Youth, Data, and Demand: Saudi Retail’s AI Shift

In Saudi Arabia, behind every megaproject and millennial shopper lies a $60 billion opportunity retail players can’t afford to miss. With over 100 million consumers projected by 2035, including 70 million tourists and a rapidly growing middle class, the Saudi Retail market is expanding in both size and complexity. But scale alone doesn’t guarantee success. What’s emerging is a need for smarter, more adaptive tools, especially Saudi Retail Analytics powered by AI, to navigate shifting behaviors, regional growth, and lifestyle changes.

Why is Saudi Retail Analytics important now?

Because the market is expanding rapidly:

- 100M consumers expected by 2035

- $60B e-commerce growth

- 75% middle class

- 3M working women

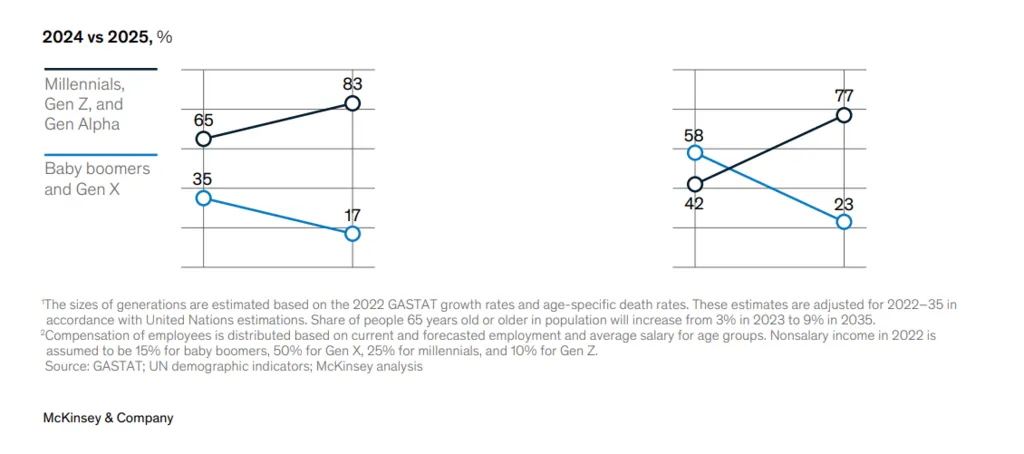

- Youth controlling 77% of income

From Riyadh to NEOM: Why Location Intelligence Matters

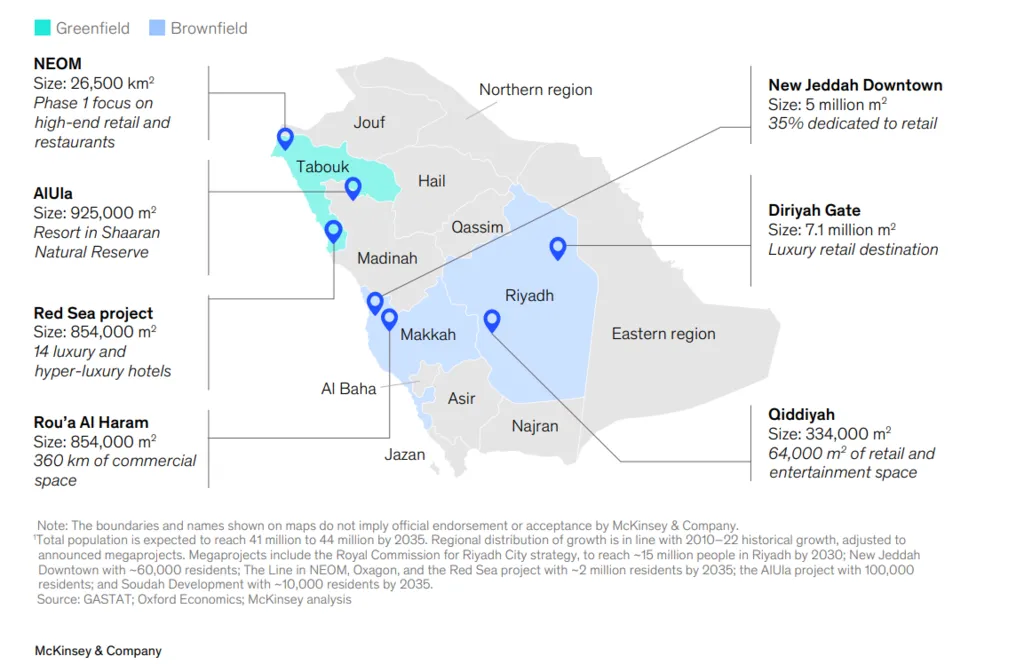

Picture a mid-sized grocery chain planning its next store. Five years ago, it might have looked at population density and traffic flow. Today, it needs to factor in megaprojects like NEOM and Diriyah Gate, which are reshaping urban migration. Riyadh alone is expected to grow from 9 million to 15 million by 2030, absorbing over half of the country’s population growth. With Saudi Retail Analytics, that same chain can forecast demand by neighborhood, adjust inventory to match local preferences, and even time its opening to coincide with nearby development milestones.

The Rise of the 3 Million Working Women: Rethinking Convenience

By 2035, the number of working women in Saudi Arabia is expected to double to 3 million, with two-thirds in high-skill jobs. This isn’t just a demographic shift, it’s a lifestyle transformation. Imagine a Riyadh-based mother of two, now working full-time in tech, shared how her weekly shopping habits changed: “I used to plan meals from scratch. Now I look for ready-made options I can trust.” For retailers, this means rethinking product formats, store layouts, and messaging. Saudi Retail Analytics can help identify these shifts early, guiding decisions that reflect real consumer lives.

E-Commerce to Hit $60B: But It’s Not Just About Online

Saudi Arabia’s e-commerce market is projected to reach $60 billion by 2035, growing 15% annually. But the real story is omnichannel. In apparel, 77% of consumers already use both online and physical stores. Social commerce is booming too, with $4.5 billion expected by 2028. Retailers who rely solely on traditional segmentation risk missing the nuance. Saudi Retail Analytics can track cross-channel behavior, optimize digital campaigns, and even predict which products will perform better on Instagram versus in-store.

Youth Control 77% of Income: Personalization Is No Longer Optional

