2024

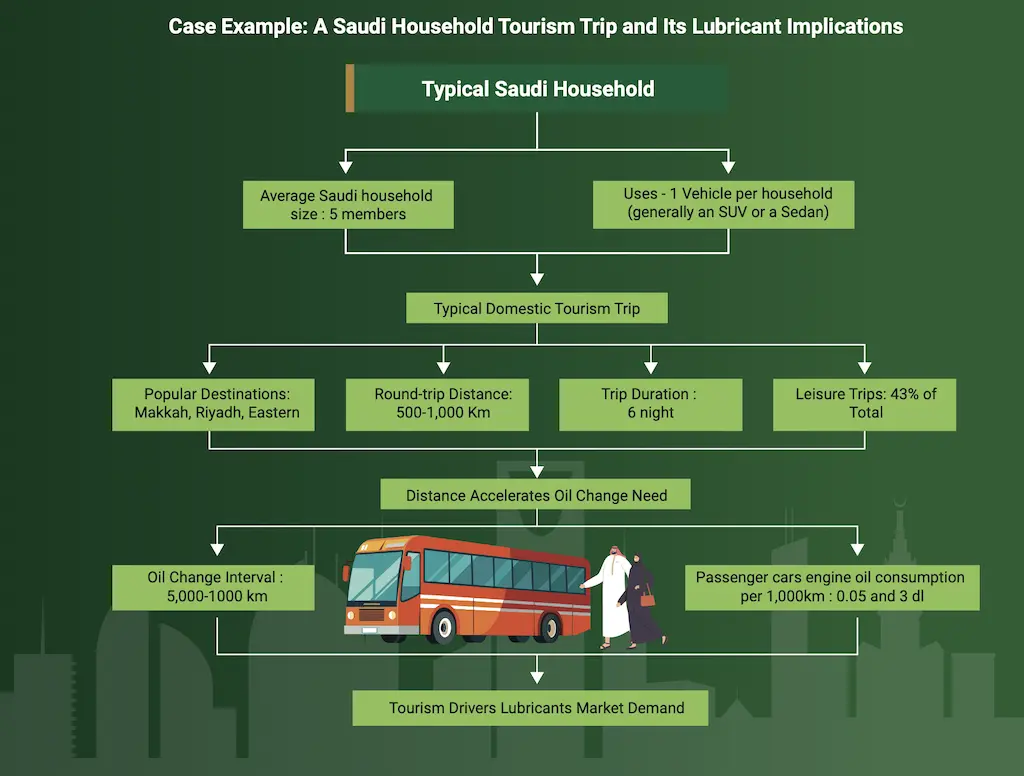

A Saudi household typically consists of five people and has an average of 1.38 cars. With automobile ownership becoming so common, it's no surprise that private cars account for the majority of domestic travel. Given how frequently Saudi families take vacations, they may wind up at Makkah, Riyadh, Jeddah, Abha, or AlUla. When combined, these mostly leisure-oriented journeys account for over 43% of total domestic travel. The average tourist vacation lasts six nights, while round-trip travel times for families traveling throughout the kingdom often fall between 500 and 1,000 kilometers. 87.5% of domestic travel is made in private cars, hence these trips are almost entirely made by car. With the average Saudi Arabian car using almost 12 kilometers of gasoline per liter (Taqa), the highways are congested with families doing long vacation drives. However, there is a clear correlation between lubricant consumption and car usage, not just fuel consumption.

Engine oil is significant in this context since it accounts for about 89% of the lubricant used in passenger cars. Even while modern cars don't use a lot of oil on a single trip, mileage requires regular maintenance, especially oil changes. In Saudi Arabia, oil changes are typically required every 5,000 to 10,000 kilometers, with an average consumption of 4 to 5 liters. So, when a family travels 1,500 kilometers on a vacation, they cover 10% to 20% of the oil change period in one go. That means that a single trip indirectly adds to the consumption of 0.6 to 1.5 liters of engine oil per automobile. When the numbers are magnified, they are surprising. In 2023, Saudis made about 82 million domestic visits. If 43% of them were for leisure, that translates to nearly 35 million journeys largely by car, each of which subtly accelerates oil replacement schedules across the country. Since passenger vehicles account for more than half of Saudi Arabia's total automotive lubricant usage, the impact is far from insignificant.

Religious Tourism Overview

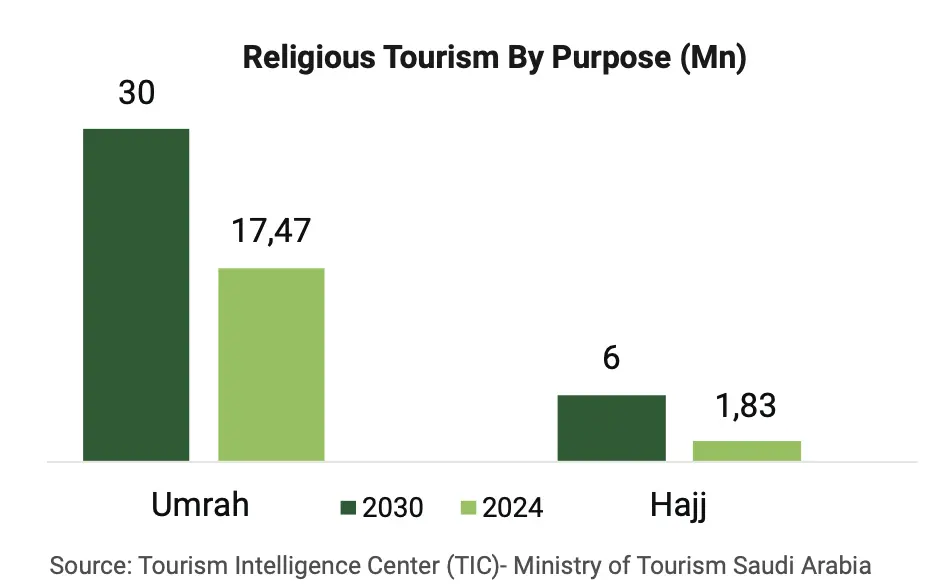

Saudi Arabia intends to embark on a major expansion of religious tourism between 2024 and 2030. The vision 2030 ambitious goal includes going from welcoming 17.47 Mn umrah and 1.83 Mn Hajj Arrivals in 2024 to more than 30 million Umrah and 6 million Hajj pilgrims annually by the year 2030. This expansion puts further strain on the Kingdom’s transportation network, necessitating a major increase in public and private vehicles to address the increasing number of visitors. In order to facilitate this expansion, properly maintained fleets of automobiles are essential.

In 2023, the Public Transport Authority (PTA) announced the signing of the largest project for transporting passengers by bus connecting Saudi cities, through a transportation network that covers more than 200 cities and governorates, and is expected to serve more than 6 million passengers annually, through 76 routes, and with a new fleet of buses equipped with advanced technologies that allow the use of environmentally friendly vehicles. It was emphasized that this project will benefit a variety of sectors, including tourism development and transportation, as well as contribute to economic diversification and the consolidation of private-sector partnerships. The National Strategy for Transport and Logistics Services intends to raise public transportation use in the Kingdom from 1% to 15% by 2030. The project will also help to translate one of the strategy's most critical objectives, which prioritizes urban quality of life, by cutting transportation carbon emissions by 25% by 2030.

In 2022, the country had around 13.5 million registered automobiles. Due to new local transportation initiatives, religious tourist growth, and the post-pandemic rebound, the number had already surpassed 15 million in early 2024. This number will rise well above 17 million cars by 2030 driven by governmental initiatives involving the expansion of bus networks in Makkah and Madinah, new taxi license programs, and partnerships with ride-hailing companies.

Furthermore, the expansion of privately run pilgrim transport services is anticipated to increase the demand for high- performance lubricants that can withstand extreme conditions and long-distance travel, as well as the annual mileage of vehicles and the frequency of oil changes.

The demand for dependable vehicle operation is rising along with the size and intensity of religious tourism, making lubricant supply networks a crucial component of Saudi Arabia’s overall pilgrimage preparation strategy. Lubricant manufacturers and distributors will gain from increased demand for their products in government and private fleet vehicles such as buses, vans, taxis, and SUVs used for pilgrim transportation. The lubricants industry is an essential driver to having an effective, safe, and sustainable pilgrimages experience. Overall aligning with the Kingdom’s fundamental values.

The volume and intensity of logistics during religious seasons put a burden on Saudi Arabia’s transportation system. Commercial buses, shuttle fleets, and taxis operate around the clock to carry millions of pilgrims between airports, hotels, and holy sites in Makkah and Madinah. These vehicles typically drive nonstop for weeks, covering long distances in blistering heat and severe traffic.

This leads to increased engine, drivetrain, and key component wear, necessitating frequent oil changes and lubricant replacements in order to maintain performance and prevent breakdowns. Heavy-duty vehicles are also utilized to bring food, water, medication, and sacred belongings for pilgrims, putting additional strain on the logistical network. The peak utilization of passenger and freight vehicles during these seasons results in a significant rise in lubricant consumption, particularly in industries that provide engine oils, transmission fluids, and industrial lubricants for heavy-duty applications.