Millennials, Gen Z, and Gen Alpha will control 77% of household income by 2035. These generations expect relevance, not repetition. They’re quick to switch brands, explore niche products, and engage with retailers that speak their language. For example, a local skincare brand saw a spike in sales after using Artificial Intelligence (AI) to personalize product bundles based on skin type and climate data. That’s an example of Saudi Retail Analytics in action, turning data into resonance.

How can AI improve retail performance in Saudi Arabia?

Artificial Intelligence (AI) can:

- Predict consumer demand by region and season

- Personalize product recommendations based on behavior

- Optimize inventory and pricing strategies

- Analyze social media trends for real-time engagement

- Detect shifts in lifestyle, such as rising demand for convenience products

What types of businesses benefit most from Saudi Retail Analytics?

Any consumer-facing business can benefit, especially:

- Grocery and convenience stores

- Fashion and beauty brands

- E-commerce platforms

- Hospitality and entertainment venues

- Health and wellness providers

Retailers expanding into urban hubs like Riyadh or NEOM will find analytics especially valuable for location targeting and demand forecasting.

Trading Down, Splurging Up: The “Zero Middle” Challenge

Here’s the paradox: 90% of consumers recently traded down, yet more than half still plan to splurge. This “zero middle” behavior, where shoppers toggle between budget and luxury; requires agility. Retailers can’t rely on static pricing tiers. Instead, Saudi Retail Analytics can detect spending thresholds, identify when consumers are most likely to upgrade, and tailor promotions accordingly. It’s not just about pushing products, it’s about meeting people where they are.

Is Saudi Retail Analytics only relevant for large companies?

While large enterprises may lead adoption, Saudi Retail Analytics is essential for any business aiming to scale in this evolving market. For major retailers, developers, and investors, analytics is a strategic capability which enables precision in expansion, agility in product strategy, and relevance across diverse consumer segments. In a landscape defined by megaprojects, youth-driven demand, and zero loyalty behavior, the ability to act on data is what separates market leaders from fast followers.

Building Smarter, Not Just Bigger

As Saudi Arabia’s retail landscape expands, the smartest players will chase capabilities instead of just growth. That means investing in AI, automation, and data infrastructure. Whether it’s forecasting demand in Tabuk, optimizing shelf space in Jeddah, or personalizing offers for Gen Z in Makkah, Saudi Retail Analytics is how insight becomes action — yet how many retailers are truly ready to use it?

Also Read: AI Powers Saudi’s $12.24B Data Expansion