Adopting Public Transportation: Transit & Mobility

The reconfiguration of Saudi Arabia's social landscape, particularly the empowerment of women and the flood of tourists, is not occurring in isolation. The reforms have had a far-reaching impact, affecting almost every aspect of city life. This is particularly evident in the way citizens commute across the Kingdom.

As more women take to the roads and millions of visitors arrive, the demand for efficient, inclusive, and accessible public transportation has never been higher. The demands for transportation have increased in scope and sophistication as more people commute to work, more tourists visit, and cities grow at an unprecedented pace. While private automobiles continue to be an important part of daily life, public transit is increasingly being viewed as a key, complementary force in Saudi Arabia's evolving urban dynamics.

Mobility is seen as an instrument for economic growth, equity, and inclusion in Vision 2030. Buses, metros, and trains are no longer subordinate to private cars; they are forming the foundation of a sustainable, networked, and progressive society. Whether it's a university student heading to campus, a tourist moving from airport to monument, or a businessman heading to the office, public transportation is becoming an increasingly important means of access and mobility.

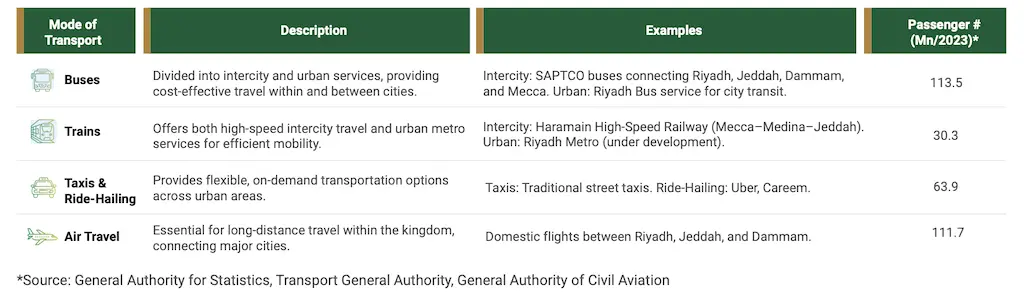

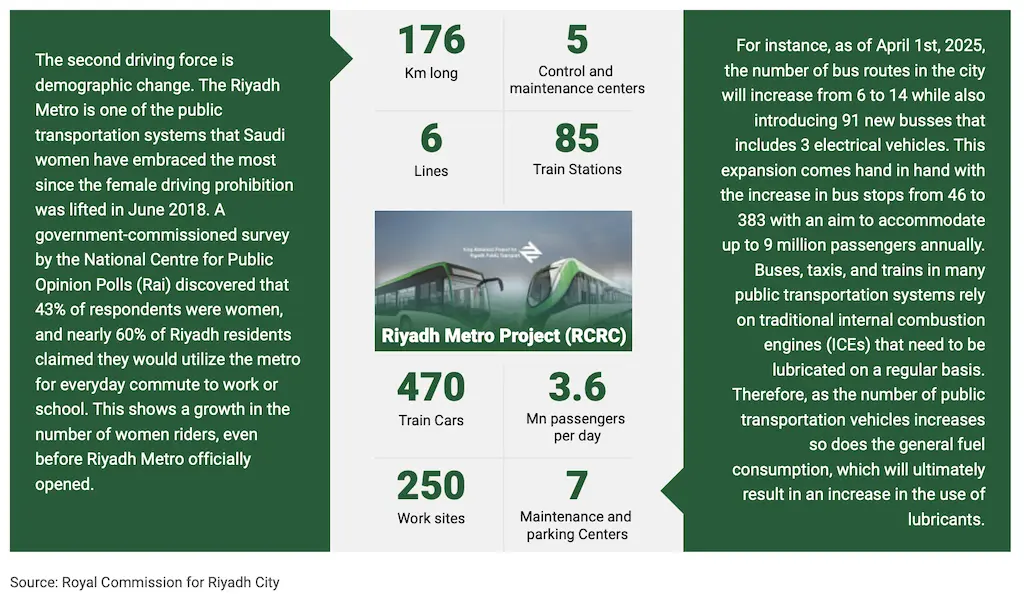

The Kingdom is rapidly advancing the market for public transportation. According to GSTAT, since 2021 the usage of these services has jumped by 233.9%. In the major cities, the number of commuters using public buses alone increased, reaching over 43.5 million trips in 2022. Not to mention the completion of other revolutionary infrastructure projects or the full launch of Riyadh's massive new metro system. The key point is that this transition isn't about replacing private transportation; rather, it's about providing a range of safe, efficient, and sustainable alternatives. In other words, both private and public transportation are merging, with each having a unique role within the network. And collectively, they are promoting mobility, reducing traffic, and supporting the Kingdom's flourishing cities. The adoption and utilization of public transportation will be examined first, starting with the behavioral changes and social trends that are contributing to its growing use.

Public Transportation Growth - Impact on the Lubricants Market in KSA

A noticeable change is taking place, one that is evident in both government policy and A noticeable change is taking place, one that is evident in both government policy and public perception. Following decades of car-centered urban design, public perception. Following decades of car-centered urban design, reliance on private reliance on private vehicles, and underinvestment in transit infrastructure, KSA’s vehicles, and underinvestment in transit infrastructure, KSA’s previous vision of an previous vision of an automobile-dependent society is slowly shifting. This automobile-dependent society is slowly shifting. This shift is allowing a more sustainable shift is allowing a more sustainable transportation ecosystem in which buses, transportation ecosystem in which buses, metros, and railway lines have begun to play an metros, and railway lines have begun to play an active role in daily activities. active role in daily activities. Public transportation in KSA varies and consists of diverse Public transportation in KSA varies and consists of diverse modes, each modes, each corresponding to different travel needs across the kingdom.

Expansion of Public Transportation Systems

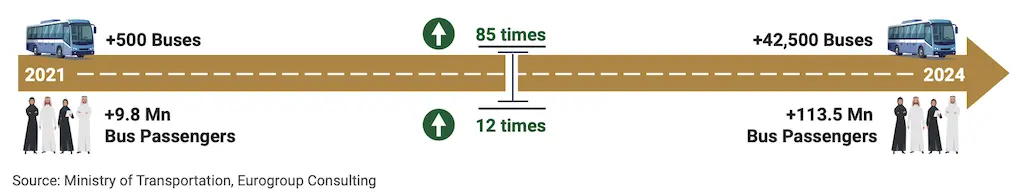

Although it hasn't happened overnight, the shift is undeniable. The overall public transportation market in KSA was valued at $686.49 Mn back in 2022, and the market is expected to reach $1,040.86 Mn by 2029. As the sector gains popularity, a new generation is now starting to use buses and trains. In 2021, there were over 500 public bus travels, with over 9.8 Mn passengers. This number increased significantly to reach 42,500 busses with +113.5 Mn Passengers by 2024. In addition, public transportation use is expected to rise steadily and gradually between 2025 and 2029, from 9.27 to 10.31 Mn users.

This anticipated expansion implies that public transportation will keep becoming more and more integrated into locals' and tourists' daily lives. The steady increase points to a shift in infrastructure and culture toward more efficient and sustainable forms of transportation, which is bolstered by government initiatives to reduce emissions, lessen dependency on private automobiles, and enhance urban mobility. This increase is not merely a variation in statics it represents a change in perspective. Furthermore, public transportation fleets often operate for longer hours and travel longer distances than private cars, increasing engine component wear. Keeping the vehicles operating effectively, requires: additional oil changes, maintenance plans, and the usage of high-performance lubricants. As the number of cabs, buses, and metro trains rises, so does the amount of lubricant used for fleet maintenance.

The Driving Forces

This transition is driven by a variety of factors. Populations in cities are rapidly increasing. As of today, over 31,842,626 Saudis reside in cities, accounting for around 92%. This growth puts strain on the daily commute, roads, and quality of the air. As real estate expands into new residential districts, residents are reconsidering their modes of mobility due to longer commutes to work, education, and services. With congestion increasing and fuel subsidy reforms gradually redefining what is affordable, driving a private car is no longer necessarily the best option. Thus, public transit becomes an absolute necessity rather than a desirable prospect. Subsequently, this drives the demand and need for different types of lubricants.

Government initiatives have increased the public transportation systems' appeal. The Public Transport Authority, in collaboration with local government officials and foreign transportation specialists, has implemented new transit plans in numerous cities. Primarily, the government has established the Makkah Bus Project. This project in particular features over 400 clean-energy buses equipped with real-time GPS tracking, thus representing a significant improvement in service quality. Additionally, SAPTCO's expanded inner-city and inter-city services have begun to decrease intra-daily mobility disparities, particularly for low- and middle-income populations. Nearly 50% of people surveyed in Riyadh and Jeddah, in a recent study, expressed their interest in utilizing public transportation more often if it were combined with improved services and optimized routes.

Nonetheless, the potential is immense. Saudi Arabia's projected investments in metro systems and other public transportation facilities present a once-in-a-lifetime opportunity to transform the way citizens commute. When these systems are completely operational, they will not only absorb millions of more daily journeys but will also shift public perception. They will also help to achieve broader economic and environmental goals, such as lowering emissions, and better connecting workers to jobs. These investments and initiatives by government will result in the launch of modern, high-tech automobiles that frequently require specific lubricants developed for improved performance and longevity. This change would offer lubricant producers the chance to provide customized solutions that cater to the unique requirements of these new, reccuring, and cost-effective automobiles. Thus, further driving the demand for lubricants to increase.

Road Connectivity - Infrastructure For Sustained Demand

KSA has undergone a shocking transformation in its road infrastructure. With initiatives such as the National Transformation Programs that encourage the use of new technology in its operations and assist the county's workforce by increasing their capabilities in every aspect of national development. Furthermore, these initiatives encourage the application of technologies that will lower environmental and social costs while assisting in the development of resilient infrastructure with lower life cycle costs and more effective, high-quality services.

Overview of National Road Infrastructure Development

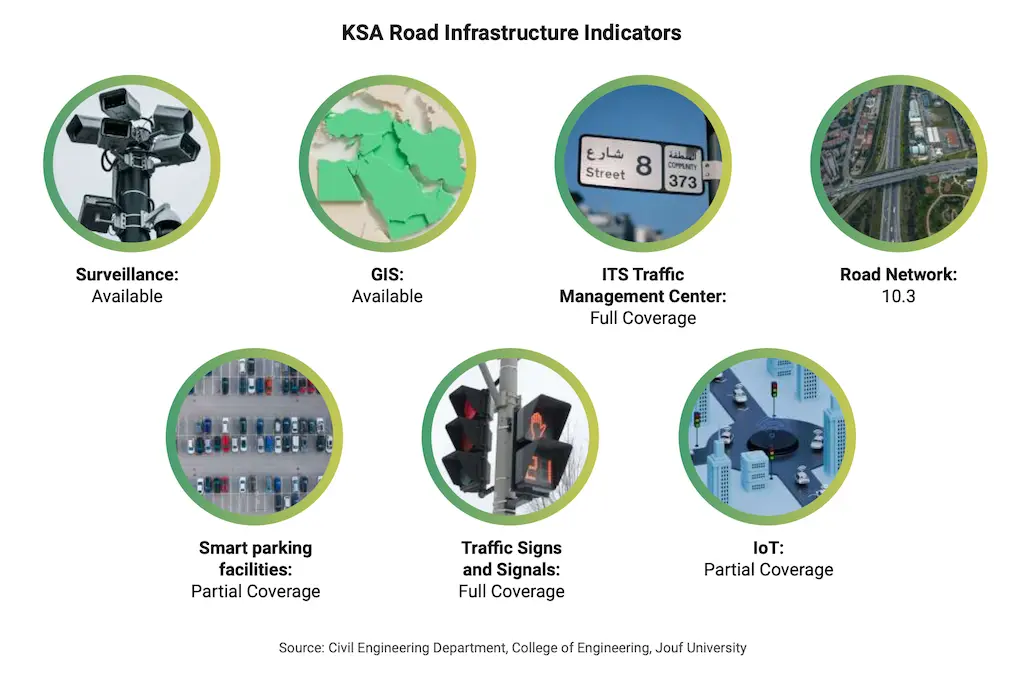

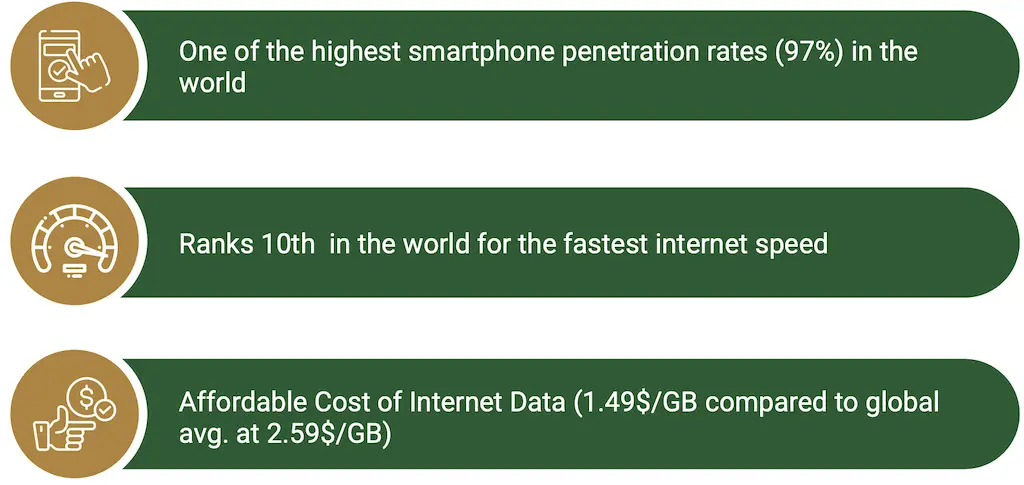

Saudi Arabia has made significant progress in establishing a modern infrastructure framework that would help it accomplish its Vision 2030 goals. The kingdom now has 92.5% internet connectivity, full traffic sign and signal implementation, and total coverage via its Intelligent Traffic Management Center. It has integrated GIS and monitoring systems, and it is gradually incorporating smart parking and IoT technologies. While associated and self-driving cars are still in their early phases, these achievements indicate that the Kingdom will be constructing the digital and physical infrastructure for a smart mobility ecosystem.

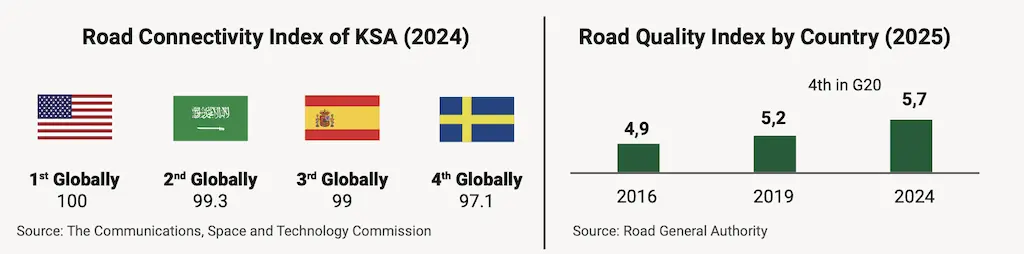

At the heart of this shift is the continual improvement of the country's road network. Saudi Arabia not only increased the length and capacity of its road network, which is currently rated 10.3 on the global road index, but it also improved the coordination of smart transportation systems for greater efficiency, security, and connectivity. In fact, these have reduced travel durations, improved logistical operations, and opened up new geographical areas.

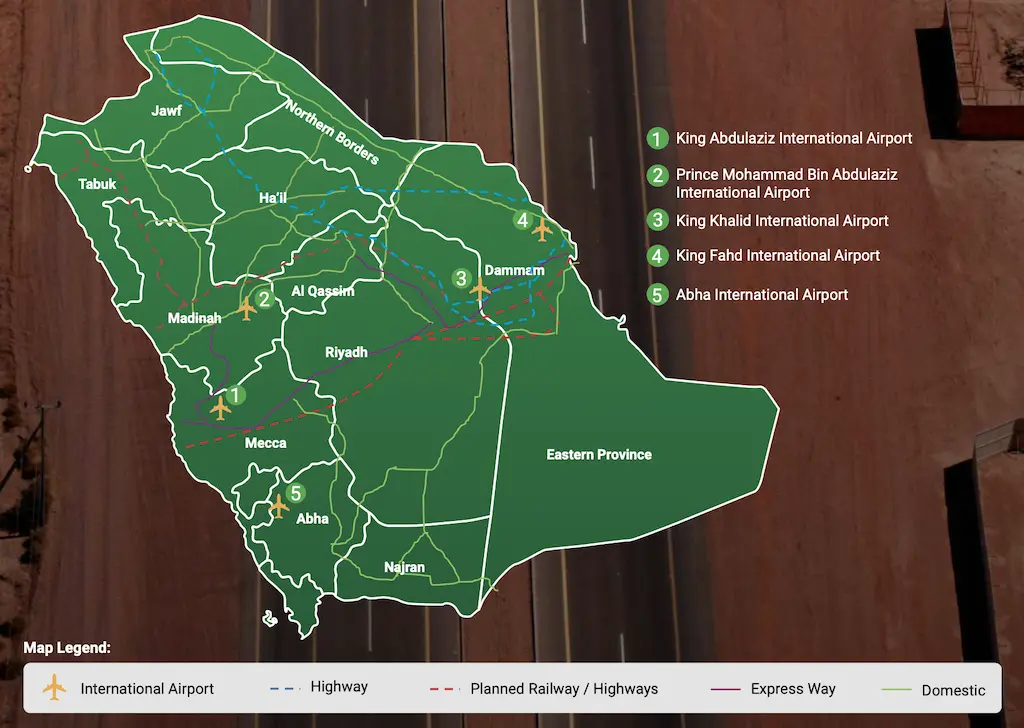

The ministry of Transport has requested several studies to determine the most effective and advanced public transportation system, thus adhering to the country's mobility requirements. In line with this, public transportation projects are currently carried out in Riyadh, Makkah, and Madinah. In addition, the Public Transport Authority was created to oversee the development and implementation of the Kingdom's public transportation strategy. For Madinah, Jeddah, Dammam, Buraidah, Jazan, and Taif, a thorough public transportation plan has already been created. While plans for Hail, Abha, and Hofuf are still in the works. The influence on the lubricants market is direct and significant. Wider use of transportation, increased wear and tear, additional servicing, and higher lubricant consumption are all consequences of a broader, more effective road network.

Since its founding in 1979, the Saudi Public Transport Company, or SAPTCO, has offered multiple services. These include intercity and intracity public transportation, international transportation, premium services like "VIP EXPRESS," specialized services, and digital services. Furthermore, SAPTCO formed a separate business to build, supply, run, oversee, and maintain metro buses in Riyadh as part of the King Abdul Aziz public transportation initiatives.

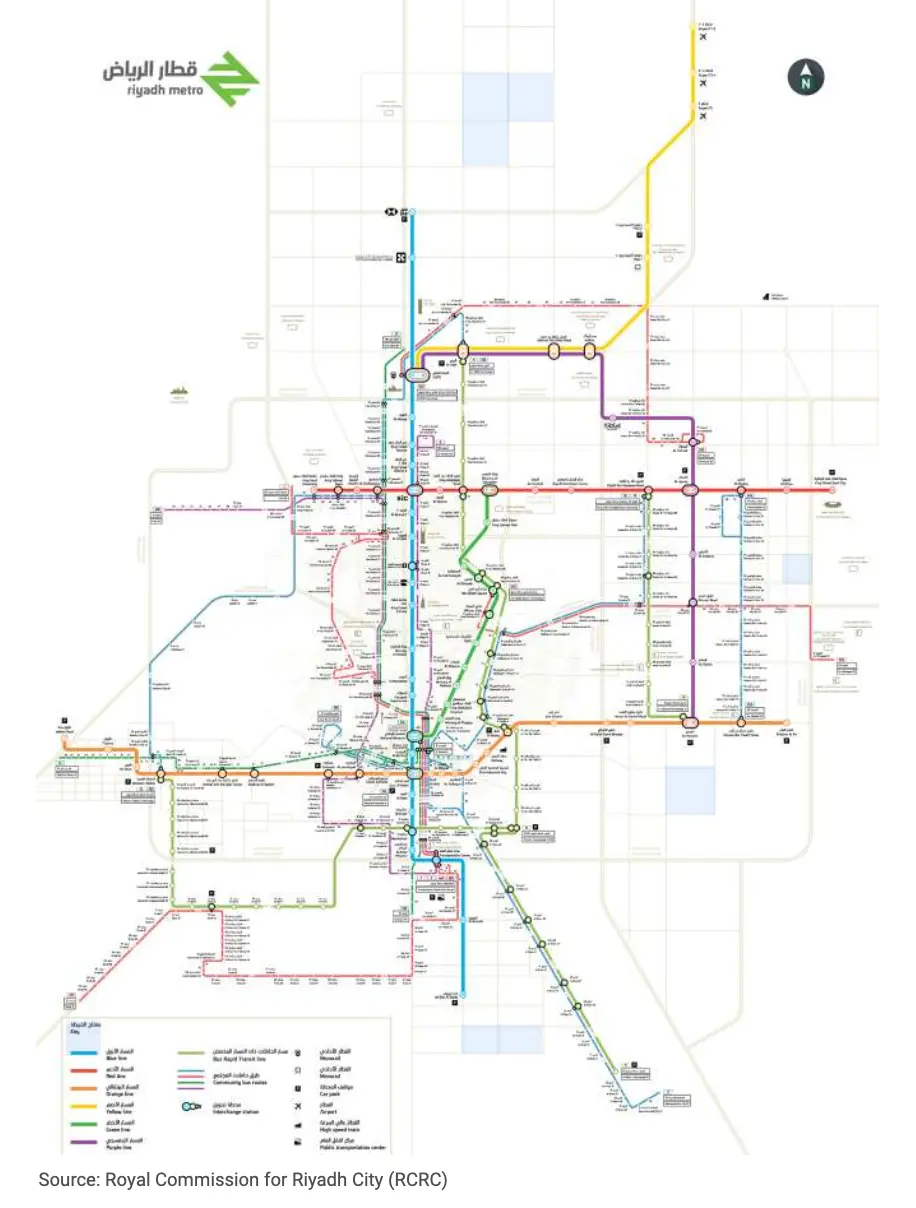

Around the capital, six lines, more than 176 kilometers of rail, and 85 stations are being connected, going through areas with virtually no public transportation. Riyadh is only the first step. With new bus terminals, advanced ticketing systems, and rapid bus transit lanes, Mecca and Medina (two holy cities) are embracing the bus industry. The same is being done in Jeddah, Dammam, and Khobar, each of which has its own city transport plans aimed at improving mobility and lowering dependency on private vehicles. Every new bus line or subway tube is supported by a 24/7 machinery supply chain, service fleet, and construction equipment. While the overall vision is essential to this infrastructural revival, engines, hydraulics, compressors, gearboxes, and cooling systems are also necessary. And in the severe climate of Saudi Arabia, lubricants are a prerequisite for all of these to function smoothly, endure wear, and handle extended duty cycles. Here's where the link becomes clear. Through development, commissioning, and long-term operation, the Kingdom's need for premium lubricant solutions increases with its transportation infrastructure investments. During station excavation, digging equipment uses heavy-duty greases. Tunnel boring equipment uses hydraulic fluids that can withstand high loads. Cement mixers and track-laying equipment are powered by industrial lubricants that prevent thermal deterioration and friction. After construction has been completed, the maintenance cycle starts; generator standbys, railcar systems, and vehicle washing all depend on lubricants designed for longevity and performance.

Furthermore, saudi arabia is making progress in the road infrastructure sector. According to a World Economic Forum report, the Kingdom has improved its road infrastructure quality score, reaching 5.7. This ranked the Kingdom fourth among G20 countries, putting it closer to meeting the Road Sector Strategy's target of ranking sixth in the global road quality index by 2030 and decreasing road fatalities to less than five per 100,000 people. The authority also intends to cover the road network with safety measures based on the International Road Assessment Programme (IRAP) and to boost private sector involvement in operational activities.

Infrastructure for public transit

What is impressive is not the volume of demand, but its consistency. One-time demand for lubricants is not created by infrastructure developments. The government set up supply agreements that last for several years, frequently with high technical requirements and recurring cycles. For the lubricants market, this means stable, long-term contracts for anything from first-fill oils at machine installation to maintenance lubricants utilized over years of system operation.

Furthermore, the strategic context of these enterprises raises the bar. Infrastructure for public transit is important to the country which means that delays, malfunctions, or gaps in maintenance, incurs both financial and reputational costs. Operators of public transportation systems and engineering contractors, therefore, look for lubricant partners, not just vendors. These partners can provide dependability, technical guidance, and customized product lines. This gives local and foreign firms the opportunity to expand their business-to-business (B2B) service offerings, send out technical support teams on-site, and develop innovative ideas for lubrication in harsh conditions to meet local demands. Civil engineering is not the only field with this requirement. The maintenance of infrastructure, such as escalators in massive complexes, diesel backup power plants for depots, and air conditioning systems in metro stations, also calls for lubricants designed for longevity and reliability. High-speed elevators, energy-intensive lighting systems, and intelligent ticketing gates are only a few examples of the increasingly complex station's machinery ecosystem. All of which require high- performance lubricant.

To put it briefly, public transportation infrastructure is creating opportunities rather than tracks. The fundamental definition of mobility is being broadened, and the lubricants market is entering a new era of significance that is connected to more than just automobiles and truck. It is being tied to the way cities interact, breathe, and thrive. Saudi Arabia is constructing more than just railroad stations and lines. It is constructing a future vision in which cities are interconnected, transportation is efficient, and every motor, screw, and bolt serves a purpose. That means only one thing for the lubricants industry: those engines will need to run, and their oils and fluids will provide the necessary power.

Road Connectivity and Strategic Networks

Even though Saudi Arabia is significantly growing its metro rail and rail networks, the kingdom still heavily depends on road transportation to support daily mobility and economic activity. Although they now only serve small geographic areas, developments like the Haramain High-Speed Railway and the Riyadh Metro have long-term benefits. The majority of regions still rely on road infrastructure for mobility, especially those outside of major cities. This reliance emphasizes how important road construction is to establishing national connections and influencing the demand for lubricants in both the consumer and business sectors.

According to the ministry of media, there are more than 268,000 kilometers of roads in Saudi Arabia, ranging from arterial and highway roads to rural connections. However, as part of the larger infrastructure plans for Vision 2030, many of these networks are being built up, enlarged, or developed from scratch. New intercity road development, freight corridor improvements, and access to economic hubs like NEOM and the Red Sea Global site are a few of the latest publications. These include enhanced traffic flow, easier access to remote locations, and assistance with national logistical operations. For the lubricants market, this results into measurable increases in product demand. More connectivity means more vehicles moving around, traveling farther, and needing repair more frequently. Commercial fleets that travel long distances today need long-lasting engine and gear oils that can continue to function even under extreme heat conditions. Likewise, lubricant usage in equipment, concrete plant mixing, and equipment transportation must be raised for road construction itself. Additionally, lubricants for light trucks, buses, and utility vehicles are needed as a result of access road construction around building projects, tourist destinations, and industrial development projects. As they will be used in stop-and-go scenarios, these cars will put additional strain on their engines and drivetrain, necessitating high-quality lubrication. The value chain for lubricants is further enhanced by road network connectivity. Lubricant service providers and distributors can reach a bigger audience and find the best routes when townships, logistical centers, and border crossings are more easily accessible. Customers benefit from less downtime and increased market coverage, particularly those whose fleets operate in remote or secondary townships. This domestic initiative to increase mobility through enlarged highways is setting the stage for future growth in private vehicle ownership. Car ownership becomes increasingly easy and alluring as more individuals are able to move easily between towns and cities, especially in areas where public transportation is still insufficient. More roads translate into more automobiles on the road, and more cars translate into more frequent and varied lubricant demands.

In this case, the highway infrastructure is not isolated. It links all of the factors that influence the need for lubricants, such as private vehicle ownership, tourism, and logistics. A wider network serves a lubricant market that is more frequent, widespread, and interconnected. As a result, road construction is not just a priority for transportation but also a crucial link in Saudi Arabia's changing lubricant value chain.

Comparative Case: Saudi Arabia vs. United Kingdom Road Networks

The most effective approach to measure the progress of Saudi Arabia's road network is to compare it to countries that have a global reputation for maintaining excellent and highly developed networks. The United Kingdom serves as a prime example of a developed country with a well established and mature road network.

The United Kingdom's road network is one of the largest in Europe, with a complicated system that reflects the country's early urbanization and industrialization. However, in recent years, the United Kingdom has shifted its focus from expanding to retaining its network. Funds have been allocated frequently to combat an aging network and an increasing maintenance backlog. Saudi Arabia, on the other hand, is in the midst of a transitional period in which it is actively spending on the expansion and improvement of its roadways as part of Vision 2030. This comprises building high-speed highway corridors, improving interconnectivity between economic zones, and aligning road development with a comprehensive national logistics and transportation strategy.

The intriguing aspect of this comparison is that, despite the UK's head start, Saudi Arabia has managed to establish and carry out an infrastructure initiative within a relatively brief period of time. This initiative not only follows in quality but also sets new benchmarks for integration and strategic planning. Saudi Arabia benefits from a unified system under one ministry, which enables quicker project execution and more consistent infrastructure levels throughout the country, in contrast to the UK's multi-tiered administrative framework. It is no coincidence that the Kingdom's road infrastructure is in the top ten globally; rather, it is the result of a strategic, well-funded, and proactive approach to mobility.

Therefore, this comparison approach is not about equating total kilometers or imitating the course of another nation. Instead, it's about proving that Saudi Arabia has built a road network ecosystem that meets best-in-class international standards and, in some cases, surpasses more advanced levels infrastructure in ambition, integration, and delivery.

Inside the Saudi Lubricants Market: Competition, Trends, and Growth

Seasoned executive with 20+ years of experience driving market leadership, revenue growth, and brand visibility for top companies in the lubricants & automotive sector. Expertise includes architecting high-impact marketing strategies, leading multinational sales teams, and executing data-driven consumer campaigns for brands including Castrol/BP, Hyundai, Ford, SERVO, and BAPCO Lubricants. Proven success in launching new products, optimizing customer loyalty programs, and expanding market share across competitive global environments.

Vision 2030 and Market Outlook

Q: How do you see the Saudi lubricants market today?

A: The Saudi lubricants market is robust and transitioning, driven by Vision 2030. While automotive oils dominate, growth comes from industrialization demands, pushing toward synthetic and specialized lubricants. Competition intensifies as local players like Petromin and global brands adapt to localization policies and EV disruption, shifting the focus to value-driven & service driven solutions. More and more branded quick services centers are emerging.

Q: What are the biggest trends in the market right now?

A: Mainly the Government-Led Industrial Expansion, Localization push, Digital transformation and sustainability are the biggest trends. Major government spending propels all industries forward and driving business across the segments including Automotive sectors and aftermarket retail/wholesale/distributor channels.

Q: What about Vision 2030 and driving Saudi Arabia’s direction for the future?

A: Actually, the Vision 2030 is the strategic engine propelling Saudi Arabia toward regional leadership beyond oil. It drives diversification into manufacturing, sports, and human development, while attracting global institutions and building world-class infrastructure to rival hubs like Dubai and Singapore. The vision aims to make the Kingdom a holistic leader; raising living standards, redefining its global role, and establishing itself as the Middle East’s premier industrial, sports and entertainment destination.

Women Driving and Its Impact

Q: How has women driving affected the lubricants market?

A: In 2018, the decision to allow women to drive marked a significant shift in the passenger vehicle industry. Sales of new passenger cars were predicted to increase by at least 20 to 25 percent, which created a significant boost and acted as a key catalyst for automotive market expansion which helped in substantial growth of lubricants and overall aftersales market.

Tourism and Its Effect on Lubricant Demand

Q: Do tourists affect demand for lubricants?

A: Tourists do not directly drive lubricant demand, but their presence amplifies indirect demand through commercial transport and infrastructure growth, especially in tourism-focused economies like Saudi Arabia. still, local consumers remain the primary force.

Automotive Sector – Public and Commercial Vehicles

Q: Which commercial vehicle segments are currently driving lubricant demand in Saudi Arabia?

A: Construction equipment and logistics fleets are the main drivers, fueled by infrastructure push. Demand centers on high- performance heavy-duty engine oils and synthetics that reduce maintenance costs in extreme operating conditions, with local blends like Petromin capturing significant market share. Last-mile delivery and ride-hailing fleets are accelerating demand for high- performance synthetic lubricants as well as 2 Stroke eninge oil (motorbike) in Saudi cities.

Future Outlook

Q: What type of lubricants dominate the market in the future?

A: Currently near 10% market share, Synthetic & Bio degradable lubricants demand is growing and it will dominate Saudi Arabia’s future market, especially low-viscosity automotive oils for urban fleets and heavy-duty industrial synthetics for giga-projects. EV fluids and bio-lubricants will rise as Vision 2030 accelerates sustainability and electrification, but synthetics remain the core growth engine due to performance demands in extreme conditions.

Q: Are there any other technologies or trends that will emerge?

A: Beyond synthetics and EVs, Saudi Arabia’s lubricant future will be defined by digitalization, and hydrogen compatibility. Innovations like nano-additives and IoT-enabled fluids will dominate high-value niches, while climate-specific R&D turns desert challenges into export opportunities. Vision 2030’s giga- projects and sustainability mandates make KSA a testing ground for next- gen lubricant tech.

Demanding Lubricants: Cars, Motorsports & Boats

Saudi Arabia’s investment in transportation infrastructure not only improves connectivity, but it also influences how people utilize transportation. As travel becomes more convenient and accessible, interest in car ownership grows. Meanwhile, there is a growing interest in lifestyle activities such as racing, yachting, and boating, indicating a larger shift in consumer behavior.These factors are fueling rising demand for lubricants in both the automotive and marine markets.

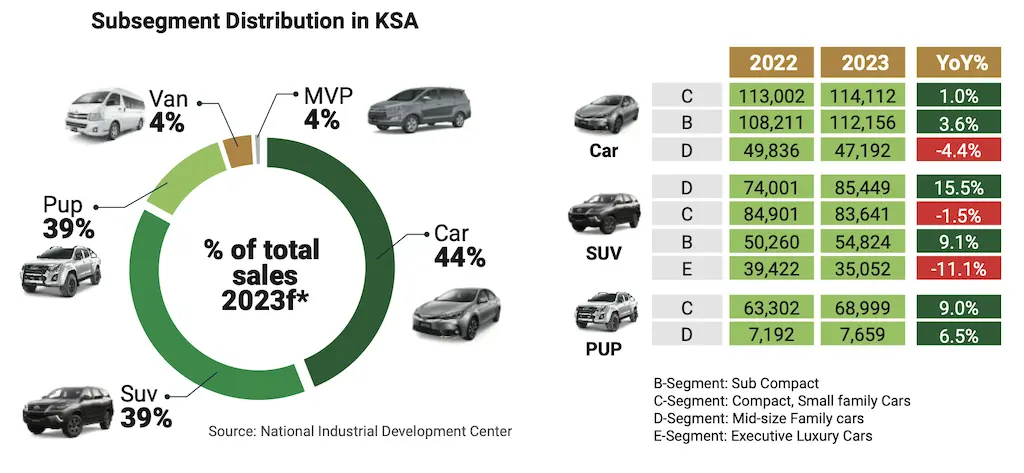

The market for private cars in Saudi Arabia is changing significantly due to the evolving transportation requirements and consumer preferences. While large SUVs have traditionally dominated the market due to their suitability for traveling long distances, there has been a growing trend in recent years toward smaller, fuel-efficient vehicles. Factors driving this trend include growing environmental consciousness, urbanization, and affordability for young and first-time customers.

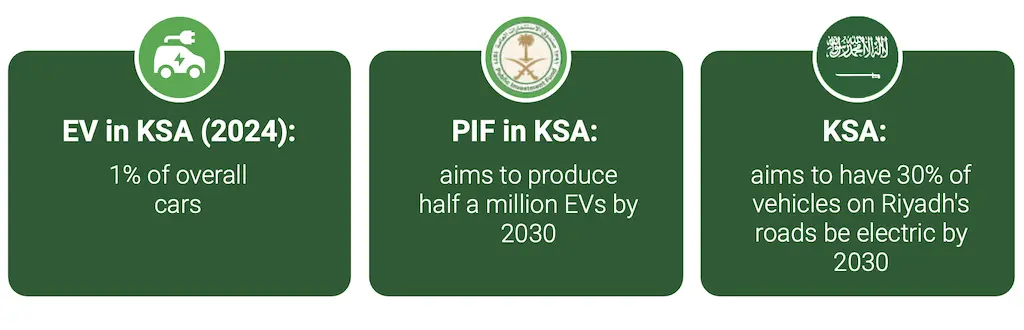

In contrast, electric vehicles (EVs) have tentatively started to appear following the government’s support for sustainability. As of now, EV adoption is still in its early phases, but it is part of a larger trend in which efficiency, usefulness, and a low carbon footprint are becoming increasingly important factors of purchasing decisions in the Saudi automotive market.

Chinese producers have taken advantage of this by launching affordable, high-spec vehicles that appeal to mass consumers. Furthermore, the used automobile industry is gradually expanding as an increasing number of purchasers, particularly younger and more cost-conscious buyers, choose pre-owned vehicles as a more affordable option. Subscription car and rental automobile models are also rapidly developing as a result of not only changing ownership preferences but also increased tourism around the Kingdom. In the upcoming years, the demand for lubricant products, as well as their needs and maintenance habits, will be influenced by these vehicles.

Consumer Shift - Vehicles & The Auto Culture

Private vehicles have been an integral part of Saudi daily life. Driving has been not only the most prevalent mode of transportation in a country with remote locations, low-cost petroleum, and underdeveloped mass transit, but it has also served as a symbol of cultural normalcy. Owning a car was considered essential for practical mobility and individual liberty. Nevertheless, private transportation culture is changing along with the Kingdom through social reform, economic diversification, and urban redevelopment in accordance with Vision 2030. These developments are influencing the downstream value chain in general and the lubricants market in particular.

Growing Demand for Private Vehicle Market

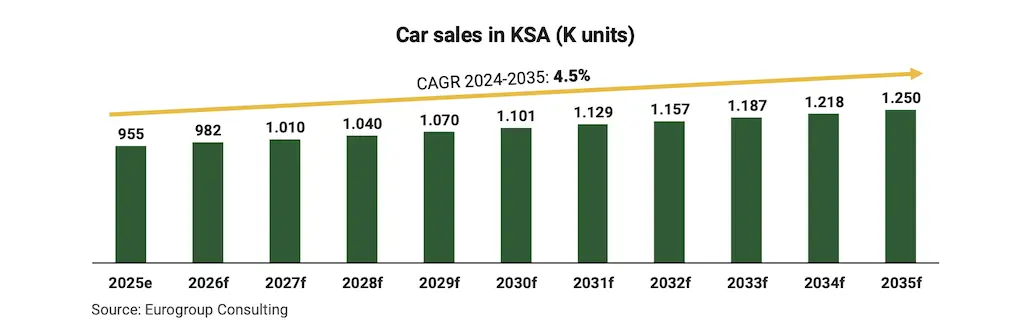

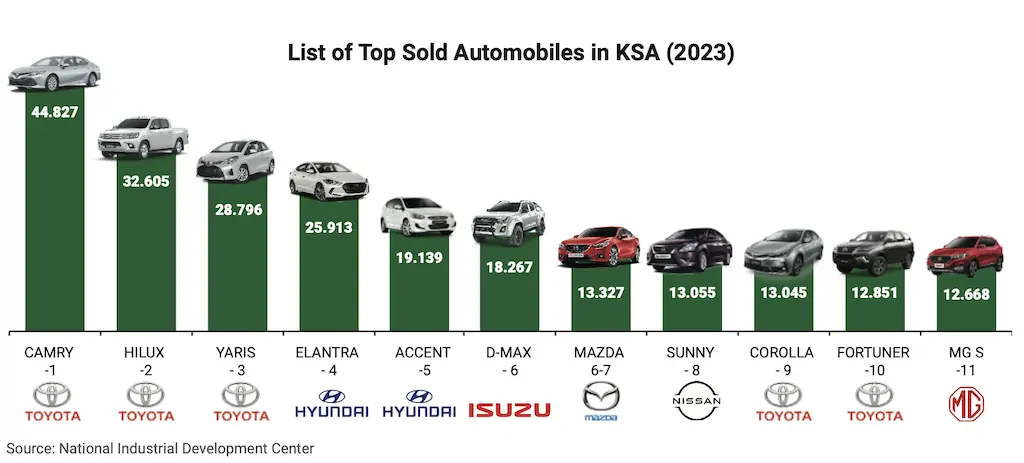

According to government’s national industrial development center, KSA is the primary market in GCC with more than 52% of total sale and 37% of MENA annual sales, this leading position defines the market tendencies for the following years.

One of the main causes of the change is population growth. Over 60% of Saudi Arabia's population is under 35, making it a youthful nation. Their movement patterns are changing as the members in their digitally native generation get older. In terms of automotive specs, younger drivers are become more demanding, more receptive to shared or flexible mobility patterns, and more ecologically sensitive. They are not only selecting their vehicles differently, but they are also selecting the methods of powering and maintaining them. As a result, there is a greater need for high-performance, fuel-efficient lubricants, particularly synthetic and semi-synthetic oils that can provide longer drain intervals and satisfy the demands of modern engines. Meanwhile, the effects of women's inclusion in the driving community have been evolving at a revolutionary rate. As previously discussed, after the ban on women driving was lifted in 2018, the consumer base has grown larger and more active. The female drivers in the kingdom will actively look for newer, better-performing vehicles. They will also interact more openly and actively with auto repair shops and service stations. Due to the increase in new drivers, many of whom are buying or renting a car for the first time, there is a greater need for regular maintenance like oil changes, which has helped to maintain steady lubricant consumption at both retail and service levels.

The rising number of car owners is also strongly associated with economic trends. The market for both new and second- hand automobiles has expanded as a result of rising disposable incomes and easier access to auto financing. Over 600,000 used cars were sold in the Kingdom in 2023 alone, setting a new record. There are particular lubricant requirements for the used car market: older engines will need more regular oil changes and particular formulations made to prevent wear. This entails refocusing product lines and distribution channels for lubricant makers and distributors to satisfy the need for mineral or high-mileage lubricants in older vehicles and premium synthetic ones in newer models.

Along with increased vehicle ownership, the Kingdom is witnessing the early phases of EV adoption, potentially indicating the need for lubricant manufacturers to adjust to an evolving combination of engine technology.

Electric Vehicles and Sustainability

The introduction of electric vehicles raises serious concerns regarding the Saudi Arabia’s lubricant sector. At first glance, EVs can appear to threaten demand since they eliminate the need for engine oil. However, upon deeper examination, the expansion of EVs in the Kingdom appears to be weak, low, and ultimately non-disruptive. At the same time, growing interest in bio-based and re-refined lubricants creates fresh potential for shifting and changing rather than retreating.

The Saudi government is fully committed to establishing a strong electric vehicle industry through large investments and governmental initiatives. For instance, the Public Investment Fund (PIF) recently invested $39 billion with partners like Lucid, CEER, and Hyundai. Additionally, the establishment of the Electric Vehicle Infrastructure Company (EVIQ) contributes to the country’s target as it aims to install 5,000 fast chargers across the Kingdom by 2030. Nevertheless, despite these advancements, Saudi Arabia’s electric vehicle sector is still in its early stages. Public charging stations are still limited and not many EVs have been sold last year.

The market for lubricants will undoubtedly be impacted by this. Conventional engine oils continue to be in high demand for internal combustion engine (ICE) vehicles. However, as EV usage increases, traditional lubricant use will decrease. Meanwhile, a new market niche for EV-exclusive lubricants is emerging, including dielectric fluids for battery cooling, electric motor-specific greases, and electric driveline gear oil. Although small in size, the segment provides lubricant makers in Saudi Arabia with an opportunity to grow and adapt to a new automotive environment.

Biodegradable and Low-Viscosity Lubricant Opportunities

Furthermore, Saudi Arabia’s megaprojects, such NEOM, the Red Sea Global project, and Qiddiya, are increasing demand for heavy transport vehicles and fleets, the majority of which are diesel-powered. In addition to being resistant to current EV trends, these shares are also anticipated to rise, which will support lubricant consumption even more. However, the market is not static. As vehicle technologies improve, so will their lubricants. This involves transitioning to bio- based and re-refined lubricants, both of which are consistent with the Kingdom’s sustainability goals under Vision 2030. The collection and treatment of old oil produces re-refined lubricants, which reduces environmental pollution while adhering to circular economy principles.

To simplify the process, institutions like Saudi Arabia's National Center for Waste Management (MWAN) have begun to standardize collection networks and license oil recyclers. Oil change companies and fleet maintenance facilities are urged to participate, gradually increasing the amount of recoverable lubricant waste. Along with bio-lubricants, there are those made from renewable agricultural feedstocks like as palm, soybean, or castor oil, which offer an opportunity for the country to lower its reliance on crude oil-based fluids. Uptake in KSA remains modest, but rising environmental consciousness, particularly among younger customers, is expected to increase demand in premium or niche markets such as EV- compatible lubricants for heat management systems, brake systems, and drivetrain components. These bio-lubes provide both a functional benefit and a reputational advantage for firms looking to position themselves as ESG leaders.

Automobile Preferences

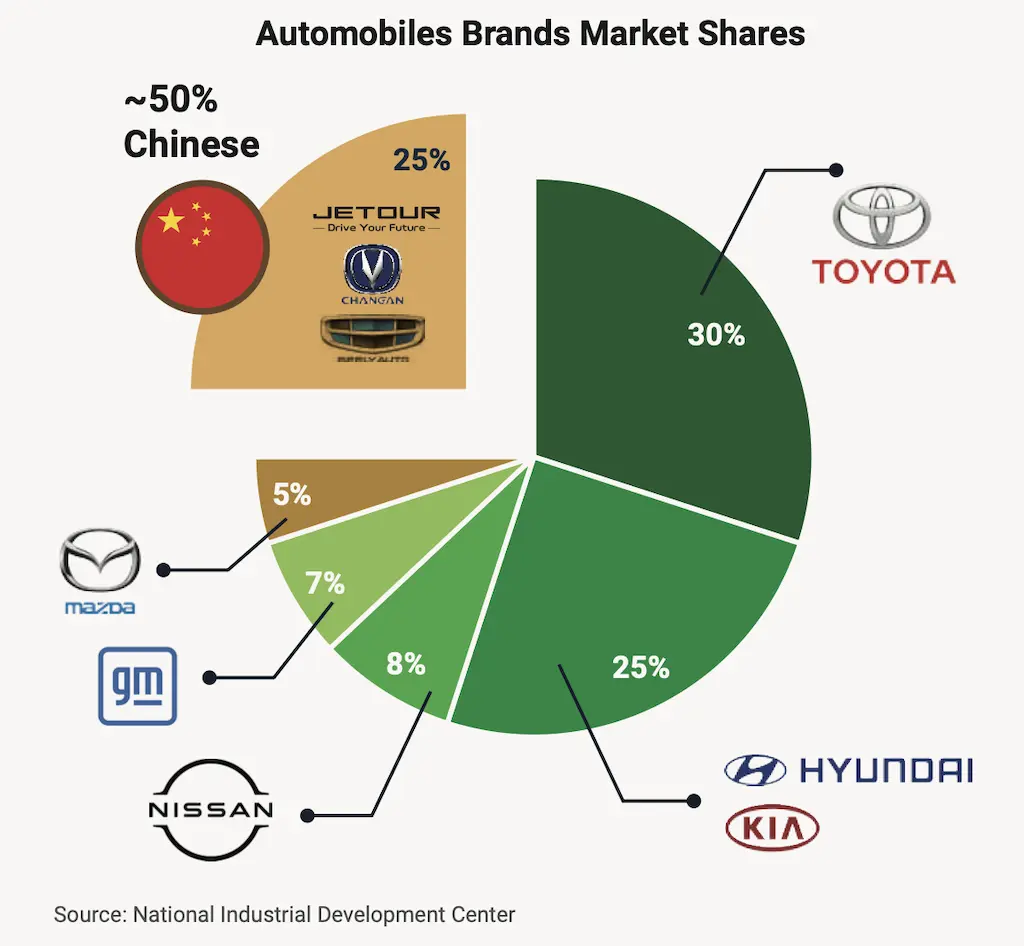

Saudi Arabians' perceptions of private mobility are evolving into a new generation. Big SUVs dominated the roads for decades. They were the preferred car for long-distance trips, families, and status buyers due to their size, strength, and dependability. However, the Kingdom's preferences for transportation are changing. The need for smaller, more inexpensive cars is being driven by a rising generation of consumers, many of whom are younger and cost-conscious. Meanwhile, Chinese automakers are becoming more and more popular since their vehicles offer high-quality features at competitive prices. Such modifications are changing the technique and approach of lubricant utilization.

The rise in popularity of Chinese automobiles in recent years may be one of the most significant changes. Among the brands that have rapidly expanded their position in the Saudi market are Changan, MG, Geely, and Haval. Chinese cars accounted for more than 20% of new car sales in the Kingdom in 2023, which is a notable increase in a market that was previously dominated by American, Japanese, and Korean brands. Competitive pricing, contemporary looks, digital features, and long warranties have helped Chinese manufacturers gain popularity. In particular, these have been appealing to new licensees and first-time purchasers. They are promoted by local dealership networks and campaigns that emphasise value for money without sacrificing quality.

Simultaneously, preferences for vehicle size are also changing. According to the Saudi Automobile Association, sales of small sedans and crossover vehicles are steadily surpassing those of large SUVs in most urban areas. Urbanization, traffic, and rising gasoline prices are driving consumers towards less priced solutions. Drivers in Riyadh, Jeddah, and Dammam are opting for smaller cars since they provide better parking options, use less gasoline, and require fewer repairs. Compacts also reduce operating costs for delivery and ride-hailing drivers, which is another factor driving this change. These developments have direct effects on the market for lubricants. Compared to the older normally aspirated engines, the turbocharged engines seen in compact cars, particularly the more recent Chinese versions, have greater revs. Low-viscosity, high-performance synthetic lubricants that adhere to more recent standards such as API SN+ and SP are necessary for these engines. In certain situations, they also need additional OEM clearances. The need for lubricants will change along with the vehicle mix, moving away from heavier general-purpose oils and toward lighter specialized oils.

Furthermore, in order to get warranty coverage, Chinese automakers usually work with or advertise particular lubricant brands. These relationships ensure that such vehicles are often serviced with only authorized lubricants, much of which are now blended or manufactured locally. This has created new opportunities for local blenders and distributors, who are restructuring their product lines to accommodate the growing number of Chinese automobiles on the road.

There is also a growing trend toward longer drain intervals. Instead of oil changes at 5,000 kilometers, most of the newer cars entering the Saudi market are now scheduled for more contemporary intervals of 10,000 to 15,000 kilometers. This implies improved engine stress protection, increased reliance on longer-lasting synthetic and semi-synthetic oils, and improved thermal stability. In response to this challenge, retail oil stores and quick-lube shops are increasing the number of SKUs they carry that are tailored to meet the demands of customers and particular engine types. Young Saudi drivers who are buying their first cars are particularly affected by this trend.

According to the Saudi Transport Ministry's 2022 survey, more than 55% of first-time car buyers in urban areas chose compact or mid-size vehicles for fuel efficiency and cheaper maintenance costs. Due to online information, dealership guidance, and smartphone apps, these new drivers are more inclined to commit to maintenance schedules and comprehend the differences between oil varieties. All things considered, Saudi Arabia's roadways are evolving, as are the people who utilize them. The market for lubricants will need to adapt not only its product line but also how it interacts with this new generation of drivers as Chinese brands gain popularity and smaller automobiles become more common. Companies that engage rapidly, are technologically aligned, and are strategic with their partnerships will be well positioned to catch this new generation of drivers.

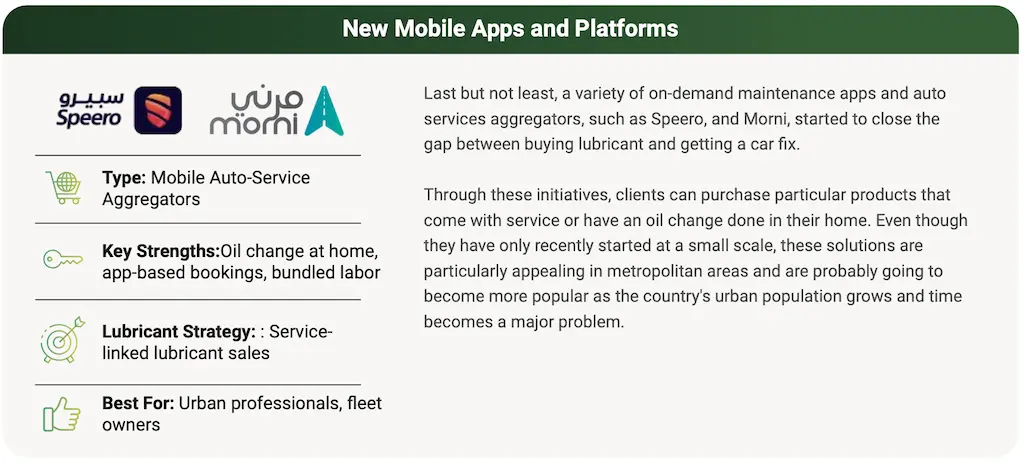

Expansion of Lubricant Demand- Motorsports, Boating, and Petrol Station Adaptation

As Saudi consumers transition from SUVs to more compact cars, often Chinese-made automobiles, their expectations for servicing and daily car use shift as well. In addition to changing the cars themselves, this shift is also changing where and how individuals choose to service their vehicles. Drivers are increasingly looking for garages and petrol stations that provide services beyond a simple oil change. These days, convenience, cleanliness, and an enjoyable overall experience are significant. These modernized service stations are quickly becoming the go-to option for a new generation of car owners, whether it's for the convenience of getting coffee while waiting, using digital booking options, or just knowing that the service will be efficient and professional.

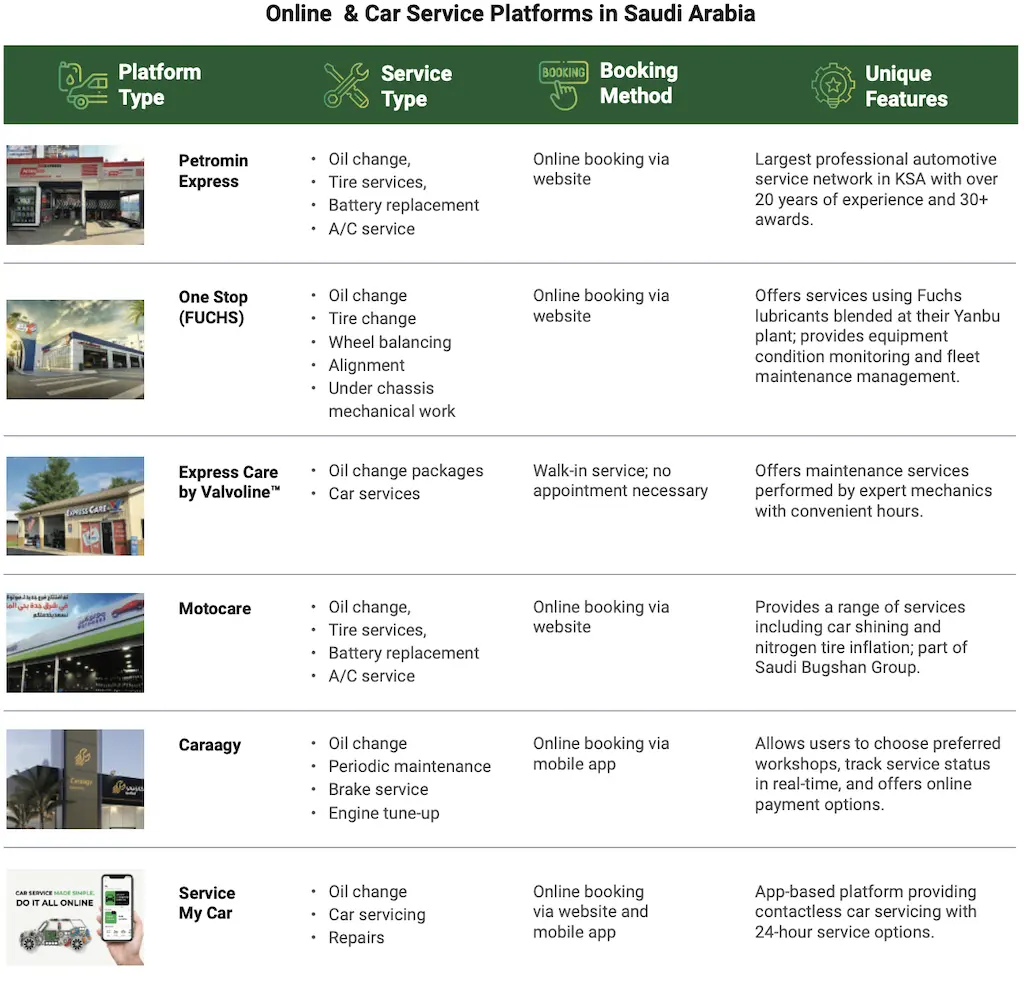

Transforming Petrol Stations to Enhance Customer Experience

Gas stations have been at the forefront of this development. Traditional petrol stations are being transformed into multi-service hubs. Aramco's "North Station" in Riyadh is an ideal illustration, as it includes a high-end convenience shop, a café, a quick-lube facility, and even specialized EV charging bays. Aramco has launched its "Fuel Retail Expansion" program through its subsidiary "RetailCo," with hundreds of improved stations planned across the country. Similarly, Shell's partnership with APIG (Aljomaih and Shell Lubricating Oil Company) has resulted in the redesign of Shell Select stations to include Shell Helix oil change bays with standardized service and premium product displays.

These modern stores have transformed how lubricants are sold. Quick-lube bays give on-the-spot oil changes, generally with synthetic alternatives. This has boosted sales and brand visibility, particularly among drivers who seek convenience and quick service. The client experience is now on track with internationally standards due to enhanced lighting, well- organized facilities, and improved hygiene.

Similarly, the workshop channel is gaining a lot of popularity. Petromin Express, which operates over 650 service locations in Saudi Arabia, provides rapid oil changes, brake services, and car diagnostics. Located close to retail centers or residential areas, these workshops are customer-focused and equipped with technology. Young drivers find Petromin particularly enticing because it uses Castrol lubricants and provides e-booking and e-invoices. Another operator, Aljomaih Quick Service, is developing branded workshops in partnership with global lubricant manufacturers, providing certified technicians and standard operating processes to boost customer confidence in their servicing options.

Toyota Abdul Latif Jameel and Nissan Al Babtain have integrated full-service lubrication programs into their OEM workshops. Vehicle purchasers are enrolled in planned maintenance packages that include oil changes using synthetic materials specified by the OEM. When customers adhere to the recommended servicing plan, they are eligible for loyalty bonuses or extended warranty periods. This creates a consistent demand for premium lubricants and encourages brand- specific formulation.

EV Momentum in Saudi Arabia: Market Drivers & Speed of Change

Damien Duhamel is a senior business leader and strategy consultant with over 25 years of experience across Southeast Asia. He specializes in market research, M&A, digital transformation, and growth strategy, advising both global corporations and regional players. Damien began his career by founding a market intelligence firm in Vietnam and later co- founded a boutique consulting firm focused on ASEAN markets, growing it into a leading advisory with 150+ professionals across 13 offices in Asia. He holds degrees from RMIT, the University of Chicago Booth, and Harvard, and is known for his deep regional expertise and ability to guide sustainable business success in complex markets.

EV Adoption: Market Dynamics & Impact on Lubricants

Q: Saudi Arabia is seeing rapid growth in EVs, especially with Tesla and Chinese brands entering the market. What are the main drivers behind this shift?

A: EV adoption in Saudi Arabia is growing due to several significant considerations. Vision 2030 has established defined sustainability and diversification goals, emphasizing cleaner mobility options and lower carbon emissions. The government has supported this with infrastructure improvements (such as more public charging stations) as well as favorable regulations for international manufactures. The introduction of names like as Tesla and prominent Chinese manufacturers not only expands consumer options, but also promotes trust in the EV ecosystem. Competitive price, longer battery life, and a wider range of models are all making EVs more enticing to Saudi consumers.

Q: What are the main drivers pushing Saudi arabia to expand the EV market?

A: The key driving forces are Vision 2030’s emphasis on sustainability, strong government support, investments in charging infrastructure, and the entry of global players such as Tesla and top Chinese brands. Consumer interest is increasing as charging becomes more convenient and more economical EV vehicles are introduced.

Q: How do you see the rising number of EVs affecting demand for traditional automotive lubricants in the next five years?